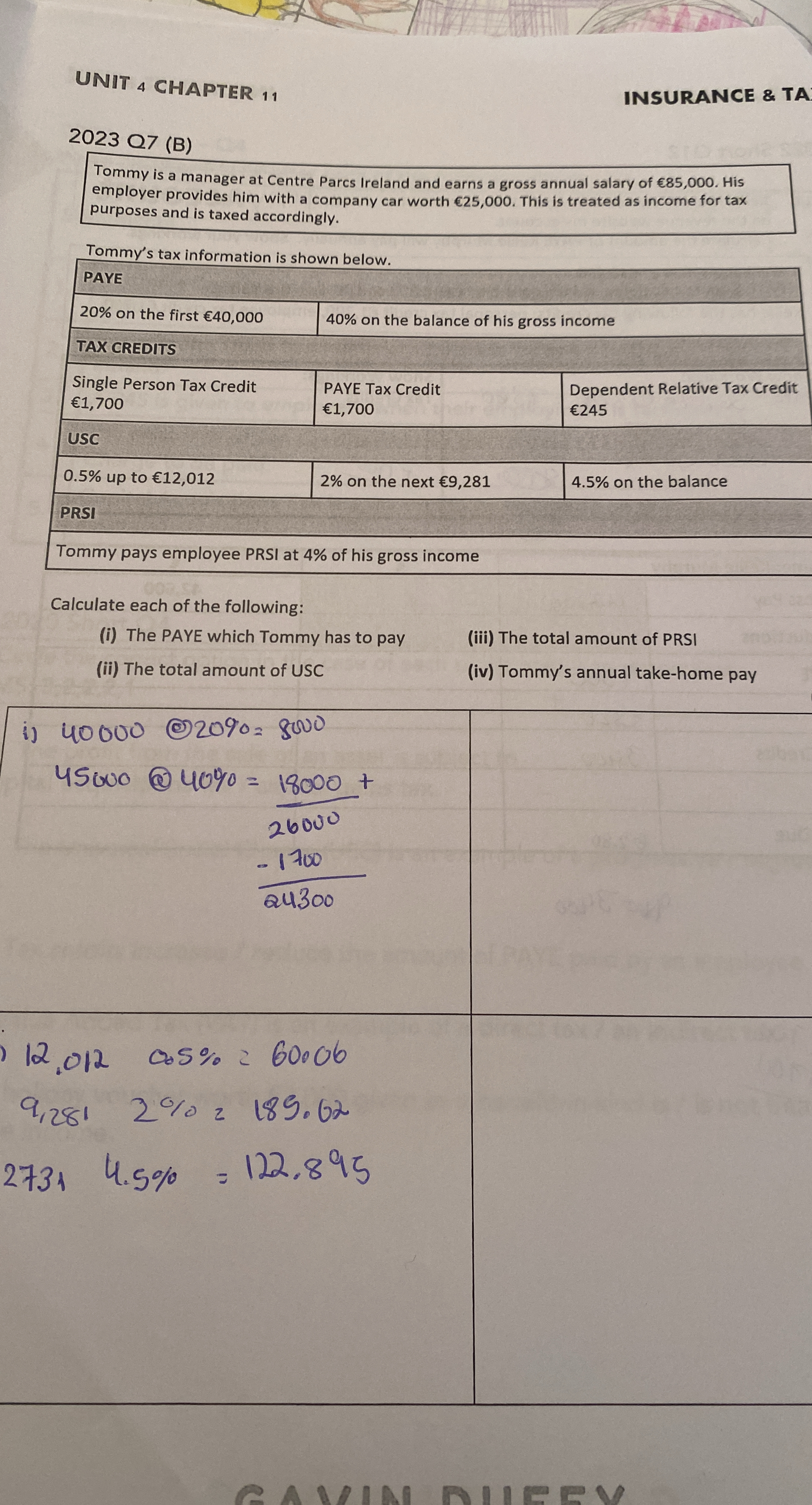

Tommy is a manager at Centre Parcs Ireland and earns a gross annual salary of €85,000. His employer provides him with a company car worth €25,000. This is treated as income for tax... Tommy is a manager at Centre Parcs Ireland and earns a gross annual salary of €85,000. His employer provides him with a company car worth €25,000. This is treated as income for tax purposes and is taxed accordingly. Tommy's tax information is shown below. Calculate each of the following: (i) The PAYE which Tommy has to pay (ii) The total amount of USC (iii) The total amount of PRSI (iv) Tommy's annual take-home pay

Understand the Problem

The question asks to calculate several components of Tommy's income and taxes, including his PAYE (Pay As You Earn) tax, total USC (Universal Social Charge), total PRSI (Pay Related Social Insurance), and annual take-home pay, based on his gross salary and the provided tax information. The user has started to answer and needs help completing the question.

