Podcast

Questions and Answers

Explain how reducing operating expenses too much might negatively impact a company's productivity.

Explain how reducing operating expenses too much might negatively impact a company's productivity.

Reducing operating expenses too much might lead to decreased investment in crucial areas like maintenance, training or necessary resources. This can result in overworked employees, outdated equipment, and ultimately, a decline in the quality and quantity of output.

Why are administrative expenses often targeted for budget cuts, and what are the potential risks associated with this approach?

Why are administrative expenses often targeted for budget cuts, and what are the potential risks associated with this approach?

Administrative expenses are often targeted for budget cuts because they aren't directly tied to producing goods or services. However, cutting too deep can harm essential support functions like HR, IT, or legal, leading to inefficiencies or compliance issues.

Differentiate between operating expenses and administrative expenses, providing an example of an expense that could potentially be classified under either category, and explain the determining factor for its classification.

Differentiate between operating expenses and administrative expenses, providing an example of an expense that could potentially be classified under either category, and explain the determining factor for its classification.

Operating expenses are directly related to a company's core business activities (e.g., cost of goods sold), while administrative expenses support the overall functioning of the business (e.g., executive salaries). Rent could be either; if it's factory rent, it's operating, if it's for the head office, it's administrative.

Describe the role of distribution costs in the overall expenses of a company, and discuss how efficient distribution management can impact profitability.

Describe the role of distribution costs in the overall expenses of a company, and discuss how efficient distribution management can impact profitability.

Explain how the depreciation on assets is classified under operating expenses, and provide examples of such assets.

Explain how the depreciation on assets is classified under operating expenses, and provide examples of such assets.

Why is it important to verify that all documentary evidence supporting recorded transactions is authenticated and related to business transactions during vouching?

Why is it important to verify that all documentary evidence supporting recorded transactions is authenticated and related to business transactions during vouching?

Explain why analyzing growth trends for utility bills is crucial in an audit. What specific insights can this provide regarding a company's operations and potential financial misstatements?

Explain why analyzing growth trends for utility bills is crucial in an audit. What specific insights can this provide regarding a company's operations and potential financial misstatements?

Describe a scenario where wage costs might be incorrectly recorded, and explain what internal controls could prevent such an error.

Describe a scenario where wage costs might be incorrectly recorded, and explain what internal controls could prevent such an error.

In the context of auditing rent expenses, why is it important to reconcile rent payments with bank statements? Explain how such reconciliation can prevent potential fraud or errors.

In the context of auditing rent expenses, why is it important to reconcile rent payments with bank statements? Explain how such reconciliation can prevent potential fraud or errors.

Explain how vouching helps in differentiating between capital and revenue expenditures. Provide an example to illustrate your explanation.

Explain how vouching helps in differentiating between capital and revenue expenditures. Provide an example to illustrate your explanation.

When auditing utility bills, what specific steps should be taken to research potential tax exemptions, and why is this research important?

When auditing utility bills, what specific steps should be taken to research potential tax exemptions, and why is this research important?

Describe how an auditor would test the completeness assertion for rent expense. What procedures would they perform to ensure that all rent expenses have been recorded?

Describe how an auditor would test the completeness assertion for rent expense. What procedures would they perform to ensure that all rent expenses have been recorded?

Explain how an auditor would test the occurrence assertion for expenses. What specific steps might they take to confirm that recorded expenses actually happened and relate to the client?

Explain how an auditor would test the occurrence assertion for expenses. What specific steps might they take to confirm that recorded expenses actually happened and relate to the client?

Describe a scenario where segregation of duties within the payroll department is inadequate, and explain how this could lead to fraudulent activities. What specific controls should be in place to mitigate this risk?

Describe a scenario where segregation of duties within the payroll department is inadequate, and explain how this could lead to fraudulent activities. What specific controls should be in place to mitigate this risk?

How does an auditor assess the reasonableness of executive compensation expenses? What benchmarks or data sources might they use to determine if the compensation is justified?

How does an auditor assess the reasonableness of executive compensation expenses? What benchmarks or data sources might they use to determine if the compensation is justified?

Explain how an auditor would test the cut-off assertion for accrued expenses at year-end. What specific procedures would they perform to ensure that expenses are recorded in the correct accounting period?

Explain how an auditor would test the cut-off assertion for accrued expenses at year-end. What specific procedures would they perform to ensure that expenses are recorded in the correct accounting period?

Describe the audit procedures an auditor would perform to verify the accuracy of commission expenses. What documentation would they examine, and what calculations would they perform to ensure commissions are correctly calculated and paid?

Describe the audit procedures an auditor would perform to verify the accuracy of commission expenses. What documentation would they examine, and what calculations would they perform to ensure commissions are correctly calculated and paid?

