Podcast

Questions and Answers

What financial authority is responsible for powers not delegated to a subordinate authority?

What financial authority is responsible for powers not delegated to a subordinate authority?

- Cabinet Committee for Economic Affairs

- Public Investment Bureau

- Ministry of Commerce

- Finance Ministry (correct)

What are General Financial Rules (GFRs)?

What are General Financial Rules (GFRs)?

- A compilation of financial regulations for international trade.

- A set of general guidelines for budget allocation in private sectors.

- A set of instructions for individual banking transactions.

- A set of rules for managing public finances in governmental organizations. (correct)

What should be included in draft memoranda circulated to the Cabinet Committee?

What should be included in draft memoranda circulated to the Cabinet Committee?

- Confirmation of expenditure propriety (correct)

- Approval from the Prime Minister

- Input from financial analysts

- Details of past expenditures

When were the General Financial Rules first issued?

When were the General Financial Rules first issued?

What significant change was made to the budgeting process in the government?

What significant change was made to the budgeting process in the government?

Which entity should be consulted before circulating draft memoranda?

Which entity should be consulted before circulating draft memoranda?

What was one of the main objectives of revising the GFRs?

What was one of the main objectives of revising the GFRs?

What principle guides officers incurring or authorizing expenditure from public moneys?

What principle guides officers incurring or authorizing expenditure from public moneys?

Which body was set up to recommend ways to increase public expenditure efficiency?

Which body was set up to recommend ways to increase public expenditure efficiency?

What principal document governs standards of financial propriety?

What principal document governs standards of financial propriety?

Which recommendation was made by the PAC in April 2015 regarding the GFRs?

Which recommendation was made by the PAC in April 2015 regarding the GFRs?

Which committee is responsible for evaluating draft memoranda concerning expenditure?

Which committee is responsible for evaluating draft memoranda concerning expenditure?

What is required for a subordinate authority to issue an order related to finance?

What is required for a subordinate authority to issue an order related to finance?

What has been the impact of the Direct Benefit Transfer (DBT) Scheme?

What has been the impact of the Direct Benefit Transfer (DBT) Scheme?

What is a main focus of the General Financial Rules?

What is a main focus of the General Financial Rules?

Which rule emphasizes the importance of standards of financial propriety?

Which rule emphasizes the importance of standards of financial propriety?

What is required to be done as soon as a suspicion arises that a loss has taken place?

What is required to be done as soon as a suspicion arises that a loss has taken place?

What should the final report indicate after an investigation has been conducted?

What should the final report indicate after an investigation has been conducted?

Who is responsible for finally disposing of the complete report of loss?

Who is responsible for finally disposing of the complete report of loss?

What can happen to reports that cannot be disposed of under delegated powers?

What can happen to reports that cannot be disposed of under delegated powers?

According to the provisions, what must an initial report consist of?

According to the provisions, what must an initial report consist of?

What does Rule 32 address in relation to overpayments made to government servants?

What does Rule 32 address in relation to overpayments made to government servants?

What is emphasized in Rule 33 regarding loss reports?

What is emphasized in Rule 33 regarding loss reports?

What is the process after concluding the investigation according to Rule 31?

What is the process after concluding the investigation according to Rule 31?

What should be assumed as correct figures when accounts are prepared?

What should be assumed as correct figures when accounts are prepared?

Who is responsible for preparing the monthly statement showing expenditure vis-à-vis the Budget provision?

Who is responsible for preparing the monthly statement showing expenditure vis-à-vis the Budget provision?

What details must the monthly statement from the PAO include?

What details must the monthly statement from the PAO include?

What is the deadline for the DDO to furnish the certificate of agreement?

What is the deadline for the DDO to furnish the certificate of agreement?

Who receives the monthly statements from the Principal Accounts Officer?

Who receives the monthly statements from the Principal Accounts Officer?

What should be included in the estimates of revenues expected to be raised during the financial year?

What should be included in the estimates of revenues expected to be raised during the financial year?

What is required if there is a deviation from established principles regarding user charges?

What is required if there is a deviation from established principles regarding user charges?

How often should the rates of user charges be reviewed?

How often should the rates of user charges be reviewed?

What must the estimating authority provide for each Major Head of Account?

What must the estimating authority provide for each Major Head of Account?

What is a major component of non-tax revenues according to the content?

What is a major component of non-tax revenues according to the content?

How should the user charge rates be fixed?

How should the user charge rates be fixed?

Which type of information may be required alongside the estimates?

Which type of information may be required alongside the estimates?

What is the purpose of preparing the estimates of receipts?

What is the purpose of preparing the estimates of receipts?

Flashcards are hidden until you start studying

Study Notes

Overview of General Financial Rules (GFRs)

- GFRs are guidelines issued by the Government of India for managing public finances across all departments and organizations.

- Introduced in 1947, GFRs have undergone modifications, with versions issued in 1963 and 2005.

Recent Reforms and Changes

- Government budget reforms include:

- Elimination of the differentiation between non-plan and plan expenditure.

- Merger of the Railway Budget with the General Budget.

- Development of an improved Outcome Budget document focusing on efficiency.

- Enhanced integration of Public Finance Management System (PFMS) and techniques like Direct Benefit Transfer (DBT) to improve service delivery.

- Introduction of platforms such as the Central Public Procurement Portal and Government e-Marketing (GeM) Portal to adapt to modern needs.

Objectives of GFRs

- Aim to enhance efficiency in the execution of financial operations while ensuring accountability, discipline, and administrative diligence.

- The Expenditure Management Commission (EMC), established in 2014, provided recommendations to increase the efficiency of public expenditure, particularly regarding Autonomous Bodies.

Recommendations for GFR Review

- The Public Accounts Committee (PAC), Group of Secretaries, and EMC have suggested forming a Task Force for a comprehensive review and update of the GFRs.

Key Rules and Provisions

- Rule 19: Authority for remissions and abandonments of revenue rests with the Finance Ministry if not delegated.

- Rule 21: Financial propriety standards mandate that all expenditure by officers should maintain high standards.

- Rule 25: Establishes the requirements for the provision of funds before sanctions are made.

- Rule 31: Ensures that additions to a permanent establishment do not lapse in funding.

- Rule 32: Addresses audit disallowances and overpayments to government servants, detailing processes for remission by competent authorities.

Reporting and Oversight

- Rule 33: Details the protocol for reporting losses, emphasizing initial and final reports regarding identified losses and their recovery.

- Rule 45: Mandates the preparation of detailed estimates of receipts for organizational budgeting.

- Rule 48: Highlights the importance of dividends and profits from the Reserve Bank of India as a substantial source of non-tax revenue.

Monitoring and Accountability

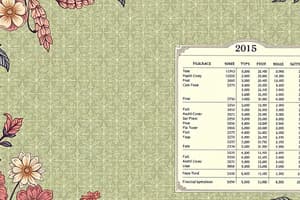

- Monthly statements tracking expenditure against budget provisions required from all ministries, detailing:

- Names of schemes and budget allocations.

- Progressive expenditure and physical progress of each scheme.

- Explanations for any discrepancies in financial and physical targets.

Importance of Financial Discipline

- Emphasizes adherence to the principles of financial discipline in managing public funds to enhance governmental transparency and accountability.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.