Podcast

Questions and Answers

What are operating activities?

What are operating activities?

- Only buying goods.

- Financing activities.

- Infrequent investment activities.

- Day-to-day functions involved in running a business. (correct)

What is the operating cycle?

What is the operating cycle?

The period from buying goods and services through to collecting cash from customers.

What does the income statement summarize?

What does the income statement summarize?

The financial impact of operating activities during the accounting period.

What are revenues?

What are revenues?

What are expenses?

What are expenses?

How is net income calculated?

How is net income calculated?

What does the Time Period Assumption allow?

What does the Time Period Assumption allow?

Which financial statement reports the financial effects of activities only during the current period?

Which financial statement reports the financial effects of activities only during the current period?

What is cash basis accounting?

What is cash basis accounting?

What is accrual basis accounting?

What is accrual basis accounting?

What are the two basic accounting principles under accrual basis accounting?

What are the two basic accounting principles under accrual basis accounting?

What does the revenue recognition principle state?

What does the revenue recognition principle state?

What is unearned revenue?

What is unearned revenue?

What is accounts receivable?

What is accounts receivable?

What is the expense recognition principle (or 'matching')?

What is the expense recognition principle (or 'matching')?

What is the difference between the timing of reporting expenses and cash payments?

What is the difference between the timing of reporting expenses and cash payments?

What is accounts payable?

What is accounts payable?

What is the purpose of a trial balance?

What is the purpose of a trial balance?

How is net profit margin calculated?

How is net profit margin calculated?

Flashcards are hidden until you start studying

Study Notes

Operating Activities

- Daily functions that sustain business operations; regular and short-term impact compared to infrequent investing and financing activities.

- Key components include purchasing goods/services and selling them, alongside cash collection.

Operating Cycle

- Timeframe from acquiring goods/services until cash is collected from customers.

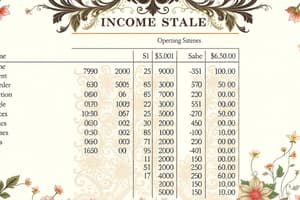

Income Statement Accounts

- Summarizes financial outcomes of operating activities for an accounting period.

- Comprises three sections: revenues, expenses, and net income.

Revenues

- Amounts charged to customers for goods/services provided.

- Reported first in the income statement.

Expenses

- Costs incurred to operate the business and generate revenues.

- Recognized when resources are used, regardless of payment timing, and reported after revenues.

Net Income

- Result of subtracting expenses from revenues.

- A key indicator of financial performance; termed net loss if expenses exceed revenues.

Time Period Assumption

- Allows for reporting on a company's long-term operations in shorter intervals.

Balance Sheet vs Income Statement

- Income statement reflects activities of the current period with temporary accounts; balance sheet accounts are permanent and have ongoing effects.

Cash Basis Accounting

- Records revenues upon cash receipt and expenses when cash is paid.

Accrual Basis Accounting

- Records revenues when earned and expenses when incurred, unaffected by cash timing.

- Emphasizes actual occurrence of business activities over cash flow.

Revenue Recognition Principle

- Revenues recognized when obligations to customers are fulfilled, typically at delivery.

Timing of Reporting Revenue vs Cash Receipts

- Revenue recognition is dependent on service provision, not cash timing; cash can be received concurrently, before, or after services are rendered.

Unearned Revenue

- Liability indicating obligation to deliver goods/services post payment.

Accounts Receivable

- Asset reflecting rights to collect cash from customers when goods/services are provided on credit.

Expense Recognition Principle ("Matching")

- Aligns expense recording with associated revenue periods, ensuring accurate financial reporting.

Timing of Reporting Expenses vs Cash Payments

- Expense recognition tied to business activities, independent of cash payment timing.

Accounts Payable

- Liability for costs incurred but not yet paid, reflecting unpaid wages as an example.

Stockholders' Equity

- Represents claims of owners on company resources, sourced from contributed capital and retained earnings.

Retained Earnings Subcategories

- Includes revenues and expenses, which flow into retained earnings but are initially recorded separately for clarity.

Expanded Debit/Credit Framework

- Revenues credited to increase stockholders' equity; expenses debited reduce net income and retained earnings.

Trial Balance

- Internal report to verify equality of total debits and credits; lists all account balances organized by category.

Net Profit Margin

- Indicates profit earned per revenue dollar; calculated as Net Income divided by Total Revenue.

- Example: Pizza Aroma's net income of $6,400 from $15,500 revenue gives a net profit margin of approximately 41.3%.

Studying That Suits You

Use AI to generate personalized quizzes and flashcards to suit your learning preferences.