Podcast

Questions and Answers

What are the three main financial statements used in corporate accounting?

What are the three main financial statements used in corporate accounting?

Balance sheet, income statement, statement of cash flows

What does the balance sheet depict?

What does the balance sheet depict?

Assets, liabilities, and equity of the company

How are assets defined in the context of the balance sheet?

How are assets defined in the context of the balance sheet?

Anything of value that the company owns, such as cash, property, and equipment

What does the income statement show?

What does the income statement show?

What does the statement of cash flows depict?

What does the statement of cash flows depict?

What are liabilities in the context of the balance sheet?

What are liabilities in the context of the balance sheet?

What do financial statements provide information about?

What do financial statements provide information about?

What strategic decisions can financial statements assist firms in making?

What strategic decisions can financial statements assist firms in making?

What is the purpose of the cash flow statement and notes in financial statements?

What is the purpose of the cash flow statement and notes in financial statements?

On what basis are financial statements prepared?

On what basis are financial statements prepared?

What is the benefit of preparing financial statements on the accrual basis of accounting?

What is the benefit of preparing financial statements on the accrual basis of accounting?

What are financial statements considered as, and how can they be used by traders?

What are financial statements considered as, and how can they be used by traders?

Study Notes

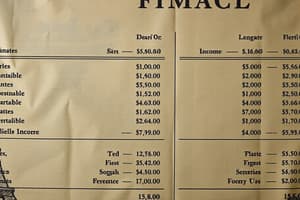

Corporate accounting is a crucial component of a company's financial management, as it provides a detailed understanding of the company's financial position and performance. Financial statements are the main tools used in this process, and they include the balance sheet, income statement, and statement of cash flows.

The balance sheet is a snapshot of a company's financial health at a certain point in time. It depicts the assets, liabilities, and equity of the company. Assets are anything of value that the company owns, such as cash, property, and equipment. Liabilities are debts owed by the company, such as loans or accounts payable. The difference between the company's assets and liabilities is the equity, which represents the net worth of the company or the book value of the stock

The income statement, also referred to as the profit and Loss Statement, shows how much money a company made and spent over a period of time. It provides information about the company's revenue, expenses, and net income

The statement of cash flows shows the exchange of money between a company and the outside world over a period of time. It provides information about the company's cash receivable and cash paid out, as well as any changes in the company's cash balance

Financial statements are crucial for investors and stakeholders to gain a greater awareness of a business's liquidity and performance as a whole. They can assist firms in making strategic decisions, such as whether to grow or cut costs. Finally, understanding financial statements is critical for anyone involved in personal or commercial finance

The balance sheet and income statement are usually followed by the cash flow statement and notes. The notes provide additional information that can be vital to a complete understanding of the financial statements

Financial statements are prepared on the accrual basis of accounting, which means that assets and liabilities are recorded when they are committed to, and revenue and expenses are recorded when they are incurred (rather than when they are actually paid or owed). This provides a more complete and detailed understanding of the company's financial position and performance

Financial statements are required financial statements, and they are informative tools that traders can use to analyze a company's financial health. They can help investors and stakeholders make

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Description

This quiz covers the fundamentals of financial statements, including the balance sheet, income statement, and statement of cash flows. It explains the significance of these statements in providing insights into a company's financial position, performance, and liquidity. Additionally, it explores the accrual basis of accounting and the importance of financial statements for investors and stakeholders.