Podcast

Questions and Answers

Which of the following is NOT considered an operating expense?

Which of the following is NOT considered an operating expense?

- Labor

- Depreciation

- Fertilizer

- Interest (correct)

What is the primary purpose of the income statement?

What is the primary purpose of the income statement?

- To show the revenue and expenses over a period of time, usually one year (correct)

- To compare the farm's performance to other farms in the area

- To illustrate the net worth of the farm

- To track the financial position of the farm at a specific point in time

What does 'net farm income from operations' represent?

What does 'net farm income from operations' represent?

- The difference between cash revenue and cash expenses

- Total revenue earned by the farm from all sources

- Profit earned from the normal day-to-day operations of the farm (correct)

- Income from the sale of assets such as land or machinery

Which of the following is NOT included in cash revenue for the Kendalls' farm?

Which of the following is NOT included in cash revenue for the Kendalls' farm?

What is the purpose of accrual adjustments in the income statement?

What is the purpose of accrual adjustments in the income statement?

What is the main distinction between the income statement and the net worth statement?

What is the main distinction between the income statement and the net worth statement?

Which of the following is included in operating expenses?

Which of the following is included in operating expenses?

How is 'net farm income from operations' calculated?

How is 'net farm income from operations' calculated?

How does the value of the raised breeding livestock relate to the net worth statement?

How does the value of the raised breeding livestock relate to the net worth statement?

What does the 'Change' column in Figure 19 represent?

What does the 'Change' column in Figure 19 represent?

How is the change in value of the raised breeding livestock reflected on the income statement?

How is the change in value of the raised breeding livestock reflected on the income statement?

What is the primary assumption for the category of 'Raised Breeding Livestock'?

What is the primary assumption for the category of 'Raised Breeding Livestock'?

Why would a complete account for breeding livestock have separate sections for different age groups?

Why would a complete account for breeding livestock have separate sections for different age groups?

What is the purpose of depreciating machinery and equipment used for farming?

What is the purpose of depreciating machinery and equipment used for farming?

What is the recommended depreciation schedule for farm machinery and equipment based on the provided information?

What is the recommended depreciation schedule for farm machinery and equipment based on the provided information?

What is the purpose of having a separate depreciation schedule for the chart of accounts?

What is the purpose of having a separate depreciation schedule for the chart of accounts?

What is another name for a net worth statement?

What is another name for a net worth statement?

What does the net worth statement represent?

What does the net worth statement represent?

What function does an income statement serve for a business?

What function does an income statement serve for a business?

Which of the following is NOT a use of good farm and ranch records?

Which of the following is NOT a use of good farm and ranch records?

Which of the following is included in the net worth equation?

Which of the following is included in the net worth equation?

What is typically used to value assets for financial management?

What is typically used to value assets for financial management?

What is the first step in setting up a record system for a farm and ranch business?

What is the first step in setting up a record system for a farm and ranch business?

Which approach is beneficial when applying for loans?

Which approach is beneficial when applying for loans?

Why is it important for Alex and Mindy to utilize a good set of farm and ranch records?

Why is it important for Alex and Mindy to utilize a good set of farm and ranch records?

Which of the following accounts is typically included in the chart of accounts?

Which of the following accounts is typically included in the chart of accounts?

How are assets and liabilities categorized in the net worth statement?

How are assets and liabilities categorized in the net worth statement?

What type of statement shows the financial condition of a business at a specific time?

What type of statement shows the financial condition of a business at a specific time?

What does the equation for net worth state?

What does the equation for net worth state?

How often do the Kendalls typically see their accountant for financial information?

How often do the Kendalls typically see their accountant for financial information?

In a farm business, which of the following is considered a liability?

In a farm business, which of the following is considered a liability?

Which method assumes a specific price paid for an asset in historical records?

Which method assumes a specific price paid for an asset in historical records?

What amount would the Kendalls owe if they paid off their loan on December 31st of year zero?

What amount would the Kendalls owe if they paid off their loan on December 31st of year zero?

How is accrued interest treated in the net worth statement?

How is accrued interest treated in the net worth statement?

Which part of the loan payment represents the principal in year three for the Kendalls?

Which part of the loan payment represents the principal in year three for the Kendalls?

At the end of year two, what would be included in the non-current liabilities section of the Kendalls' net worth statement?

