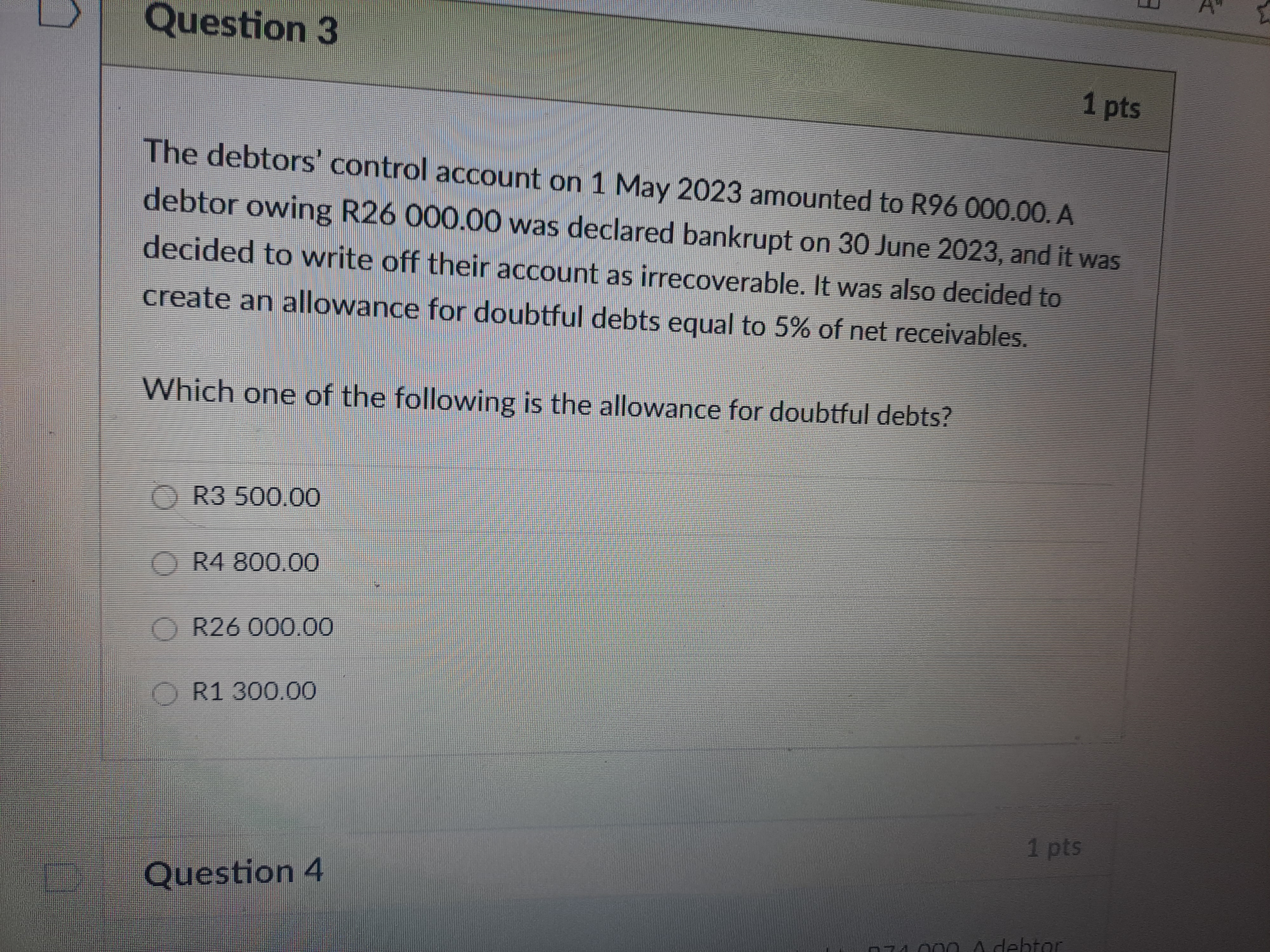

Which one of the following is the allowance for doubtful debts?

Understand the Problem

The question is asking for the calculation of the allowance for doubtful debts based on the provided information about the debtors' control account and a specific debtor's bankruptcy. It involves understanding the concept of allowances for bad debts and applying a percentage to determine the correct amount.

Answer

The allowance for doubtful debts is \( R3,500 \).

Answer for screen readers

The allowance for doubtful debts is ( R3,500 ).

Steps to Solve

- Determine Net Receivables

Calculate the net receivables after writing off the bankrupt debtor.

[ \text{Net Receivables} = \text{Debtors' Control} - \text{Bankrupt Debtor} ]

Substituting in the values:

[ \text{Net Receivables} = R96,000 - R26,000 = R70,000 ]

- Calculate Allowance for Doubtful Debts

To find the allowance for doubtful debts, apply the percentage to the net receivables.

[ \text{Allowance for Doubtful Debts} = 5% \times \text{Net Receivables} ]

Substituting in the value of net receivables:

[ \text{Allowance for Doubtful Debts} = 0.05 \times R70,000 = R3,500 ]

The allowance for doubtful debts is ( R3,500 ).

More Information

The allowance for doubtful debts is a provision made to cover potential future losses due to receivables that may not be collectible. This method helps in presenting a more accurate picture of assets in financial statements.

Tips

- Not deducting the amount of the bankrupt debtor from the total receivables before calculating the allowance.

- Confusing percentage calculations by not converting the percentage into a decimal (5% should be 0.05).

- Misreading the total amount of the debtors' control account.

AI-generated content may contain errors. Please verify critical information