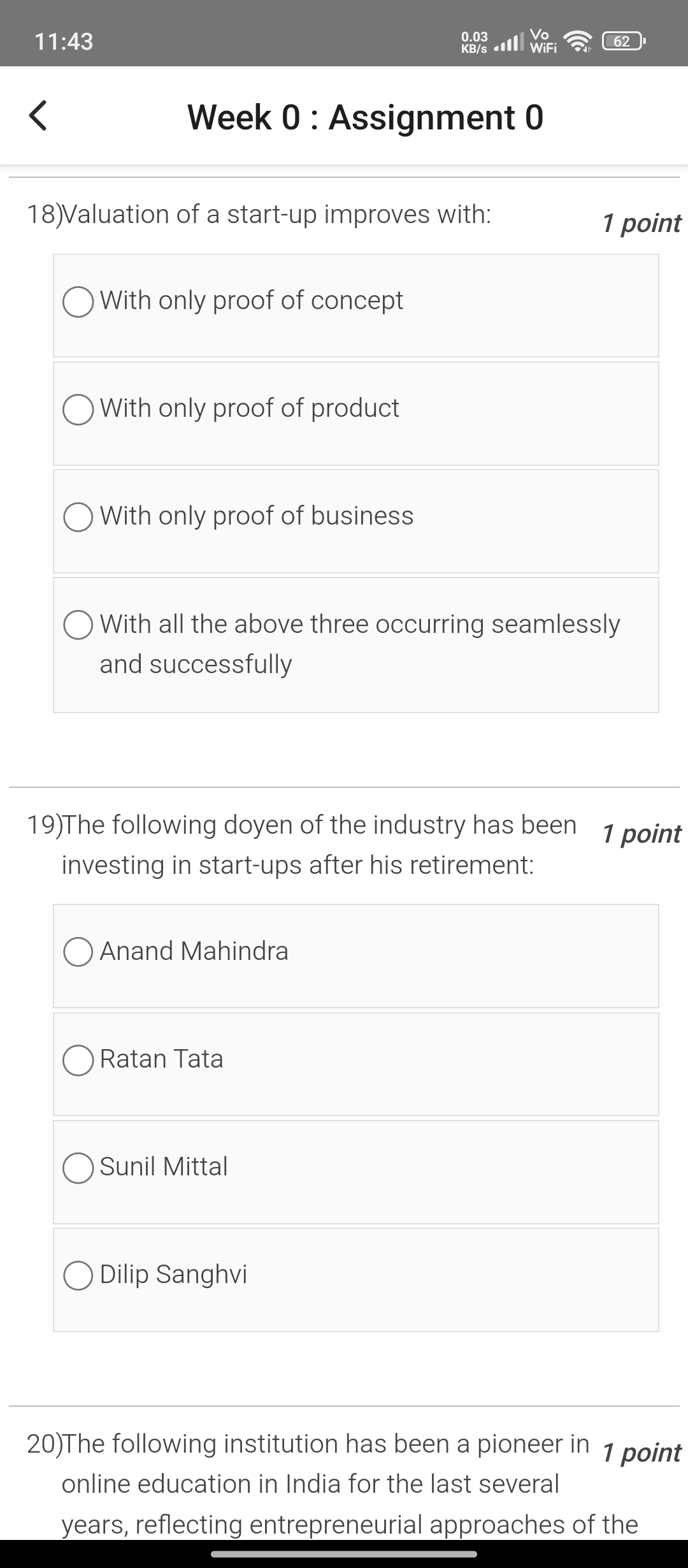

Valuation of a start-up improves with: 1) With only proof of concept, 2) With only proof of product, 3) With only proof of business, 4) With all the above three occurring seamlessl... Valuation of a start-up improves with: 1) With only proof of concept, 2) With only proof of product, 3) With only proof of business, 4) With all the above three occurring seamlessly and successfully. The following doyen of the industry has been investing in start-ups after his retirement: 1) Anand Mahindra, 2) Ratan Tata, 3) Sunil Mittal, 4) Dilip Sanghvi.

Understand the Problem

The questions in the image focus on valuation factors for start-ups and prominent figures in the industry. The first question asks what contributes to a start-up's improved valuation, while the second question identifies an investor in start-ups post-retirement, indicating a context related to entrepreneurship and investment.

Answer

18) With all the above three occurring seamlessly and successfully. 19) Ratan Tata.

The final answer is: 18) With all the above three occurring seamlessly and successfully. 19) Ratan Tata.

Answer for screen readers

The final answer is: 18) With all the above three occurring seamlessly and successfully. 19) Ratan Tata.

More Information

Start-up valuations generally improve when there is a seamless integration of proof of concept, product, and business, demonstrating viability and potential for growth. Ratan Tata, former chairman of Tata Sons, has been well-known for his investments in numerous start-ups after his retirement.

Tips

A common mistake is undervaluing the importance of having all proofs (concept, product, and business) to enhance start-up valuation.

Sources

- Valuing Startup Ventures - Investopedia - investopedia.com

AI-generated content may contain errors. Please verify critical information