At the end of year two, what would be included in the non-current liabilities section of the Kendalls' net worth statement?

What does the principal portion of a term loan represent?

What does the principal portion of a term loan represent?

On December 31st, which portion of the loan payment is recorded as the current portion of term debt?

On December 31st, which portion of the loan payment is recorded as the current portion of term debt?

How is the loan balance shown after each annual payment for the Kendalls?

How is the loan balance shown after each annual payment for the Kendalls?

If the Kendalls were in year three of a loan, what portion would be reflected in their payment amount?

If the Kendalls were in year three of a loan, what portion would be reflected in their payment amount?

What does the undepreciated balance of a machine represent?

What does the undepreciated balance of a machine represent?

Which statement about the depreciable balance of an asset is correct?

Which statement about the depreciable balance of an asset is correct?

What should the values on the net worth statement reflect over time regarding land?

What should the values on the net worth statement reflect over time regarding land?

How is the depreciable total calculated if new items are purchased?

How is the depreciable total calculated if new items are purchased?

What characteristic distinguishes the cost basis net worth statement from a market value net worth statement?

What characteristic distinguishes the cost basis net worth statement from a market value net worth statement?

In which instance might the value of land differ from its original cost?

In which instance might the value of land differ from its original cost?

What implication does the purchase of new depreciable items have on the overall assets?

What implication does the purchase of new depreciable items have on the overall assets?

Which asset typically does not increase in value over time according to the cost basis method?

Which asset typically does not increase in value over time according to the cost basis method?

Flashcards

Net Worth or Equity

Net Worth or Equity

The value of what the owner has invested in their business. This is calculated by subtracting total liabilities from total assets.

Net Worth Statement

Net Worth Statement

A financial statement that summarizes a farm's assets, liabilities, and net worth at a specific point in time.

Cost Basis Valuation

Cost Basis Valuation

An accounting method that values assets at their original purchase price.

Market Value Valuation

Market Value Valuation

Signup and view all the flashcards

Current Assets and Liabilities

Current Assets and Liabilities

Signup and view all the flashcards

Non-Current Assets and Liabilities

Non-Current Assets and Liabilities

Signup and view all the flashcards

Balance Sheet Equation

Balance Sheet Equation

Signup and view all the flashcards

Asset Valuation

Asset Valuation

Signup and view all the flashcards

Income Statement

Income Statement

Signup and view all the flashcards

Record Keeping

Record Keeping

Signup and view all the flashcards

Chart of Accounts

Chart of Accounts

Signup and view all the flashcards

Financial Health

Financial Health

Signup and view all the flashcards

Financial Analysis

Financial Analysis

Signup and view all the flashcards

Financial Management

Financial Management

Signup and view all the flashcards

Accounting System

Accounting System

Signup and view all the flashcards

Net Farm Income From Operations

Net Farm Income From Operations

Signup and view all the flashcards

Operating Expenses

Operating Expenses

Signup and view all the flashcards

Cash Revenue

Cash Revenue

Signup and view all the flashcards

Accrual Adjustments (Revenue)

Accrual Adjustments (Revenue)

Signup and view all the flashcards

Accrual Adjustments (Expenses)

Accrual Adjustments (Expenses)

Signup and view all the flashcards

Interest Expense

Interest Expense

Signup and view all the flashcards

Cash Operating Expenses

Cash Operating Expenses

Signup and view all the flashcards

Breeding Livestock Valuation

Breeding Livestock Valuation

Signup and view all the flashcards

Breeding Livestock as Non-Current Asset

Breeding Livestock as Non-Current Asset

Signup and view all the flashcards

Breeding Livestock Value Increase

Breeding Livestock Value Increase

Signup and view all the flashcards

Breeding Livestock Value Link

Breeding Livestock Value Link

Signup and view all the flashcards

Machinery Depreciation

Machinery Depreciation

Signup and view all the flashcards

Depreciation Schedule

Depreciation Schedule

Signup and view all the flashcards

Depreciation Methods

Depreciation Methods

Signup and view all the flashcards

Straight-Line Depreciation

Straight-Line Depreciation

Signup and view all the flashcards

What is book value?

What is book value?

Signup and view all the flashcards

What is a depreciation schedule?

What is a depreciation schedule?

Signup and view all the flashcards

How is land value treated?

How is land value treated?

