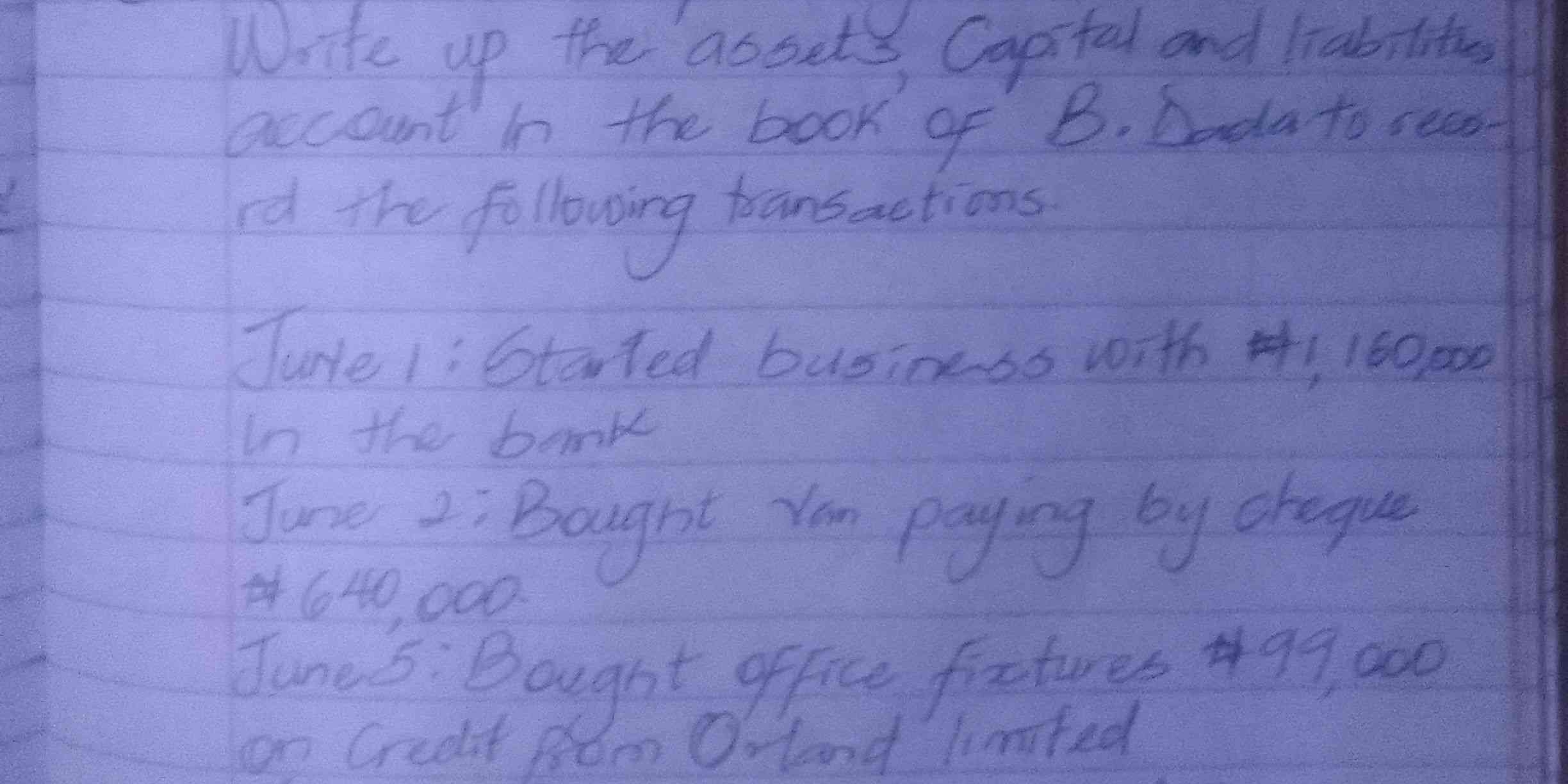

Write up the assets, capital, and liabilities account in the book of B. Dada to record the following transactions: June 1: Started business with ₦1,160,000 in the bank. June 2: Bo... Write up the assets, capital, and liabilities account in the book of B. Dada to record the following transactions: June 1: Started business with ₦1,160,000 in the bank. June 2: Bought van paying by cheque ₦640,000. June 5: Bought office fixtures ₦99,000 on credit from Orland Limited.

Understand the Problem

The question requires us to prepare the assets, capital, and liabilities account in the book of B. Dada based on the given transactions. We need to record the transactions for June 1st, June 2nd, and June 5th, which involve starting a business, buying a van, and buying office fixtures on credit, respectively.

Answer

**Assets:** Bank: $ \#520,000 $, Van: $ \#640,000 $, Office Fixtures: $ \#99,000 $ **Capital:** $ \#1,160,000 $ **Liabilities:** Orland Limited: $ \#99,000 $

Answer for screen readers

Assets:

Bank: $ #520,000 $

Van: $ #640,000 $

Office Fixtures: $ #99,000 $

Capital:

$ #1,160,000 $

Liabilities:

Orland Limited: $ #99,000 $

Steps to Solve

-

Record the initial investment (June 1)

B. Dada started the business with $ #1,160,000 $ in the bank. This increases the bank account (an asset) and represents the initial capital.

Assets (Bank): $ #1,160,000 $

Capital: $ #1,160,000 $

-

Record the purchase of the van (June 2)

The business bought a van for $ #640,000 $ by cheque. This increases the value of vans (an asset) and decreases the bank balance (another asset).

Assets (Van): $ #640,000 $

Assets (Bank): $ #1,160,000 - #640,000 = #520,000 $

-

Record the purchase of office fixtures on credit (June 5)

The business bought office fixtures for $ #99,000 $ on credit. This increases the value of office fixtures (an asset) and creates a liability (accounts payable) to Orland Limited.

Assets (Office Fixtures): $ #99,000 $

Liabilities (Orland Limited): $ #99,000 $

-

Summarize the accounts

Assets:

Bank: $ #520,000 $

Van: $ #640,000 $

Office Fixtures: $ #99,000 $

Total Assets: $ #520,000 + #640,000 + #99,000 = #1,259,000 $

Capital: $ #1,160,000 $

Liabilities:

Orland Limited: $ #99,000 $

Total Liabilities and Capital: $ #1,160,000 + #99,000 = #1,259,000 $

Assets:

Bank: $ #520,000 $

Van: $ #640,000 $

Office Fixtures: $ #99,000 $

Capital:

$ #1,160,000 $

Liabilities:

Orland Limited: $ #99,000 $

More Information

The accounting equation (Assets = Liabilities + Owner's Equity) holds true: $ #1,259,000 = #99,000 + #1,160,000 $

Tips

- Forgetting to decrease the bank balance when a payment is made by cheque.

- Not recognizing that buying on credit creates a liability.

- Incorrectly classifying assets, liabilities, and capital.

AI-generated content may contain errors. Please verify critical information