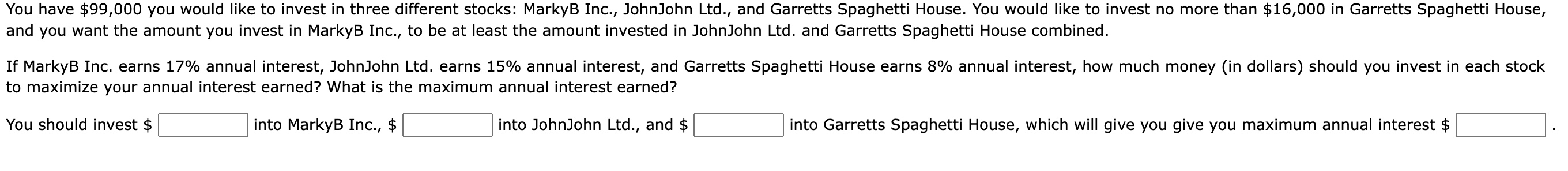

You have $99,000 you would like to invest in three different stocks: MarkyB Inc., JohnJohn Ltd., and Garretts Spaghetti House. You would like to invest no more than $16,000 in Garr... You have $99,000 you would like to invest in three different stocks: MarkyB Inc., JohnJohn Ltd., and Garretts Spaghetti House. You would like to invest no more than $16,000 in Garretts Spaghetti House, and you want the amount you invest in MarkyB Inc., to be at least the amount invested in JohnJohn Ltd. and Garretts Spaghetti House combined. If MarkyB Inc. earns 17% annual interest, JohnJohn Ltd. earns 15% annual interest, and Garretts Spaghetti House earns 8% annual interest, how much money (in dollars) should you invest in each stock to maximize your annual interest earned? What is the maximum annual interest earned? You should invest $ into MarkyB Inc., $ into JohnJohn Ltd., and $ into Garretts Spaghetti House, which will give you give you maximum annual interest $.

Understand the Problem

The question is about optimizing an investment portfolio to maximize annual interest earned. You have $99,000 to invest in three different stocks with varying annual interest rates, subject to constraints on the amount invested in each stock. We must determine the optimal amount to invest in each stock to achieve the highest possible annual interest income.

Answer

You should invest $83000 into MarkyB Inc., $0 into JohnJohn Ltd., and $16000 into Garretts Spaghetti House, which will give you give you maximum annual interest $15390.

Answer for screen readers

You should invest $83000 into MarkyB Inc., $0 into JohnJohn Ltd., and $16000 into Garretts Spaghetti House, which will give you give you maximum annual interest $15390.

Steps to Solve

-

Define the variables Let $x$ be the amount invested in MarkyB Inc., $y$ be the amount invested in JohnJohn Ltd., and $z$ be the amount invested in Garretts Spaghetti House.

-

Write down the constraints We have the following constraints:

- Total investment: $x + y + z = 99000$

- Garretts Spaghetti House limit: $z \le 16000$

- MarkyB Inc. investment condition: $x \ge y + z$

- Non-negativity: $x \ge 0$, $y \ge 0$, $z \ge 0$

-

Define the objective function The objective is to maximize the annual interest earned, which is given by: $I = 0.17x + 0.15y + 0.08z$

-

Transform the constraints

- From $x + y + z = 99000$, we have $y = 99000 - x - z$.

- Substitute $y$ in the inequality $x \ge y + z$: $x \ge (99000 - x - z) + z$, which simplifies to $2x \ge 99000$, or $x \ge 49500$.

-

Consider the extreme cases to maximize interest Since MarkyB Inc. has the highest interest rate, we want to maximize the investment in it. Also, given the constraint on Garretts Spaghetti House, we want to analyze cases where $z = 16000$ and where $z < 16000$.

-

Case 1: $z = 16000$ If $z = 16000$, then $x + y = 99000 - 16000 = 83000$. Also, $x \ge y + z$ becomes $x \ge y + 16000$, so $y \le x - 16000$. Substitute $y = 83000 - x$ into $y \le x - 16000$: $83000 - x \le x - 16000$, which gives $2x \ge 99000$, or $x \ge 49500$. Since $x + y = 83000$, we have $y = 83000 - x$. The interest earned in this case is $I = 0.17x + 0.15(83000 - x) + 0.08(16000)$. To maximize this, we need to maximize $x$. The largest possible amount for $x$ occurs when $y$ is minimized. Since $x \ge y+z$ and $z=16000$, $x$ needs to be at least 49500. The constraints are $x+y=83000$ and $x \ge y+16000$. Let $x = y + 16000$. Then $2y + 16000 = 83000$, so $2y = 67000$ and $y = 33500$. Then $x = 33500 + 16000 = 49500$. Then $I = 0.17(49500) + 0.15(33500) + 0.08(16000) = 8415 + 5025 + 1280 = 14720$. Now check $x = 83000 - y$. Since $x \ge y + 16000$, $83000 - y \ge y + 16000$, so $67000 \ge 2y$ and $y \le 33500$.

Let $y = 0$. Then $x = 83000$, $z = 16000$, $I = 0.17(83000) + 0.15(0) + 0.08(16000) = 14110 + 1280 = 15390$. However $83000 \ge 0 + 16000$ and $x = 83000, y = 0, z =16000$ and the sum is 99000.

Case 2: $x+y+z = 99000$. If MarkyB is at least JohnJohn + Garrett, invest the rest in MarkyB Maximize x. Let $x = y + z$, then $2x = 99000$, when y = z. It also means $x+x = 99000$. $x = 99000/2 = $49500$ To maximize interest earned, we want to make y zero, then $x = z$, meaning $2x = 99000$, so x + y + z is false.

So $Garretts Spaghetti House = 0$. and let $z = 0.$ We now have: $x+y = 99000$ and $x \ge y$, implying $x\ge 49500$

- Optimal Solution From the above analysis, it is clear that to maximize the earning we need to invest as much as possible in MarkyB and the condition of $x \ge y+z$ needs to meet, and $x+y+z = 99000$, $z=16000$

Then, $x=83000, y=0, z=16000$. Interest = $0.17 * 83000 + 0.15 * 0 + 0.08 * 16000 = 14110 + 1280 = 15390$

You should invest $83000 into MarkyB Inc., $0 into JohnJohn Ltd., and $16000 into Garretts Spaghetti House, which will give you give you maximum annual interest $15390.

More Information

The problem is a linear optimization problem that can be solved by analyzing the constraints and the objective function to find the optimal allocation of investments.

Tips

A common mistake is not considering all the constraints or not correctly formulating the objective function. Another mistake is choosing a local maximum instead of a global maximum by not considering extreme cases.

AI-generated content may contain errors. Please verify critical information