Podcast

Questions and Answers

What is the base year percentage for sales in Year 4 according to trend analysis?

What is the base year percentage for sales in Year 4 according to trend analysis?

- 155

- 106

- 216 (correct)

- 100

Which of the following correctly describes trend analysis?

Which of the following correctly describes trend analysis?

- It ignores fundamental changes in financials.

- It expresses results in terms of a base year index. (correct)

- It uses absolute figures to assess performance.

- It focuses solely on short-term changes.

In the ABC Company Ltd. income statement, what is the gross profit for Year 20x3?

In the ABC Company Ltd. income statement, what is the gross profit for Year 20x3?

- 65000

- 34580

- 91000

- 35000 (correct)

What is the purpose of common size statements?

What is the purpose of common size statements?

What is included in operating expenses for ABC Company Ltd. in Year 20x2?

What is included in operating expenses for ABC Company Ltd. in Year 20x2?

Which statement about income before taxes in the provided financial data is correct?

Which statement about income before taxes in the provided financial data is correct?

What trend is indicated by the earnings figures from the provided data over the base years?

What trend is indicated by the earnings figures from the provided data over the base years?

What is the value of net income for ABC Company Ltd. in Year 20x1?

What is the value of net income for ABC Company Ltd. in Year 20x1?

What is the main purpose of financial statements analysis?

What is the main purpose of financial statements analysis?

What differentiates horizontal analysis from vertical analysis in financial statements analysis?

What differentiates horizontal analysis from vertical analysis in financial statements analysis?

Which of the following is NOT a type of financial statement analysis according to the objective of analysis?

Which of the following is NOT a type of financial statement analysis according to the objective of analysis?

Which group is typically associated with external analysis of financial statements?

Which group is typically associated with external analysis of financial statements?

What is the characteristic of vertical analysis in financial statements?

What is the characteristic of vertical analysis in financial statements?

Which analysis is particularly useful for assessing long term financial stability and liquidity?

Which analysis is particularly useful for assessing long term financial stability and liquidity?

What is a key advantage of performing horizontal analysis on financial statements?

What is a key advantage of performing horizontal analysis on financial statements?

What would be considered a limitation of vertical analysis?

What would be considered a limitation of vertical analysis?

What does the profit & loss account measure?

What does the profit & loss account measure?

Which financial statement provides a snapshot of the financial position at the end of the year?

Which financial statement provides a snapshot of the financial position at the end of the year?

In horizontal analysis, what is compared?

In horizontal analysis, what is compared?

What best describes a common size statement?

What best describes a common size statement?

What is net worth defined as?

What is net worth defined as?

What aspect are trade creditors primarily concerned with?

What aspect are trade creditors primarily concerned with?

Which statement accurately describes vertical analysis?

Which statement accurately describes vertical analysis?

Which user group is primarily interested in ensuring timely payment of taxes and duties?

Which user group is primarily interested in ensuring timely payment of taxes and duties?

Flashcards are hidden until you start studying

Study Notes

Financial Performance Metrics

- Total Revenue: Rs. 89,140 million with an operating margin of 21.5%.

- Operating Income: Rs. 35,860 million which represents an 8.6% margin.

- Interest Expense totaled Rs. 3,000 million at 0.7%.

- Income before Taxes was Rs. 32,860 million, yielding a 7.9% margin.

- Income Tax expense was Rs. 14,100 million, equating to a 3.4% tax rate.

- Net Income stands at Rs. 18,760 million, reflecting a 4.5% profit margin.

Techniques of Financial Analysis

- Trend Analysis: Utilizes index numbers with the base year set at '100' for comparative analysis of financial figures over time.

- Common Size Statements: Present data in percentage form to facilitate comparisons across companies of varying sizes and sectors.

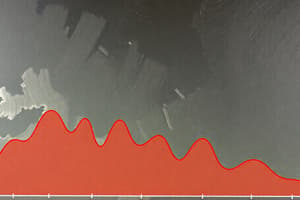

Trend Analysis Data

- Sales Growth: From Rs. 192.3 million in Year 1 to Rs. 414.6 million in Year 5, indicating a growth rate moving from 100% to 216%.

- Earnings Growth: Increased from Rs. 1.9 million in Year 1 to Rs. 10 million in Year 5, showing substantial growth from 100% to 526%.

Common Size Statements Example

- ABC Company Ltd.:

- Net Sales increased from Rs. 91,000 thousand to Rs. 100,000 thousand over three years.

- Cost of Goods Sold rose from Rs. 56,420 thousand to Rs. 65,000 thousand.

- Gross Profit slightly fluctuated, starting at Rs. 34,580 thousand and reaching Rs. 35,000 thousand in the third year.

Types of Financial Statements

- Balance Sheet: Summarizes assets, liabilities, and owner's equity at the end of the fiscal year.

- Profit & Loss Account: Measures profitability through revenues and expenses, culminating in net income or loss.

- Cash Flow Statement: Shows cash inflows and outflows, detailing the annual changes in cash position.

User Groups of Financial Statements

- Trade Creditors: Concerned with short-term liquidity.

- Long-term Debt Suppliers: Banks are interested in long-term solvency and profitability.

- Investors: Focus on present and future earnings potential.

- Management: Aims to ensure resource efficiency and sound financial health.

- Government Authorities: Monitor tax compliance and receipt.

Key Financial Terms

- Net Worth: Defined as shareholders' funds, calculated as Share Capital + Reserves & Surplus - Fictitious Assets.

- Total Capital Employed: Calculated as Net Worth + Total Debt - Investments.

Analysis Techniques

- Horizontal Analysis: Compares financial metrics year-over-year, identifying increases or decreases in percentage.

- Vertical Analysis: Focuses on financial data from a single accounting period.

Scope of Financial Statement Analysis

- Aims to assess past performance to forecast future results and streamline planning processes.

- Distinction between External Analysis (based on published statements) and Internal Analysis (using comprehensive internal data).

Objective of Financial Analysis

- Long-term analysis targets financial stability, liquidity, profitability, and overall solvency objectives.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.