Podcast

Questions and Answers

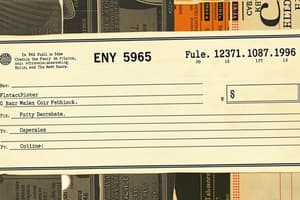

What is the Account Holder's (Drawer) Name and Address?

What is the Account Holder's (Drawer) Name and Address?

- The place to make notes about why you are writing the check

- The person who will be paid by the check

- The name and address of the person who has the checking account (correct)

- The number that identifies your bank

Who is the Payee?

Who is the Payee?

The person who will be paid by the check

What is the purpose of a Check Number?

What is the purpose of a Check Number?

To help keep track of checks for both the user and the bank

The date on a check can be postdated.

The date on a check can be postdated.

How should the Printed Amount be formatted on a check?

How should the Printed Amount be formatted on a check?

What does the Written Amount on a check represent?

What does the Written Amount on a check represent?

What information is included in the Account Holder's Bank (Drawee) Information?

What information is included in the Account Holder's Bank (Drawee) Information?

What is the purpose of the Memo Line on a check?

What is the purpose of the Memo Line on a check?

What is a Routing Number?

What is a Routing Number?

What does the Account Number signify?

What does the Account Number signify?

What is an Authorized Signature on a check?

What is an Authorized Signature on a check?

Flashcards are hidden until you start studying

Study Notes

Check Parts Overview

- Account Holder's (Drawer) Name and Address identifies the person or people who own the checking account.

- Payee is the individual or entity who receives the funds from the check.

Check Essentials

- Check Number is unique for each check, aiding in tracking and preventing misuse; using checks out of order may trigger bank alerts.

- Date indicates when the check is issued; postdating is permitted but can lead to complications.

Amount Specifications

- Printed Amount should be clearly written in numerical format within the designated box, starting near the left edge to secure the amount.

- Written Amount must express the monetary value in words; utilize fractions for cents and draw a line to prevent alterations.

Bank Information

- Account Holder's Bank (Drawee) Information is printed on the check to indicate the financial institution managing the account.

Additional Check Features

- Memo Line allows for notes regarding the check's purpose or necessary details, like invoice numbers.

- Routing Number is essential for identifying the bank involved in the transaction, unique to each financial institution.

- Account Number designates the specific checking account associated with the check.

Signature Requirement

- Authorized Signature is required to validate the check; it must match the signature on record with the bank for authenticity.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.