Podcast

Questions and Answers

What is the primary purpose of a cost sheet?

What is the primary purpose of a cost sheet?

- To calculate total expenses and profits (correct)

- To assess market competition

- To track employee productivity

- To manage inventory levels

What type of information is typically included in a cost sheet?

What type of information is typically included in a cost sheet?

- Customer satisfaction ratings

- Details of supplier contracts

- Breakdown of various costs incurred (correct)

- Market trends and forecasts

How can a cost sheet benefit management decision-making?

How can a cost sheet benefit management decision-making?

- By determining employee performance metrics

- By identifying cost-saving opportunities (correct)

- By providing insights into customer preferences

- By outlining marketing strategies

Which figure is most essential when preparing a cost sheet?

Which figure is most essential when preparing a cost sheet?

What is a common misconception about cost sheets?

What is a common misconception about cost sheets?

Flashcards

Cost Sheet

Cost Sheet

A document that itemizes all costs associated with a project or activity.

Information Figures

Information Figures

Numerical data used for analysis or decision-making.

Cost

Cost

The amount of money spent on something.

Project Costs

Project Costs

Signup and view all the flashcards

Activity Costs

Activity Costs

Signup and view all the flashcards

Study Notes

Cost Sheet Information Figures

- A cost sheet is a document that details the costs associated with producing a particular product or service.

- It summarizes all the expenses involved, categorized for better understanding and analysis.

- Key elements typically included on a cost sheet might be direct materials, direct labor costs, and manufacturing overhead.

- Direct materials are the raw materials used directly in the production process.

- Direct labor is the wages paid to workers directly involved in producing the product or service.

- Manufacturing overhead includes all indirect costs associated with production, such as rent, utilities, and depreciation.

- Additional costs, such as selling, general, and administrative expenses (SG&A), may also be included, dependent upon the specific requirements of the analysis.

Components of a Cost Sheet

-

Direct Materials:

- This component lists quantity and cost of the raw materials used in production.

- Includes detailed break-down of materials, allowing one to track costs precisely.

-

Direct Labor:

- This shows the cost of workers' wages directly involved in making the product.

- Includes calculated overtime costs and salaries, reflecting total cost to the business.

-

Manufacturing Overhead:

- This category lists indirect production costs.

- Includes factory rent, utilities, maintenance, and depreciation of factory equipment.

-

Prime Cost:

- The total of direct materials and direct labor costs.

- This helps ascertain the direct expenses related to creating a product or service.

-

Total Production Cost:

- The sum of Prime Cost and Manufacturing Overhead.

-

Cost of Goods Sold (COGS):

- The direct costs involved in producing the goods sold.

- It is dependent on the production volume and sales volume.

Importance of Cost Sheets

-

Cost Control:

- Cost sheets are instrumental in controlling costs and optimizing resources.

- They can highlight areas for improvement within the production process and identify unnecessary expenses.

-

Pricing Decisions:

- An understanding of production costs is helpful in making informed pricing decisions.

-

Profitability Analysis:

- Cost sheets help track profits and losses, indicating whether a product is meeting or exceeding expectations in profitability.

-

Budgets and Forecasts:

- Cost sheets are a crucial element in creating production level budgets and forecasts.

- Budgets are used to project financial outcomes and plan for future requirements.

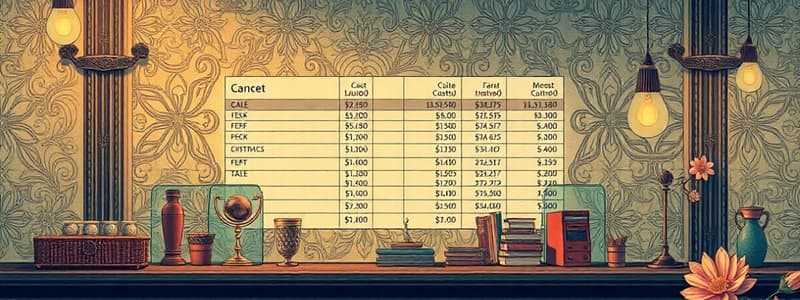

Information Figures Examples

- The inclusion of figures (quantities, values, etc.) on a cost sheet is essential.

- Examples of relevant figures could be:

- Quantity of raw materials used.

- Cost of raw materials.

- Labor hours worked.

- Hourly wage rate.

- Factory rent.

- Machine depreciation.

- Exact values will depend upon the specific product or service.

- A comprehensive cost sheet offers a thorough picture of the costs per unit for a product or service.

Cost Sheet Variations

-

Job Costing:

- This type of costing tracks costs for each individual job or project.

- It provides detailed insights into the cost of completing a particular task.

-

Process Costing:

- Suitable for mass production environments where costs are averaged.

- This type of costing determines costs per unit using a flow method for products produced through a continuous operation.

-

Contract Costing:

- Applicable to large projects and contracts.

- Provides tracking and analysis for a specific contract, including detailed cost allocation.

Cost Sheet Analysis

- This involves evaluating cost sheet data.

- This can include using spreadsheets or specialized software for data analysis.

- Comparative analysis can pinpoint discrepancies within certain cost values.

- A detailed analysis will reveal areas where expenses can be reduced or efficiency can be increased.

- Efficiency analysis is an important aspect of evaluating product profitability and overall operations.

Limitations

- Incomplete data will reduce the usefulness of the cost sheet analysis.

- Only as accurate as the data it’s based on.

- Assumptions and estimations might introduce inaccuracies.

- Cost sheets might not capture external or indirect costs.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.