Discuss the potential risks associated with inadequate internal controls over travel and entertainment (T&E) expenses. What specific audit procedures should be performed to detect and prevent fraudulent T&E claims?

Discuss the potential risks associated with inadequate internal controls over travel and entertainment (T&E) expenses. What specific audit procedures should be performed to detect and prevent fraudulent T&E claims?

Explain how an auditor would evaluate the design and operating effectiveness of internal controls over payroll expenses. What specific tests of controls would they perform to assess whether these controls are functioning as intended?

Explain how an auditor would evaluate the design and operating effectiveness of internal controls over payroll expenses. What specific tests of controls would they perform to assess whether these controls are functioning as intended?

How would an auditor respond if they discovered a significant number of unexplained variances when comparing budgeted expenses to actual expenses? What additional audit procedures would they perform, and what potential issues might these variances indicate?

How would an auditor respond if they discovered a significant number of unexplained variances when comparing budgeted expenses to actual expenses? What additional audit procedures would they perform, and what potential issues might these variances indicate?

Flashcards

Operating Expenses

Operating Expenses

Expenses related to a company's core activities, like cost of goods sold, direct labor and rent.

Operating Income

Operating Income

Expenses subtracted from revenue to calculate operating income (profit from the direct business activities).

Administrative Expenses

Administrative Expenses

Expenses not directly tied to a specific core function like manufacturing or sales; overhead expenses related to the organization as a whole.

Administrative Expenses

Administrative Expenses

Signup and view all the flashcards

Distribution Cost

Distribution Cost

Signup and view all the flashcards

Selling & Distribution Expenses

Selling & Distribution Expenses

Signup and view all the flashcards

Expenses Audit

Expenses Audit

Signup and view all the flashcards

Goal of Expenses Audit

Goal of Expenses Audit

Signup and view all the flashcards

Completeness (Expense Audit)

Completeness (Expense Audit)

Signup and view all the flashcards

Cut-off (Expense Audit)

Cut-off (Expense Audit)

Signup and view all the flashcards

Accuracy (Expense Audit)

Accuracy (Expense Audit)

Signup and view all the flashcards

Valid Wage Payment

Valid Wage Payment

Signup and view all the flashcards

Valid Employees

Valid Employees

Signup and view all the flashcards

Rent Accrual

Rent Accrual

Signup and view all the flashcards

Rent Reconciliation

Rent Reconciliation

Signup and view all the flashcards

Utility Trend Analysis

Utility Trend Analysis

Signup and view all the flashcards

Objective of Vouching

Objective of Vouching

Signup and view all the flashcards

Vouching: Documentary Evidence

Vouching: Documentary Evidence

Signup and view all the flashcards

Vouching: Internal Check System

Vouching: Internal Check System

Signup and view all the flashcards

Vouchers for Sales

Vouchers for Sales

Signup and view all the flashcards

Study Notes

- Shubhra Paul ACA is a partner at Arun & Company, Chartered Accountants.

- Her WhatsApp number is 01717-450527.

- Her email address is [email protected].

- She is also on Facebook as Shubhra Paul ACA.

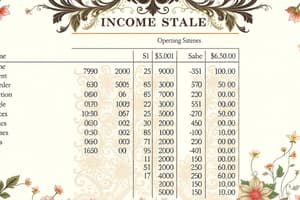

Classification of Types of Expenses

- Operating expenses.

- Administrative expenses.

- Selling and Distribution expenses.

Operating Expenses

- Operating expenses relate to a company's core activities, such as the cost of goods sold, administrative fees, factory supplies, direct labor and rent.

- These expenses are incurred from normal, day-to-day operations.

- Operating expense is deducted from revenue to arrive at operating income and managing these expenses ensures profit maximization.

- Reducing expenses too much can hurt the company's productivity.

- Examples of operating expenses include rent, wages, repairs, utilities expenses, depreciation, and amortization.

Administrative Expenses

- These are expenses that an organization incurs that are not directly related to a specific core function such as manufacturing, production, or sales.

- They are overhead expenses related to the organization as a whole, not individual departments.

- Administrative expenses support the overall functioning of a business.

- A level of administrative expenses will always be incurred as a necessary part of operations.

- They are often among the first identified for budget cuts due to not directly impacting a company's main business functions.

- Management may allocate administrative expenses to business units based on a percentage of revenue, expenses, or other measures.

- Examples of administrative expenses include rent, utilities, insurance, executives' wages and benefits, depreciation on office fixtures and equipment, legal counsel and accounting staff salaries, and office supplies.

Selling and Distribution Expenses

- Distribution costs encompass all expenses a producer incurs to deliver a product from its production site to the end customer's location.

- For a manufacturer, this includes expenses incurred to make product delivery possible to the customer's location, whether retailer, wholesaler, or the final customer.

