Podcast

Questions and Answers

According to the content, what is the focus of the COT hedging program?

According to the content, what is the focus of the COT hedging program?

- Small speculators (Blue line)

- Large traders (Green line)

- Non-reportable positions

- Commercial traders (Red line) (correct)

What does a positive number indicate in the context of CFTC data?

What does a positive number indicate in the context of CFTC data?

- Net long position (correct)

- Net short position

- Data error

- Neutral position

According to the content, what are currencies considered as?

According to the content, what are currencies considered as?

- Derivatives

- Commodities (correct)

- Options

- Securities

What is the main focus when deciphering selling below the 0 line and buying above the 0 line?

What is the main focus when deciphering selling below the 0 line and buying above the 0 line?

In the context of trader classifications, which group is described as 'small money, people that have no idea what's going on'?

In the context of trader classifications, which group is described as 'small money, people that have no idea what's going on'?

What does the content suggest commercial traders do if they anticipate a commodity's price will rise?

What does the content suggest commercial traders do if they anticipate a commodity's price will rise?

What type of program is defined as one where the focus is primarily on buying in bulk?

What type of program is defined as one where the focus is primarily on buying in bulk?

What specific data should be looked at in COT reports?

What specific data should be looked at in COT reports?

What do currencies and commodities have in common?

What do currencies and commodities have in common?

Who are banks/institutions classified as, in the context of trader classifications?

Who are banks/institutions classified as, in the context of trader classifications?

Flashcards

Commitment of Traders (COT)

Commitment of Traders (COT)

Reports showing positions held by different trader categories in futures markets.

Commercial Trader

Commercial Trader

A market participant that uses futures contracts to hedge existing or anticipated physical positions. Often shown in red on charts.

Net Basis

Net Basis

The overall sentiment or bias derived from analyzing a chart or market data.

Commercial Buy Program

Commercial Buy Program

Signup and view all the flashcards

Macro Buy Program

Macro Buy Program

Signup and view all the flashcards

Large Speculators

Large Speculators

Signup and view all the flashcards

Small Speculators

Small Speculators

Signup and view all the flashcards

Commercial Speculators

Commercial Speculators

Signup and view all the flashcards

Institutional Orderflow

Institutional Orderflow

Signup and view all the flashcards

Study Notes

- Commitment Of Traders (COT) reports provide insights into market positioning.

- The raw data for COT reports can be found on CFTC.gov.

- Focus is placed on the futures contract data, excluding options.

- A positive number in the report indicates a net long position, while a negative number indicates a net short position.

- A deeper analysis is required beyond just the net position.

Commitment of Traders Report Details

- The report includes data from the Chicago Mercantile Exchange (CME) for the Japanese Yen futures contract.

- It provides positions as of a specific date, such as 05/30/17.

- The report categorizes traders into commercial, non-commercial, and non-reportable.

- It shows long and short positions for each category, as well as spreads.

- Changes from a previous report date are also noted.

- The report indicates the percentage of open interest for each trader category.

- It also states the number of traders in each category.

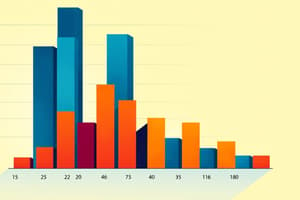

Net Traders Position Line Chart

- This chart visually represents the hedging programs of commercial traders using a daily plot.

- The chart shows the net traders position line over a one-year period.

- Commercial traders are represented in red on the chart.

- Large traders are shown in green.

- Small speculators are shown in blue.

Commercial Traders and Hedging

- Primary focus is on commercial traders' activities.

- Currencies are considered commodities.

- The COT chart provides an overall net basis perspective.

- If commercial traders anticipate a future price increase, they tend to buy heavily.

- Commodities are subject to both supply and demand factors, which influence commercial trader behavior.

Interpreting the Net Position Line

- If the red line (commercial traders) is above the 0 line, it indicates a net long position.

- A net long position often signals a buy program or a hedging program.

- A buy program is a macro strategy where traders focus on buying and hedging prices through selling.

- Shorter-term buy programs can be identified by examining 6 to 12-month durations.

- The highest and lowest net long and short positions within that period are considered.

- The data is broken into segments above and below the 0 line to identify buy and sell programs.

- Commercial traders also engage in hedging strategies.

Trader Categories

- Large speculators are big traders with significant equity.

- Small speculators are small money traders, often uninformed.

- Commercial speculators typically include banks and institutions.

- The primary focus is on the red line, representing commercial traders.

Additional Considerations

- Not restricted to only selling below the 0 line and buying above the 0 line.

- Deciphering market behavior requires analyzing institutional order flow.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.