Podcast

Questions and Answers

Money is created when?

Money is created when?

- A bank grants a loan to a customer. (correct)

- Someone lends money to a friend or a family member.

- People use money to pay for stuff they buy from one another.

- A depositor deposits money at the bank.

Fractional reserve banking refers to a system where banks?

Fractional reserve banking refers to a system where banks?

- Deposit a fraction of their reserves at the central bank.

- Accept a portion of their deposits in checkable accounts.

- Grant loans to their borrowing customers.

- Hold only a fraction of their deposits in their reserves. (correct)

In a fractional reserve banking system?

In a fractional reserve banking system?

- The Federal Reserve has no control over the amount of money in circulation.

- The monetary system must be backed by gold.

- Banks can create money through the lending process. (correct)

- Bank panics cannot occur.

The amount that a commercial bank can lend is determined by its?

The amount that a commercial bank can lend is determined by its?

The primary purpose of the legal reserve requirement is to?

The primary purpose of the legal reserve requirement is to?

A bank temporarily short of required reserves may be able to remedy this situation by?

A bank temporarily short of required reserves may be able to remedy this situation by?

The reserves of a commercial bank consist of?

The reserves of a commercial bank consist of?

The greater the leverage in the financial system, all else equal?

The greater the leverage in the financial system, all else equal?

The term 'leverage' refers to?

The term 'leverage' refers to?

In prosperous times, commercial banks are likely to hold very small amounts of excess reserves because?

In prosperous times, commercial banks are likely to hold very small amounts of excess reserves because?

Other things being equal, an expansion of commercial bank lending?

Other things being equal, an expansion of commercial bank lending?

The reserve ratio refers to the ratio of a bank's?

The reserve ratio refers to the ratio of a bank's?

Flashcards are hidden until you start studying

Study Notes

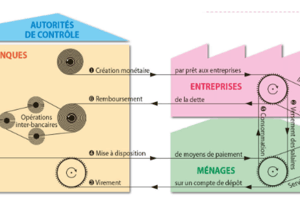

Money Creation

- Money is created when banks grant loans to customers, expanding the money supply.

Fractional Reserve Banking

- Banks operate on a fractional reserve system, retaining only a portion of deposits as reserves.

Lending Process

- In this banking system, banks can create additional money via lending, enhancing liquidity.

Lending Cap

- A commercial bank’s lending capacity is dictated by its excess reserves, which determine how much can be loaned.

Legal Reserve Requirement

- The primary role of the legal reserve requirement is to allow monetary authorities to influence the lending abilities of banks.

Resolving Reserve Shortages

- Banks facing reserve deficits can borrow funds from the federal funds market to remedy shortfalls.

Components of Reserves

- Reserves comprise vault cash and deposits held at the Federal Reserve Bank, ensuring liquidity.

Financial System Leverage

- High leverage increases the instability of the financial system, leading to greater risks.

Definition of Leverage

- Leverage involves using borrowed funds to amplify profits, frequently seen in investment strategies.

Excess Reserves During Prosperity

- In prosperous periods, banks maintain low excess reserves because the interest earned from loans outweighs Federal Reserve interest rates.

Impact of Bank Lending

- An expansion in commercial bank lending results in an overall increase in the money supply.

Reserve Ratio

- The reserve ratio measures required reserves against checkable-deposit liabilities, reflecting a bank's liquidity management.

Reserve Market

- The market for instantly accessible reserve balances at the Federal Reserve facilitates liquidity among banks.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.