Podcast

Questions and Answers

Which statement is NOT correct regarding the chart of accounts?

Which statement is NOT correct regarding the chart of accounts?

- The chart of accounts is designed based on an entity's accounting system.

- The chart of accounts consists of real and nominal accounts.

- The accounts are arranged alphabetically. (correct)

- The chart of accounts includes an entity's account titles and account numbers.

A systematic listing of all an entity's general ledger accounts is known as the:

A systematic listing of all an entity's general ledger accounts is known as the:

- Subsidiary ledger

- Chart of accounts (correct)

- General journal

- General ledger

Which of the following is NOT typically used as a business document in recording business transactions?

Which of the following is NOT typically used as a business document in recording business transactions?

- Sales invoice

- Check voucher

- Confirmation letter (correct)

- Bank statement

Which statement regarding the basic steps in the recording process is correct?

I. Analysis of each transaction based on source documents for the effect on assets, liabilities, equity, revenues and expenses

II. Transfer of the information to the appropriate account in the statement of financial position

Which statement regarding the basic steps in the recording process is correct?

I. Analysis of each transaction based on source documents for the effect on assets, liabilities, equity, revenues and expenses II. Transfer of the information to the appropriate account in the statement of financial position

Which of the following statements is correct concerning the normal balances of accounts?

Which of the following statements is correct concerning the normal balances of accounts?

A record containing the transaction date, accounts and amounts to be debited and credited, and a brief explanation is best described as a:

A record containing the transaction date, accounts and amounts to be debited and credited, and a brief explanation is best described as a:

The accounting element used to summarize the effects of transactions on each asset, liability, equity, revenue, and expense is the:

The accounting element used to summarize the effects of transactions on each asset, liability, equity, revenue, and expense is the:

Regarding a chart of accounts, a chart of accounts is:

Regarding a chart of accounts, a chart of accounts is:

Which correctly relates to the analysis of business documents or transactions?

I. The accountant determines the impact of the transactions on the financial position

II. Financial position is represented by the basic equation assts equal liabilities plus equity

Which correctly relates to the analysis of business documents or transactions?

I. The accountant determines the impact of the transactions on the financial position II. Financial position is represented by the basic equation assts equal liabilities plus equity

Which statement concerning source documents is NOT correct?

Which statement concerning source documents is NOT correct?

Which of the following statements is NOT correct concerning the rules of debit and credit?

Which of the following statements is NOT correct concerning the rules of debit and credit?

Which of the following is not a basic step in the recording process?

Which of the following is not a basic step in the recording process?

When is the chart of accounts typically entered in the accounting records?

When is the chart of accounts typically entered in the accounting records?

How are account titles and account numbers arranged in the chart of accounts?

How are account titles and account numbers arranged in the chart of accounts?

When does the debit and credit analysis of a transaction normally take place?

When does the debit and credit analysis of a transaction normally take place?

Which statement is NOT correct concerning an approved sales invoice?

Which statement is NOT correct concerning an approved sales invoice?

Which of the following is NOT a possible combination of a journal entry?

Which of the following is NOT a possible combination of a journal entry?

Double entry accounting system means:

Double entry accounting system means:

A firm's chart of accounts is best described as:

A firm's chart of accounts is best described as:

Which of the following is systematically arranged in a chart of accounts?

Which of the following is systematically arranged in a chart of accounts?

Flashcards

What is a chart of accounts?

What is a chart of accounts?

A listing of an entity's general ledger accounts in a systematic format.

What is a general journal?

What is a general journal?

A book for recording transactions in chronological order.

What is a confirmation letter?

What is a confirmation letter?

A document used to verify the existence of a balance.

Debit balance increases

Debit balance increases

Signup and view all the flashcards

What is a journal entry?

What is a journal entry?

Signup and view all the flashcards

accounting?

accounting?

