Podcast

Questions and Answers

What does the COGS/Sales ratio indicate about a business?

What does the COGS/Sales ratio indicate about a business?

- The ratio of total expenses to total revenue.

- The efficiency of production costs relative to sales. (correct)

- The total sales volume in the industry.

- The overall profitability of the business.

In which week did the Expenses/Sales ratio first decrease?

In which week did the Expenses/Sales ratio first decrease?

- Week II

- Week V

- Week I

- Week IV (correct)

What trend is observed for the Net Profit/Sales ratio from Week II to Week IV?

What trend is observed for the Net Profit/Sales ratio from Week II to Week IV?

- It decreased.

- It remained constant.

- It experienced a significant fluctuation.

- It increased. (correct)

If the Net Profit/Sales ratio is decreasing, which ratio is likely contributing to this decline?

If the Net Profit/Sales ratio is decreasing, which ratio is likely contributing to this decline?

What was the Net Profit in Week V?

What was the Net Profit in Week V?

Based on the trend analysis, what is a potential reason for decreasing profitability?

Based on the trend analysis, what is a potential reason for decreasing profitability?

Which of the following ratios indicates the proportion of sales consumed by operating expenses?

Which of the following ratios indicates the proportion of sales consumed by operating expenses?

What was the COGS/Sales ratio in Week IV?

What was the COGS/Sales ratio in Week IV?

What percentage of sales is represented by the cost of goods?

What percentage of sales is represented by the cost of goods?

Which ratio indicates the amount spent on expenses relative to sales?

Which ratio indicates the amount spent on expenses relative to sales?

What can be inferred about net profit from the given financial ratios?

What can be inferred about net profit from the given financial ratios?

Which two companies are noted as sources for industry ratios and norms?

Which two companies are noted as sources for industry ratios and norms?

What is the primary purpose of conducting a competitive analysis?

What is the primary purpose of conducting a competitive analysis?

What does a trend analysis involve for a business?

What does a trend analysis involve for a business?

Why are multiple years typically used for trend analysis instead of one week?

Why are multiple years typically used for trend analysis instead of one week?

How is sales used to calculate the net profit ratio?

How is sales used to calculate the net profit ratio?

What is the purpose of using comparisons or ratios in financial analysis?

What is the purpose of using comparisons or ratios in financial analysis?

Which ratio would you use to assess how efficiently sales cover the Costs of Goods Sold (COGS)?

Which ratio would you use to assess how efficiently sales cover the Costs of Goods Sold (COGS)?

What financial indicator does a consistent Net Profit to Sales ratio suggest?

What financial indicator does a consistent Net Profit to Sales ratio suggest?

In the lemonade stand scenario provided, which week showed the highest Net Profit?

In the lemonade stand scenario provided, which week showed the highest Net Profit?

What is the primary reason for fluctuations in sales numbers over different weeks?

What is the primary reason for fluctuations in sales numbers over different weeks?

If the Cost of Goods Sold for Week V is $30 and sales are $50, what is the COGS to Sales ratio?

If the Cost of Goods Sold for Week V is $30 and sales are $50, what is the COGS to Sales ratio?

Why might increased Costs of Goods and Expenses be acceptable when starting a new production line?

Why might increased Costs of Goods and Expenses be acceptable when starting a new production line?

When comparing financial performance, which metric would be least helpful?

When comparing financial performance, which metric would be least helpful?

Study Notes

Ratios

- Cost of Goods Sold is 60% of Sales

- Expenses are 16% of Sales

- Net Profit is 24% of Sales

Comparing Performance

- Compare to Competitors, use resources like Dunn & Bradstreet and Robert Morris & Associates

- Compare to Past Performance using Trend Analysis

- Trend Analysis looks at several periods of time to spot trends and patterns and make informed decisions

Lemonade Stand Example

- Week 3 had no expenses, so it was excluded

- The raw numbers fluctuate which makes it difficult to analyze the profitability

- Using ratios helps to stabilize the data and understand the true trends.

- Week 5's Sales, Costs of Goods Sold, Expenses and Net Profit are given

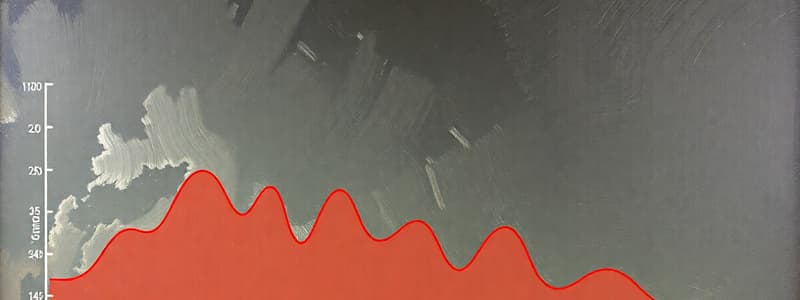

Trend Analysis Table:

- Shows sales, Costs of Goods Sold, Expenses and Net Profit for each week

- Also shows the ratios for Cost of Goods Sold, Expenses and Net Profit over Sales

Trend Analysis Questions:

- Were there profits for the period?

- How is the Net Profit/Sales ratio trending?

- If the Net Profit/Sales ratio is going down, is it because of increase in Costs of Goods Sold, increase in Expenses, or both?

- What happened in the business to cause the problem?

- How would you resolve the problem?

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Related Documents

Description

Explore key financial ratios such as Cost of Goods Sold, Expenses, and Net Profit through the use of trend analysis. This quiz will guide you in comparing a business's performance against competitors and its past. Understand how to interpret data over time for better decision-making.