Answer

(i) €32,355 (ii) €4,237.50 (iii) €4,400 (iv) €69,007.50

Answer for screen readers

(i) The PAYE which Tommy has to pay is €32,355. (ii) The total amount of USC is €4,237.50. (iii) The total amount of PRSI is €4,400. (iv) Tommy's annual take-home pay is €69,007.50.

Steps to Solve

- Calculate Gross Income

Tommy's gross income is his salary plus the value of the company car. $$ \text{Gross Income} = \text{Salary} + \text{Car Value} $$ $$ \text{Gross Income} = €85,000 + €25,000 = €110,000 $$

- Calculate PAYE (Pay As You Earn)

Tommy pays 20% on the first €40,000 and 40% on the balance of his gross income. $$ \text{PAYE}_1 = 0.20 \times €40,000 = €8,000 $$ The balance of his income is: $$ €110,000 - €40,000 = €70,000 $$ $$ \text{PAYE}_2 = 0.40 \times €70,000 = €28,000 $$ Total PAYE before tax credits is: $$ \text{Total PAYE Before Credits} = €8,000 + €28,000 = €36,000 $$

- Calculate Total Tax Credits

Tommy has three tax credits: Single Person (€1,700), PAYE (€1,700), and Dependent Relative (€245). $$ \text{Total Tax Credits} = €1,700 + €1,700 + €245 = €3,645 $$

- Calculate Net PAYE

Subtract total tax credits from the total PAYE before credits. $$ \text{Net PAYE} = €36,000 - €3,645 = €32,355 $$

- Calculate USC (Universal Social Charge)

Tommy pays 0.5% on the first €12,012, 2% on the next €9,281, and 4.5% on the balance. $$ \text{USC}_1 = 0.005 \times €12,012 = €60.06 $$ $$ \text{USC}_2 = 0.02 \times €9,281 = €185.62 $$ To find the balance, subtract the first two bands from the gross income: $$ \text{Balance} = €110,000 - €12,012 - €9,281 = €88,707 $$ $$ \text{USC}_3 = 0.045 \times €88,707 = €3,991.815 $$ Total USC is: $$ \text{Total USC} = €60.06 + €185.62 + €3,991.815 = €4,237.495 \approx €4,237.50 $$

- Calculate PRSI (Pay Related Social Insurance)

Tommy pays 4% of his gross income for PRSI. $$ \text{Total PRSI} = 0.04 \times €110,000 = €4,400 $$

- Calculate Annual Take-Home Pay

Subtract Net PAYE, Total USC, and Total PRSI from the Gross Income. $$ \text{Take-Home Pay} = \text{Gross Income} - \text{Net PAYE} - \text{Total USC} - \text{Total PRSI} $$ $$ \text{Take-Home Pay} = €110,000 - €32,355 - €4,237.50 - €4,400 = €69,007.50 $$

(i) The PAYE which Tommy has to pay is €32,355. (ii) The total amount of USC is €4,237.50. (iii) The total amount of PRSI is €4,400. (iv) Tommy's annual take-home pay is €69,007.50.

More Information

These calculations give us a detailed breakdown of how Tommy's income is taxed and what his actual take-home pay is after all deductions. It is important to note that tax calculations and rates can change from year to year.

Tips

A common mistake is forgetting to include the company car value as part of the gross income for tax calculations. Another mistake is incorrectly applying the tax credits or USC bands. Ensure all tax credits are accounted for and the correct USC rates are applied to the corresponding income bands. Rounding errors can also occur, so maintaining precision throughout the calculation is important.

AI-generated content may contain errors. Please verify critical information