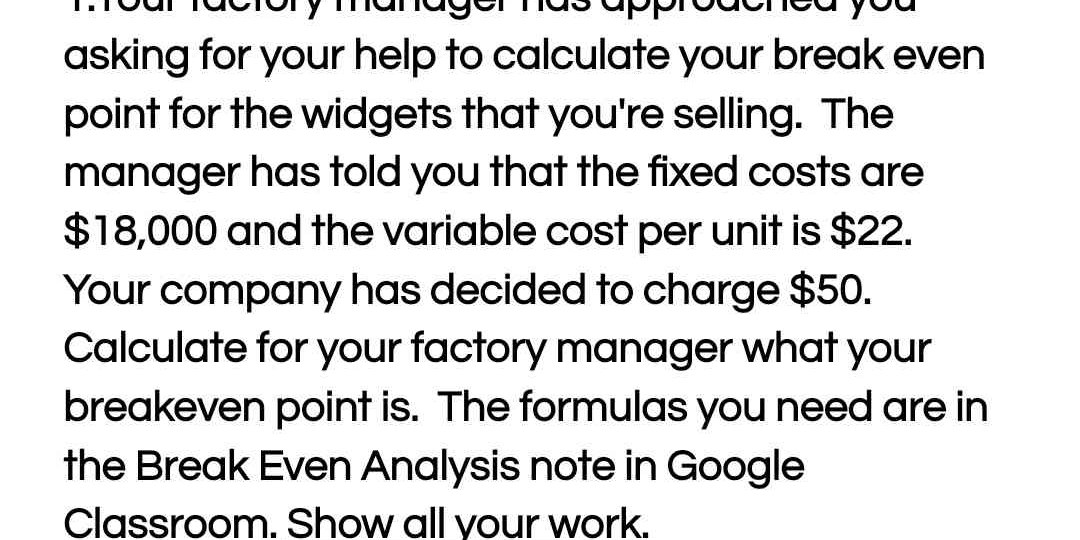

Your factory manager has approached you asking for your help to calculate your break even point for the widgets that you're selling. The manager has told you that the fixed costs a... Your factory manager has approached you asking for your help to calculate your break even point for the widgets that you're selling. The manager has told you that the fixed costs are $18,000 and the variable cost per unit is $22. Your company has decided to charge $50. Calculate for your factory manager what your breakeven point is. Show all your work.

Understand the Problem

The question is asking for the calculation of the break-even point for selling widgets, given fixed costs, variable costs per unit, and selling price. The break-even point is the number of units that must be sold to cover all costs, and the formulas needed for the calculation are specified to be in a note in Google Classroom.

Answer

643 units

Answer for screen readers

The break-even point is 643 units.

Steps to Solve

- Identify the known values

From the problem, we have the following values:

- Fixed costs (FC) = $18,000

- Variable cost per unit (VC) = $22

- Selling price per unit (P) = $50

- Calculate the contribution margin per unit

The contribution margin (CM) is calculated as:

$$ CM = P - VC $$

Substituting the known values:

$$ CM = 50 - 22 = 28 $$

- Calculate the break-even point in units

The break-even point (BEP) in units can be calculated using the formula:

$$ BEP = \frac{FC}{CM} $$

Substituting the values we have:

$$ BEP = \frac{18000}{28} $$

Calculating the result gives:

$$ BEP \approx 642.86 $$

Since we can't sell a fraction of a unit, we round up to the next whole number:

$$ BEP = 643 \text{ units} $$

The break-even point is 643 units.

More Information

The break-even point is the number of units that must be sold to cover both fixed and variable costs. Selling any units beyond this point will contribute to profit.

Tips

- Forgetting to round up when calculating the break-even point, as selling a fraction of a unit is not possible.

- Miscalculating the contribution margin by mistakenly using the wrong values for selling price or variable cost.

AI-generated content may contain errors. Please verify critical information