Signup and view all the flashcards

How are permanent improvements valued?

How are permanent improvements valued?

Signup and view all the flashcards

What is a market value net worth statement?

What is a market value net worth statement?

Signup and view all the flashcards

What is a cost basis net worth statement?

What is a cost basis net worth statement?

Signup and view all the flashcards

How does book value differ from market value?

How does book value differ from market value?

Signup and view all the flashcards

Can the total value of depreciable items decrease?

Can the total value of depreciable items decrease?

Signup and view all the flashcards

Accrued Interest

Accrued Interest

Signup and view all the flashcards

Principal of a Term Loan

Principal of a Term Loan

Signup and view all the flashcards

Current Portion of Term Debt

Current Portion of Term Debt

Signup and view all the flashcards

Loan Amortization Schedule

Loan Amortization Schedule

Signup and view all the flashcards

Non-Current Liabilities

Non-Current Liabilities

Signup and view all the flashcards

Loan Balance

Loan Balance

Signup and view all the flashcards

Net Worth

Net Worth

Signup and view all the flashcards

Study Notes

Introduction to Record Keeping

- Without proper record keeping, managing a successful business is difficult.

- Records are crucial for making sound business decisions.

- Records are a valuable asset for business managers.

Why Keep Records

- Complying with income tax reporting requirements is a key reason. (Figure 1)

- Assisting in planning and management, such as obtaining credit, is another reason. (Figure 2)

Kinds of Records

- Chart of Accounts: An inventory of information needed for financial statements to analyze farm business health and profitability. Includes income/expense ledger, current assets inventory, machinery depreciation, loans, and land.

- Net Worth Statement: A snapshot of business financial condition at a specific time. Lists assets, values, and liabilities (balance sheet, financial statement, or statement of financial condition).

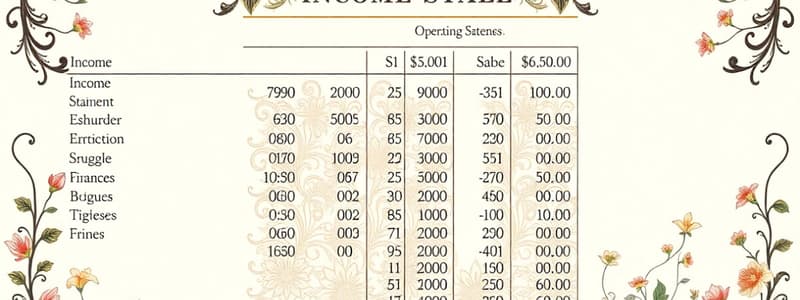

- Income Statement: Shows a business's profitability over a specific period, usually annually. Also known as a profit and loss statement or operating statement.

Useful Records

- Measure the financial health of the farm.

- Evaluate profitability.

- Aid in making business decisions.

- Obtaining loans is made easier.

- Aids in investment analysis.

- Assists in tax returns and tax management.

Record Systems

- Financial Records: Include receipts, expenses, assets, and liabilities. Used to construct financial statements for analysis. (Figure 3)

- Physical Records: Show the production of crops and livestock, along with usage of inputs, like crop yields, calving percentages, and machinery use. (Figure 4)

- Levels of Record Keeping Systems:

- Income tax purposes only

- Income taxes plus some business analysis

- Complete farm or ranch business analysis

Accounting Systems

- Accounting Period: Calendar year (January 1st to December 31st) is common, though other fiscal years can be used.

- Cash vs. Accrual Accounting:

- Cash method: Records income and expenses based on actual cash transactions.

- Accrual method: Records income and expenses when they occur, irrespective of cash inflows/outflows.

- Single vs. Double Entry Accounting: A single entry system records just one entry per transaction while a double entry system has a debit and corresponding credit entry per transaction.

Financial Statements

- Net worth statement (balance sheet): Shows the assets, liabilities, and equity (net worth) of a business at a specific point in time.

- Income statement (profit and loss statement): Shows the revenues and expenses of a business over a period of time (e.g., one year).

Charts of Accounts

- A well-designed chart of accounts provides the data needed for financial statements.

- Computerized farm accounting systems automatically create the link.

Cash Account

- Simple recording of cash on hand.

- Separate from personal cash.

Revenue and Expenses

- Accounts are created to record dates, vendors, units, prices, and totals.

- Categorization by type.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.