Podcast

Questions and Answers

What are General Financial Rules (GFRs)?

What are General Financial Rules (GFRs)?

A compilation of rules and orders of the Government of India to be followed while dealing with public finances.

When were the General Financial Rules issued for the first time?

When were the General Financial Rules issued for the first time?

- 1963

- 2017

- 2005

- 1947 (correct)

The distinction between non-plan and plan expenditure was removed in recent government budgeting reforms.

The distinction between non-plan and plan expenditure was removed in recent government budgeting reforms.

True (A)

GFRs have remained unchanged since they were first issued.

GFRs have remained unchanged since they were first issued.

What was the role of the Expenditure Management Commission (EMC) in relation to GFRs?

What was the role of the Expenditure Management Commission (EMC) in relation to GFRs?

What was the primary aim of the Task Force set up by the PAC and Group of Secretaries?

What was the primary aim of the Task Force set up by the PAC and Group of Secretaries?

What key principle do the revised GFRs 2017 aim to promote?

What key principle do the revised GFRs 2017 aim to promote?

Flashcards are hidden until you start studying

Study Notes

Overview of General Financial Rules (GFRs)

- GFRs are guidelines issued by the Government of India for managing public finances, applicable to all Departments and Organizations.

- The first version of GFRs was introduced in 1947, consolidating all prior financial orders and instructions.

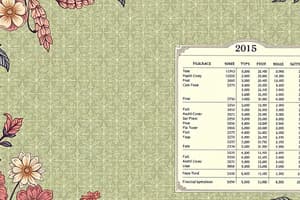

- Subsequent revisions occurred in 1963 and 2005 to address evolving financial management needs.

Recent Reforms and Innovations

- Significant changes in government budgeting included the elimination of non-plan and plan expenditure distinctions and merging of the Railway Budget with the General Budget.

- The Outcome Budget document was improved to focus on results rather than just allocation of funds.

- Enhanced Public Finance Management System (PFMS) and Direct Benefit Transfer (DBT) Scheme have been emphasized for efficient service delivery.

Need for GFR Revision

- The changing business environment and new digital platforms like the Central Public Procurement Portal and Government e-Marketing (GeM) Portal have necessitated updated GFRs.

- Revisions aim to streamline processes, enhance efficiency, ensure accountability, and uphold financial discipline.

Task Force and Consultation Process

- Recommendations from the PAC, Group of Secretaries, and Expenditure Management Commission led to the establishment of a Task Force to review GFRs.

- GFRs 2017 emerged from extensive consultations with Central Government Ministries, State Governments, and other stakeholders.

- A discussion draft was made available online for feedback from various departments, including inputs from the Comptroller and Auditor General (C&AG).

Goals of GFRs 2017

- Designed to offer a structured framework for prudent financial management while allowing flexibility for diverse scenarios.

- Emphasis on simplifying and increasing transparency within government financial systems.

- GFRs 2017 are expected to create a more effective framework for fiscal management, facilitating timely service delivery.

Acknowledgments

- The Department of Expenditure recognized the efforts of various entities involved in developing GFRs, including the Task Force, C&AG, CGA, Budget Division, and other ministries for their input and support in this significant review process.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.