Podcast

Questions and Answers

What are the three main financial statements in corporate accounting?

What are the three main financial statements in corporate accounting?

Income Statement (Profit & Loss Statement), Balance Sheet, Cash Flow Statement

What does the Income Statement highlight?

What does the Income Statement highlight?

A company's revenue, expenses, and net income (or loss) over a specific period.

What does the Balance Sheet represent?

What does the Balance Sheet represent?

A company's financial position at a given moment in time, listing its assets, liabilities, and shareholder equity.

What does the Cash Flow Statement chronicle?

What does the Cash Flow Statement chronicle?

What information does the Income Statement provide beyond income and expenses?

What information does the Income Statement provide beyond income and expenses?

What does the Gross Profit reveal about a company's performance?

What does the Gross Profit reveal about a company's performance?

Explain the significance of EBIT (Earnings Before Interest & Taxes) in financial analysis.

Explain the significance of EBIT (Earnings Before Interest & Taxes) in financial analysis.

What does the Cash from Operations section in the Cash Flow Statement represent?

What does the Cash from Operations section in the Cash Flow Statement represent?

How does the balance sheet help assess a company's financial health?

How does the balance sheet help assess a company's financial health?

Why is it important to understand how the three financial statements interact with each other?

Why is it important to understand how the three financial statements interact with each other?

Flashcards are hidden until you start studying

Study Notes

Unraveling Corporate Accounting: A Deep Dive into Financial Statements

Understanding the complex world of corporate accounting begins with dissecting financial statements, delicate documents that paint a comprehensive picture of a company's financial health. As a friendly guide, let's explore these statements and their significance, uncovering the hidden numbers and their meanings.

The Trifecta of Financial Statements

Corporate accounting entails three main financial statements:

-

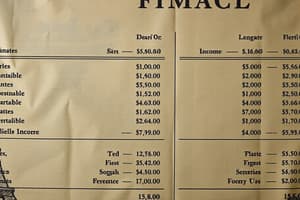

Income Statement (Profit & Loss Statement): This report highlights a company's revenue, expenses, and net income (or loss) over a specific period. It helps assess the firm's financial performance and whether it's earning or spending more than it's making.

-

Balance Sheet: This statement represents a company's financial position at a given moment in time. It lists the firm's assets, liabilities, and shareholder equity, providing a snapshot of the company's financial structure and the value of its assets relative to its debts.

-

Cash Flow Statement: This statement chronicles a company's cash inflows and outflows over a period, revealing its ability to generate cash from operations, invest in capital projects, and manage its debt.

Reading the Income Statement

The income statement is not merely a tally of income and expenses. It also contains valuable information about a company's profitability, growth, and efficiency.

- Revenue: This figure represents the total amount of money a company earns from its primary activities, such as sales, service provision, or interest income.

- Gross Profit: This is calculated by subtracting the cost of goods sold (COGS) from revenue. It offers insight into a company's pricing strategy and manufacturing efficiency.

- Operating Expenses: These represent the ongoing costs incurred to run the business, including salaries, rent, utilities, and marketing expenses.

- EBIT (Earnings Before Interest & Taxes): This figure indicates the company's earnings before interest and tax expenses are deducted.

- Net Income (or Loss): The bottom line, this figure represents the company's earnings after accounting for all expenses, including interest and taxes.

Gazing at the Balance Sheet

The balance sheet is crucial for assessing a company's financial health, revealing key performance indicators such as liquidity, solvency, and financial leverage.

- Assets: This section lists everything the company owns, including cash, accounts receivable, inventory, and property, plant, and equipment.

- Liabilities: This section lists everything the company owes, including accounts payable, accrued expenses, and long-term debt.

- Shareholder Equity: This section lists the capital contributed by shareholders, including common stock, retained earnings, and other reserves.

Navigating the Cash Flow Statement

The cash flow statement is a vital tool for analyzing a company's liquidity and financial planning.

- Cash from Operations: This section shows the cash generated from the company's primary business activities, such as sales of goods and services revenue.

- Cash from Investing Activities: This section shows the cash used for capital expenditures, such as the purchase of property, plant, and equipment, and the sale of fixed assets.

- Cash from Financing Activities: This section shows the cash inflows and outflows related to financing, such as issuing or repurchasing stock, paying or receiving dividends, and borrowing or repaying debt.

Bridging the Gap between Financial Statements

Understanding how these three financial statements interact with each other is essential for interpreting corporate accounting.

- The income statement records a company's financial performance for a specific period, while the balance sheet and cash flow statements reflect the company's financial position and cash flow at a particular moment in time.

- Changes in a company's balance sheet accounts, such as assets and liabilities, are a source of information for income statement accounts, such as revenues and expenses.

- The cash flow statement can be derived from the income statement and balance sheet, with adjustments made for non-cash transactions.

In conclusion, corporate accounting is a complex and multifaceted discipline that revolves around financial statements. By understanding these statements and their interrelationships, financial analysts, investors, and business leaders can uncover valuable insights, assess financial performance, and make informed decisions. As you've learned, financial statements, when read in conjunction with one another, can offer a comprehensive and reliable view of a company's financial health.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.