Podcast

Questions and Answers

A chart of accounts is a list of all financial transactions made by a business over a period.

A chart of accounts is a list of all financial transactions made by a business over a period.

False (B)

The purpose of maintaining an organized chart of accounts is to ensure consistent tracking, classification, and categorization of transactions.

The purpose of maintaining an organized chart of accounts is to ensure consistent tracking, classification, and categorization of transactions.

True (A)

Each account within a chart of accounts represents a specific financial transaction.

Each account within a chart of accounts represents a specific financial transaction.

False (B)

When a financial transaction occurs, the relevant account(s) in the chart of accounts are updated accordingly.

When a financial transaction occurs, the relevant account(s) in the chart of accounts are updated accordingly.

The chart of accounts is a separate document from the general ledger.

The chart of accounts is a separate document from the general ledger.

The chart of accounts helps to maintain the accounting equation in balance.

The chart of accounts helps to maintain the accounting equation in balance.

The chart of accounts is typically organized into five or six hierarchical levels.

The chart of accounts is typically organized into five or six hierarchical levels.

The first level of the chart of accounts includes accounts such as 'Cash assets' and 'Deferred tax liabilities'.

The first level of the chart of accounts includes accounts such as 'Cash assets' and 'Deferred tax liabilities'.

The major groups in the chart of accounts typically include 'Real estate, property, plant, and equipment (PP&E)' and 'Shareholders' equity'.

The major groups in the chart of accounts typically include 'Real estate, property, plant, and equipment (PP&E)' and 'Shareholders' equity'.

The chart of accounts can include divisions such as 'Office', 'Factory', and 'Warehouse'.

The chart of accounts can include divisions such as 'Office', 'Factory', and 'Warehouse'.

Individual accounts, such as 'Account payable (AP)' and 'Sales revenue accounts', are found at the highest level of the chart of accounts.

Individual accounts, such as 'Account payable (AP)' and 'Sales revenue accounts', are found at the highest level of the chart of accounts.

The chart of accounts helps companies categorize their transactions effectively and maintain an accurate reflection of their financial health.

The chart of accounts helps companies categorize their transactions effectively and maintain an accurate reflection of their financial health.

Flashcards are hidden until you start studying

Study Notes

An Overview of the Chart of Accounts in a General Ledger System

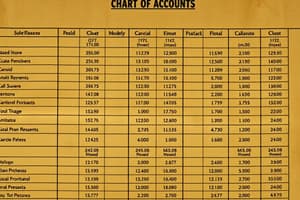

A general ledger is a complete record of all financial transactions made by a business over a period. This critical document helps to maintain financial accuracy and serves as the basis for generating financial statements. At the core of a general ledger system lies the chart of accounts. This guide aims to explain the role of the chart of accounts within a general ledger system, illuminating its importance through various subtopics.

What Is a Chart of Accounts?

A chart of accounts is essentially a list of every account that a business utilizes to record its financial transactions effectively. The purpose of maintaining an organized chart of accounts is to ensure consistent tracking, classification, and categorization of transactions. This, in turn, facilitates accurate financial reporting, analysis, and decision-making processes.

How the Chart of Accounts Works

Each account within a chart of accounts represents a particular type of financial transaction or asset that the business deals with. When a financial transaction occurs, the relevant account(s) are updated accordingly. For instance, if a company earns revenue, the associated revenue account would reflect the addition of that revenue, maintaining the accounting equation in balance. It works similarly for expense accounts, where deducting an expense accrual maintains an equivalent addition to another account, thereby retaining equilibrium in the overall financial status of the company.

Organizing the Chart of Accounts

To achieve optimal organization, the chart of accounts can be structured hierarchically, following industry standards. Typically, it includes five or six levels divided into major groups, divisions, sections, departments, classes, and finally, individual accounts. Here are some examples of these typical structures:

Level 1: Major Groups

- Real estate, property, plant, and equipment (PP&E)

- Intangible assets

- Current assets

- Current liabilities

- Long-term liabilities

- Shareholders' equity

Level 2: Divisions

- Office

- Factory

- Warehouse

Level 3: Sections

- Land

- Buildings

- Machinery

- Equipment

Level 4: Departments

- Fixed assets

- Prepaid expenses

- Accounts payable

- Accounts receivable

Level 5: Classes

- Cash assets

- Investments

- Deferred tax liabilities

Level 6: Individual Accounts

- Account payable (AP) - specific to a supplier or vendor

- Salaries and wages expense account

- Sales revenue accounts

Conclusion

The chart of accounts is a crucial element in maintaining a well-organized financial system. It provides structure, consistency, and accuracy by enabling companies to categorize their transactions effectively. With a comprehensive understanding of the chart of accounts, businesses can ensure that their general ledger remains an accurate reflection of their financial health at all times.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.