What is the amount of TCS from Mr. Sunil?

Understand the Problem

The question is asking to calculate the Tax Collected at Source (TCS) from Mr. Sunil based on different remittances made for his son's education, personal expenditures, and sister's medical treatment. It presents formulae for TCS on various amounts and requires the application of these rates to determine the total TCS.

Answer

The total TCS from Mr. Sunil is ₹ 70,500.

Answer for screen readers

The total Tax Collected at Source (TCS) from Mr. Sunil is ₹ 70,500.

Steps to Solve

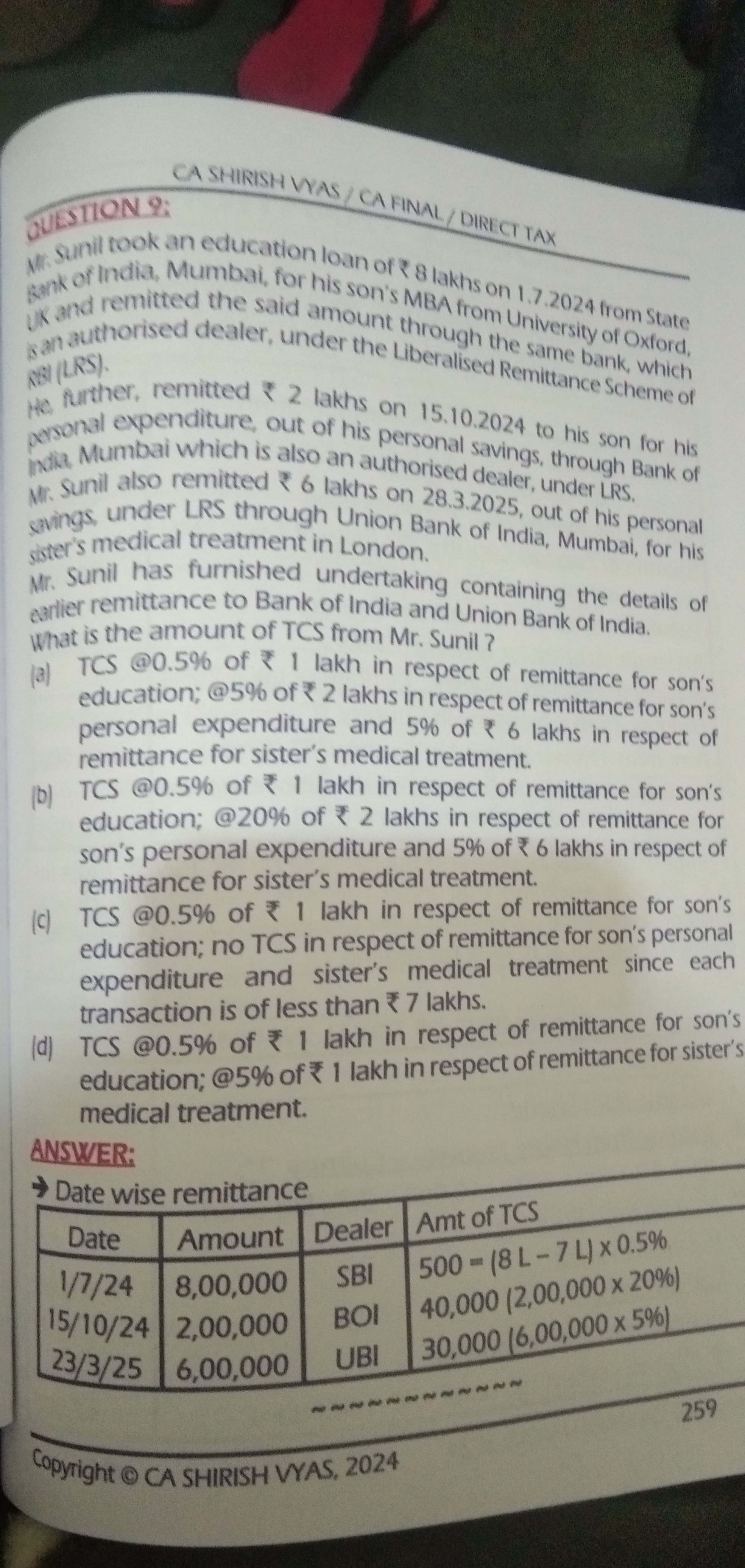

- Calculate TCS for Education Remittance The remittance of ₹ 8 lakhs for education incurs a TCS at 0.5% only on the amount exceeding ₹ 7 lakhs.

Calculating TCS:

- Excess amount = ₹ 8,00,000 - ₹ 7,00,000 = ₹ 1,00,000

- TCS for education = (0.5% \times 1,00,000 = \frac{0.5}{100} \times 1,00,000 = ₹ 500)

- Calculate TCS for Personal Expenditure Remittance The remittance of ₹ 2 lakhs for personal expenses incurs TCS at 20% since it exceeds ₹ 7 lakhs in total remittances.

Calculating TCS:

- TCS for personal expenditure = (20% \times 2,00,000 = \frac{20}{100} \times 2,00,000 = ₹ 40,000)

- Calculate TCS for Medical Treatment Remittance The remittance of ₹ 6 lakhs for medical treatment also incurs TCS at 5% since it exceeds ₹ 7 lakhs in total remittances.

Calculating TCS:

- TCS for medical treatment = (5% \times 6,00,000 = \frac{5}{100} \times 6,00,000 = ₹ 30,000)

- Calculate Total TCS Finally, sum up all the TCS amounts calculated above.

Total TCS = (500 + 40,000 + 30,000 = ₹ 70,500)

The total Tax Collected at Source (TCS) from Mr. Sunil is ₹ 70,500.

More Information

The calculations provided help illustrate how different remittance purposes are taxed under the TCS rules, depending on the amount and purpose of the remittance as specified by the LRS guidelines.

Tips

- Forgetting to apply percentage correctly: Ensure the percentage is applied to the correct portion of the remittance amount.

- Misunderstanding the TCS thresholds: Always check if the total remittance exceeds ₹ 7 lakhs when determining the applicable rates for different remittance types.

AI-generated content may contain errors. Please verify critical information