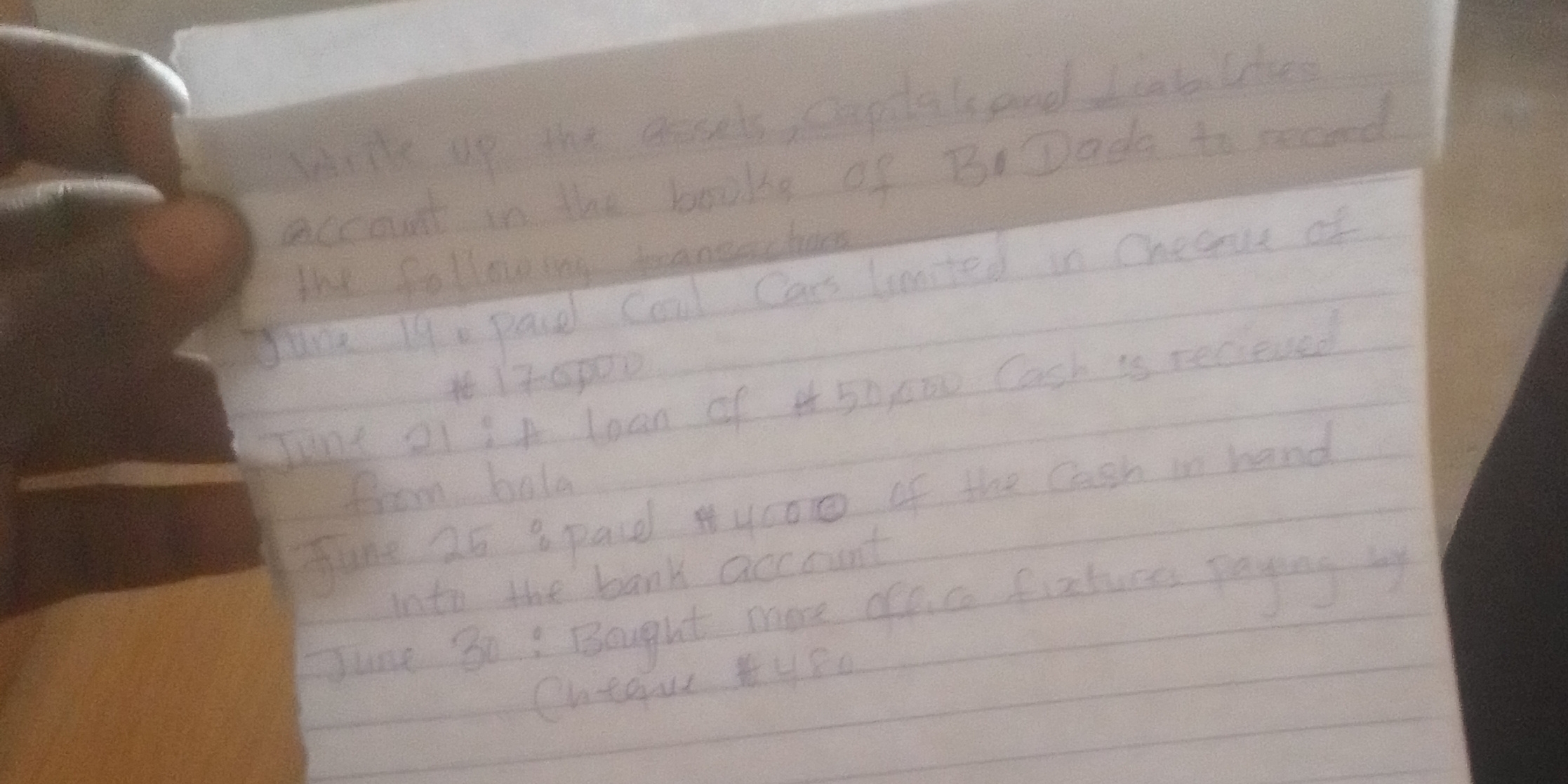

Write up the assets, capital, and liabilities account in the books of Bo Dada to record the following transactions: June 14: Paid Coul Cars Limited in cheque of #170,000 June 21:... Write up the assets, capital, and liabilities account in the books of Bo Dada to record the following transactions: June 14: Paid Coul Cars Limited in cheque of #170,000 June 21: A loan of #50,000 cash is received from bala June 25: Paid #4000 of the cash in hand into the bank account June 30: Bought more office fixtures paying by cheque #480

Understand the Problem

The question requires preparing an assets, capital, and liabilities account for 'Bo Dada' to record several financial transactions. Specifically, you need to account for payments made, loans received, cash deposits into a bank account, and purchases of office fixtures. This likely involves creating a balance sheet or similar accounting statement to reflect these activities.

Answer

The assets, liabilities and capital accounts for Bo Dada have been recorded based on given transactions.

To prepare the assets, capital, and liabilities accounts for Bo Dada, we need to record each transaction in the appropriate accounts.

Assets

- Cash: + ₦50,000 (Loan from Bala) - ₦4,000 (Paid into bank) = +₦46,000

- Bank: - ₦170,000 (Paid Coul Cars) + ₦4,000 (From cash) - ₦480 (Office fixtures) = - ₦166,480

- Office Fixtures: + ₦480

Liabilities

- Loan from Bala: + ₦50,000

- Coul Cars Limited: -#170,000

Capital

- The capital account would be affected by the net increase/decrease in assets minus any increase/decrease in liabilities. However, since the starting balance of capital is not given, and there are drawings or profits, we can't determine the final capital balance with the given information.

Answer for screen readers

To prepare the assets, capital, and liabilities accounts for Bo Dada, we need to record each transaction in the appropriate accounts.

Assets

- Cash: + ₦50,000 (Loan from Bala) - ₦4,000 (Paid into bank) = +₦46,000

- Bank: - ₦170,000 (Paid Coul Cars) + ₦4,000 (From cash) - ₦480 (Office fixtures) = - ₦166,480

- Office Fixtures: + ₦480

Liabilities

- Loan from Bala: + ₦50,000

- Coul Cars Limited: -#170,000

Capital

- The capital account would be affected by the net increase/decrease in assets minus any increase/decrease in liabilities. However, since the starting balance of capital is not given, and there are drawings or profits, we can't determine the final capital balance with the given information.

More Information

Accounting is the process of recording financial transactions pertaining to a business. The accounting equation is Assets = Liabilities + Equity.

Tips

Ensure each transaction is recorded in the correct account (Asset, Liability, or Capital). Be mindful of increases and decreases in each account based on the transaction.

AI-generated content may contain errors. Please verify critical information