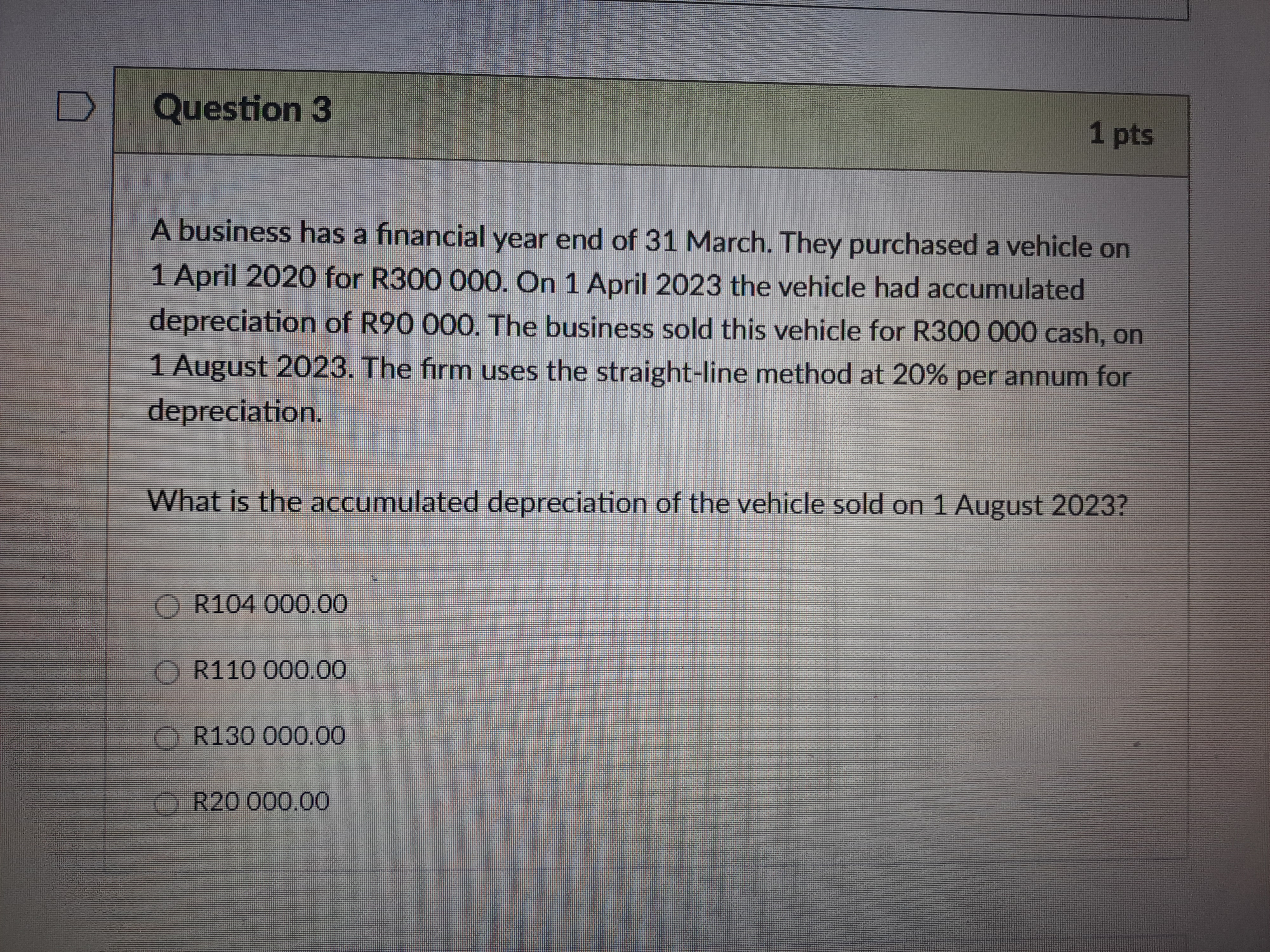

What is the accumulated depreciation of the vehicle sold on 1 August 2023?

Understand the Problem

The question is asking for the accumulated depreciation of a vehicle sold on a specific date, given its purchase date, initial depreciation, and depreciation rate. It requires calculating the total depreciation up to the sale date using the straight-line method at 20% per annum.

Answer

The accumulated depreciation of the vehicle sold on 1 August 2023 is R110,000.

Answer for screen readers

The accumulated depreciation of the vehicle sold on 1 August 2023 is R110,000.

Steps to Solve

-

Determine the initial purchase details

The vehicle was purchased on 1 April 2020 for R300,000 and had an accumulated depreciation of R90,000 by 1 April 2023. -

Calculate the depreciation period

From 1 April 2023 to 1 August 2023 is 4 months. Since the annual depreciation rate is 20%, we need to calculate the monthly depreciation.

The formula to find monthly depreciation is:

$$ \text{Monthly Depreciation} = \frac{\text{Annual Depreciation}}{12} $$

$$ \text{Annual Depreciation} = 300,000 \times 20% = 60,000 $$

Therefore,

$$ \text{Monthly Depreciation} = \frac{60,000}{12} = 5,000 $$ -

Calculate the total depreciation for 4 months

The total depreciation from 1 April 2023 to 1 August 2023:

$$ \text{Total Depreciation} = \text{Monthly Depreciation} \times 4 = 5,000 \times 4 = 20,000 $$ -

Add the accumulated depreciation up to the sale date

The total accumulated depreciation on 1 August 2023 will be:

$$ \text{Accumulated Depreciation} = \text{Initial Accumulated Depreciation} + \text{Total Depreciation} $$

$$ \text{Accumulated Depreciation} = 90,000 + 20,000 = 110,000 $$

The accumulated depreciation of the vehicle sold on 1 August 2023 is R110,000.

More Information

Accumulated depreciation is important for reflecting the reduction in value of an asset over time. In this case, the vehicle was depreciated using the straight-line method, which spreads the cost evenly across its useful life.

Tips

- Failing to convert the annual depreciation rate to a monthly rate.

- Miscalculating the number of months between the dates.

- Forgetting to add the initial accumulated depreciation to the depreciation calculated after the sale date.

AI-generated content may contain errors. Please verify critical information