Signup and view all the flashcards

Chart of accounts

Chart of accounts

Signup and view all the flashcards

Analyzing business documents

Analyzing business documents

Signup and view all the flashcards

Source documents

Source documents

Signup and view all the flashcards

Debits and Credits Rules

Debits and Credits Rules

Signup and view all the flashcards

Recording Process

Recording Process

Signup and view all the flashcards

When is the chart of accounts?

When is the chart of accounts?

Signup and view all the flashcards

Systematic format order

Systematic format order

Signup and view all the flashcards

What normally takes place?

What normally takes place?

Signup and view all the flashcards

Approved Sales Invoice

Approved Sales Invoice

Signup and view all the flashcards

double entry?

double entry?

Signup and view all the flashcards

Business Entity

Business Entity

Signup and view all the flashcards

Real world scenarios

Real world scenarios

Signup and view all the flashcards

Which is correct?

Which is correct?

Signup and view all the flashcards

Best statement.

Best statement.

Signup and view all the flashcards

Study Notes

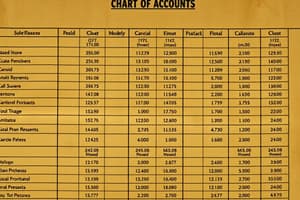

Chart of Accounts

- Accounts are not arranged alphabetically within the chart of accounts.

- The chart of accounts lists all general ledger accounts systematically.

- The chart of accounts includes an entity's account titles and numbers and is designed based on the entity’s accounting system.

- A chart of accounts is entered upon assumption of a business

- Account titles and numbers are arranged as assets, liabilities, equity, revenue, and expenses

- A firm's chart of accounts is a list account titles used by a business entity

- Creating it is the first step undertaken in the accounting cycle

- Accounts are arranged following the Balance Sheet and then the Income Statement.

- A chart of accounts is specific for a particular entity.

Business Transactions and Source Documents

- A confirmation letter is not a business document used in recording business transactions.

- Source documents received from outside parties are important.

- Source documents are a basis for recording business transactions.

- Business source documents are required to analyze business transactions in the real world.

- A debit memo from a supplier is a source document that evidences a business transaction

- analyzing transactions from source documents is the first step in the accounting cycle.

Accounting and Financial Position

- Assets, expenses, and drawing accounts are debited for increases.

- An "account" is used to summarize the effects of transactions on assets, liabilities, equity, revenue, and expenses.

- The accountant determines the impact of transactions on the financial position.

- Financial position is represented by the basic equation: assets equal liabilities plus equity

Journal Entries

- A general journal entry includes the transaction date, accounts and amounts to be debited and credited, and a brief explanation.

- Debit and credit analysis of a transaction happens before the entry is recorded in the journal.

- Increasing an asset and decreasing equity is not a possible combination

- In the Double-entry accounting system, the dual effect of each transaction is recorded with a debit and a credit.

- Increase to assets and expense accounts use debit entries, while increases to liabilities, equity, and revenue accounts use credit entries

- "Debit" increases while "credit" decreases.

Recording process

- Transferring journal information into the appropriate account is not a basic step in the recording process

- Analysis of transactions looks at the effect on assets, liabilities, equity, revenues, and expenses.

- First step is to analyze each transaction based on source documents for the effect on balances

Sales Invoice and VAT

- Payment made after 10 days from the invoice date includes the full invoice amount plus the 12% Output VAT

- In the invoice terms of 2/10, n/30, the customer can get a 2% discount by paying in 10 days.

- An invoice supports the cash purchase of equipment and the transaction is recorded in the Cash Disbursements Journal

Accounting System

- A purchase order is not a source document used in recording a business transaction.

- The double-entry system means the dual effect of each transaction is recorded with a debit and a credit

- Complete sets of journals and ledgers are maintained in the double-entry accounting system.

Transaction Example

- Purchasing equipment for P160,000 by paying P60,000 cash and issuing a note payable for the balance increases total assets and total liabilities by P100,000.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.