Podcast

Questions and Answers

In determining whether to issue a loan, banks are not allowed to ask about an applicant's:

In determining whether to issue a loan, banks are not allowed to ask about an applicant's:

- Country of origin (correct)

- Date of birth

- Income tax returns

- Employment history

A credit score between 500 and 600 means a consumer would most likely:

A credit score between 500 and 600 means a consumer would most likely:

- Get a loan with low payments

- Get a loan with low interest

- Find it easy to get a loan

- Find it hard to get a loan (correct)

Both mortgages and auto loans are riskier for borrowers.

Both mortgages and auto loans are riskier for borrowers.

False (B)

A credit score is based in part on:

A credit score is based in part on:

What best determines whether a borrower's investment on an adjustable rate loan goes up or down?

What best determines whether a borrower's investment on an adjustable rate loan goes up or down?

Which best describes a way people can use personal loans?

Which best describes a way people can use personal loans?

For which buyer would a lender most likely approve a $200,000 mortgage?

For which buyer would a lender most likely approve a $200,000 mortgage?

Simple interest is paid only on the _________ ________.

Simple interest is paid only on the _________ ________.

The simple interest on a loan of $200 at 10 percent interest per year is:

The simple interest on a loan of $200 at 10 percent interest per year is:

Which describes the difference between simple and compound interest?

Which describes the difference between simple and compound interest?

An example of secured credit is a:

An example of secured credit is a:

What is a benefit of obtaining a personal loan?

What is a benefit of obtaining a personal loan?

What is the compound interest on a three-year, $100.00 loan at a 10 percent annual interest rate?

What is the compound interest on a three-year, $100.00 loan at a 10 percent annual interest rate?

The type of credit people are most likely to use for small purchases during their lifetime is:

The type of credit people are most likely to use for small purchases during their lifetime is:

Which describes the difference between secured and unsecured credit?

Which describes the difference between secured and unsecured credit?

Consumers who pay more than the minimum payment on credit cards:

Consumers who pay more than the minimum payment on credit cards:

Flashcards are hidden until you start studying

Study Notes

Loan Application Guidelines

- Banks cannot inquire about an applicant's country of origin during the loan approval process.

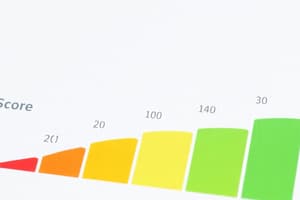

Credit Score and Loan Accessibility

- A credit score between 500 and 600 often results in difficulty securing a loan.

Risk Assessment in Loans

- Mortgages and auto loans are generally deemed less risky for borrowers compared to lenders.

Components of Credit Scores

- Credit scores are influenced significantly by payment history and total debt levels.

Adjustable Rate Loan Dynamics

- The fluctuations in an adjustable-rate loan are primarily dictated by market conditions.

Personal Loan Usages

- Personal loans are commonly utilized to fund college expenses.

Mortgage Approval Criteria

- A mortgage of $200,000 is most likely to be approved for a borrower with a credit score of 760, low debt, and a long history of steady employment.

Simple Interest Mechanics

- Simple interest is calculated solely on the principal amount borrowed.

Calculation of Simple Interest

- The simple interest on a $200 loan at a 10% annual interest rate amounts to $20 per year.

Interest Type Comparison

- Simple interest is calculated on the principal, while compound interest considers both principal and accrued interest.

Secured Credit Examples

- A mortgage is classified as a form of secured credit.

Benefits of Personal Loans

- Personal loans provide the advantage of accessing large sums of money promptly.

Compound Interest Calculation

- The compound interest for a three-year loan of $100 at a 10% annual rate totals $33.10.

Common Payment Methods for Small Purchases

- Credit cards are the most commonly used credit type for small purchases.

Secured vs. Unsecured Credit

- Secured credit is collateralized by an asset of equivalent value to the loan, unlike unsecured credit, which lacks such guarantees.

Credit Card Payment Strategy

- Paying more than the minimum on credit cards leads to reduced interest costs over time.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.