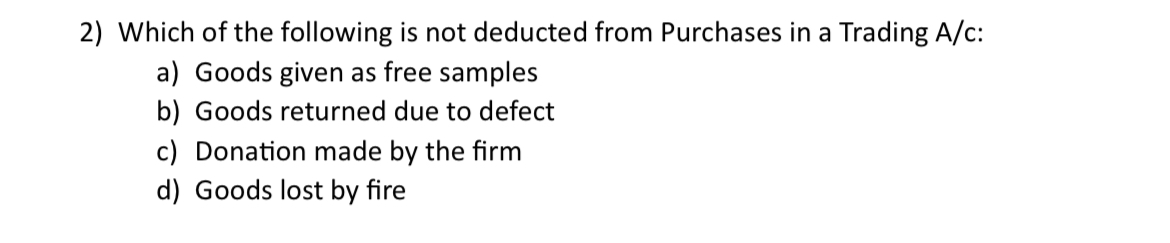

Which of the following is not deducted from Purchases in a Trading Account: a) Goods given as free samples b) Goods returned due to defect c) Donation made by the firm d) Goods los... Which of the following is not deducted from Purchases in a Trading Account: a) Goods given as free samples b) Goods returned due to defect c) Donation made by the firm d) Goods lost by fire

Understand the Problem

The question is asking which of the given options is not deducted from purchases in a Trading Account. This involves understanding accounting practices regarding how different types of goods affect the purchases account.

Answer

c) Donation made by the firm

The final answer is c) Donation made by the firm.

Answer for screen readers

The final answer is c) Donation made by the firm.

More Information

In a Trading Account, purchases are adjusted by returns and losses directly related to stock handling. Donations are not directly linked to inventory management and are not deducted from purchases.

Tips

Avoid confusing general business expenses with purchase-related adjustments.

AI-generated content may contain errors. Please verify critical information