- These expenses include costs such as shipping , packing, transport, storage and insurance.

Audit Objectives

- An audit of expenses assesses whether company expenses were necessary and aligned with business policies.

- Auditors gather evidence to reach a conclusion on this matter.

- The audit ensures expenses are reasonable, accurately recorded, and efficiently managed.

- Accuracy is crucial as it affects profit statements if expenses are understated or overstated.

Audit Procedures

- Completeness: Ensure all expenses that should have been recorded are actually recorded.

- Cut-off: Verify expenses are recorded in the correct accounting period.

- Accuracy: Ensure all expense transactions are recorded correctly.

- Occurrence: Confirm recorded expenses actually occurred and are relevant to the client.

- Classification: Check all expenses are properly classified.

Auditing Procedures for Salaries & Wages include

- Verifying data across various accounts and software systems, that is used to manage employee data.

- Ensuring employees appointed for part-time work are not incorrectly paid for full-time work.

- Typical control objectives of wages and salaries includes to ensure: payments are for work done and made to valid employees.

- Payments are authorized and complying with employment terms and calculation.

- Furthermore payments should recorded correctly and any tax compliance is performed according to regulation.

Evaluation of the Internal Control System

- Assessing whether employees can be paid without working.

- Whether wages and salaries can be paid to fictitious employees.

- Whether wages can be paid without approval.

- Confirming the chances of errors in wage calculations or incorrect wage cost recordings

Auditing Procedures for RENT

- Involves reading the rent agreement and note important term and conditions such as Rent expense, security deposit amount, validity period .

- Examination to determine whether rent is recorded as and when rent accrued.

- Verification of the authenticity of rent receipts and whether it belongs to the tenant.

- Determine if there is any advance payment, including its adjustment against rent expense.

- Also to reconcile payments made via bank statements.

- Ensuring any rent increase complies with the agreement.

- Verification of the rent expense for proper accounting such as prepaid and outstanding.

Auditing Procedures For Utility Bills

- Reviewing the Numbers in a Utilities Expense Audit.

- Looking at Rate Structures.

- Monitoring Growth Trends.

- Researching Tax Exemptions.

- Checking for Clerical Errors.

Test of Details of Expenses Vouching Objectives

- To verify business transactions are accurately recorded in the books of accounts.

- To confirm that recorded transactions have appropriate documentary support.

- To ensure all documentary evidence is genuine, relevant to business activities, and free from errors or fraud.

- To confirm proper voucher processing through all stages of the Internal Check System.

- To verify the appropriate recording of entries based on capital and revenue nature

- Aim to check the accuracy of accounting transactions.

Examples of Vouchers for Test of Details of Expenses

- For Sales: Sales order, sales invoice, goods outward register, cash receipt, bank pay-in-slip.

- For Purchase: Quotations, purchase orders, purchase bills, goods inward register.

- For Cash Payments: Demand note, cash receipt, cash memo.

- For Cash Received: Duplicate or carbon copy of cash receipt, contracts, and correspondence with payee

- For BankPayments: Cheques, counterfoils, bank statements

- For Payment received through Banking Channels: Bank deposit slip, bank statements.

Analytical Procedures-Variance of Expenses through Cost Variance

- Cost variance analysis is a tool used to check costs compared to budgeted numbers.

- Its steps include:

- Calculate the difference between actual and budgeted spending.

- Investigate the reason for the gap.

- Compile the information and talk to management.

- Develop a plan to align costs with the budget.

Cut Off in Audit

- Cut-off testing checks if accounting entries are logged in the correct periods.

- The goal is to confirm the reported profit or loss aligns with the period it claims to represent.

- Cut-off testing validates transactions recorded correspond to activities within the specified accounting period.

Auditors Procedure for Cut-off Testing

- Revenue requires auditors to review the last invoices with goods dispatched notes of the accounting period

- Reconcile the goods dispatched notes and the invoices of the auditee

- Invoices and goods must match to apply this audit to property, plant and equipment – PPE

Auditors Procedure for PPEs must include

- Request purchase invoices and delivery notes for the assets under consideration during auditing

- To ensure date of capitalization is correct and depreciation begins on time: the delivery note and purchase invoices require the same capitalization.

Auditor's Cut-off Testing for Expenses

- Request last three expenses, then review invoices and receiving notes for last three expenses.

- Ensure accounting system is updated on same date as invoices and should fall in the period under reporting.

- If the dates on purchase invoices and receiving notes match the posting date, it can assure proper expense recording according to the appropriate period.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.

Related Documents

Description

Understand the different types of expenses in accounting, including operating, administrative, and selling & distribution costs. Operating expenses stem from core business activities and are crucial for calculating operating income. Learn how managing these expenses impacts a company's profitability.