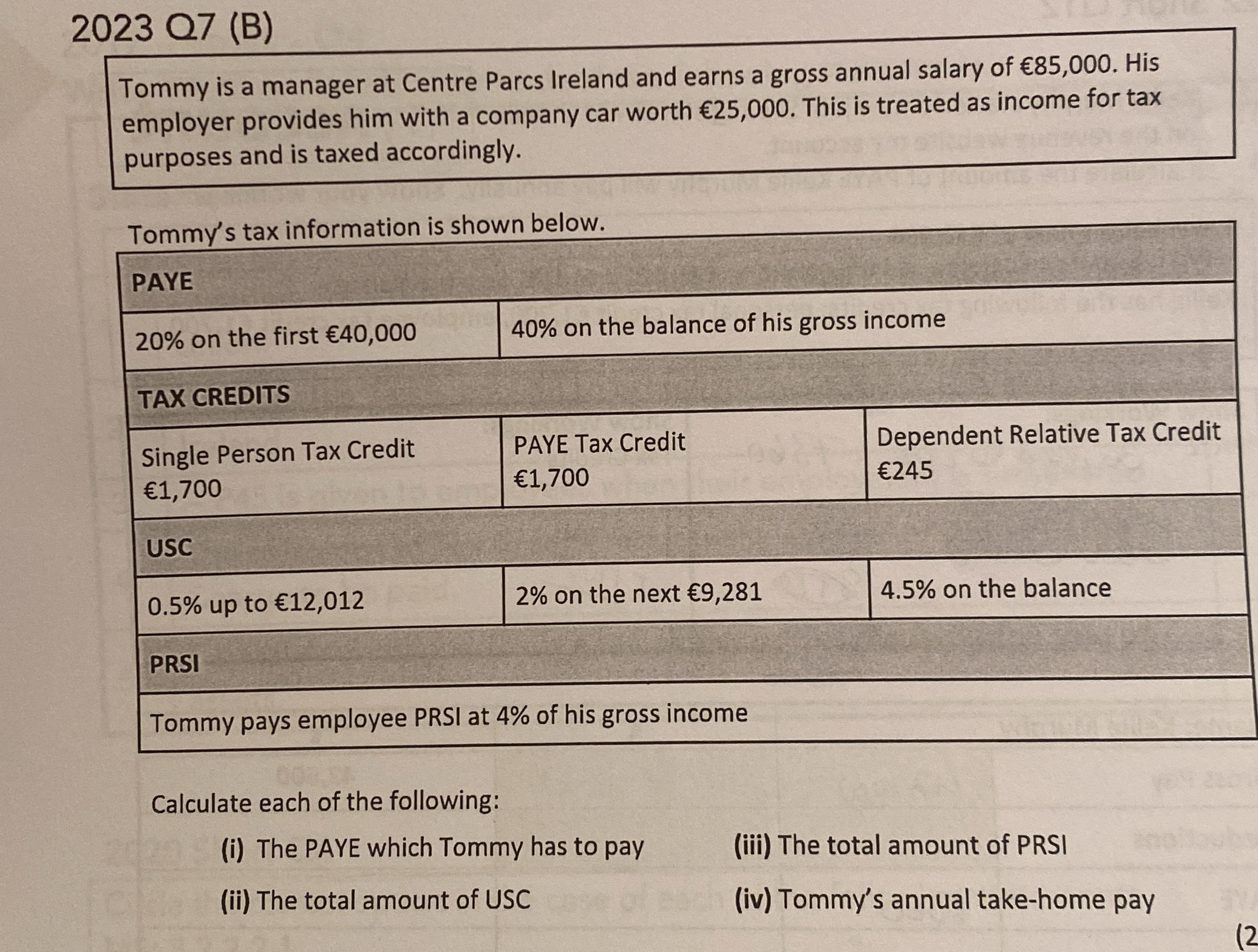

Tommy is a manager at Centre Parcs Ireland and earns a gross annual salary of €85,000. His employer provides him with a company car worth €25,000. This is treated as income for tax... Tommy is a manager at Centre Parcs Ireland and earns a gross annual salary of €85,000. His employer provides him with a company car worth €25,000. This is treated as income for tax purposes and is taxed accordingly. Tommy's tax information is shown below. PAYE 20% on the first €40,000 40% on the balance of his gross income TAX CREDITS Single Person Tax Credit €1,700 PAYE Tax Credit €1,700 Dependent Relative Tax Credit €245 USC 0.5% up to €12,012 2% on the next €9,281 4.5% on the balance PRSI Tommy pays employee PRSI at 4% of his gross income Calculate each of the following: (i) The PAYE which Tommy has to pay (ii) The total amount of USC (iii) The total amount of PRSI (iv) Tommy's annual take-home pay

Understand the Problem

The question is asking to calculate Tommy's PAYE, USC, PRSI and annual take-home pay, given his gross annual salary, the value of the company car, and the tax rates and credits applicable. We need to follow the tax brackets to determine the amount of taxes that Tommy will pay.

Answer

(i) €32,355 (ii) €4,237.50 (iii) €4,400 (iv) €69,007.50

Answer for screen readers

(i) The PAYE which Tommy has to pay is €32,355. (ii) The total amount of USC is €4,237.50. (iii) The total amount of PRSI is €4,400. (iv) Tommy's annual take-home pay is €69,007.50.

Steps to Solve

- Calculate Tommy's total gross income

Tommy's gross annual salary is €85,000 and the company car is worth €25,000. His total gross income is the sum of these two amounts. $$ \text{Total Gross Income} = €85,000 + €25,000 = €110,000 $$

- Calculate Tommy's PAYE

The first €40,000 is taxed at 20%, and the balance is taxed at 40%. Tax on first €40,000: $$ 0.20 \times €40,000 = €8,000 $$ The balance of his income is: $$ €110,000 - €40,000 = €70,000 $$ Tax on the balance: $$ 0.40 \times €70,000 = €28,000 $$ Total gross PAYE: $$ €8,000 + €28,000 = €36,000 $$

- Calculate Tommy's total tax credits

Tommy has a single person tax credit of €1,700, a PAYE tax credit of €1,700 and a dependent relative tax credit of €245. His total tax credits are the sum of these three amounts. $$ \text{Total Tax Credits} = €1,700 + €1,700 + €245 = €3,645 $$

- Calculate Tommy's net PAYE

Subtract the total tax credits from the gross PAYE to find the net PAYE. $$ \text{Net PAYE} = €36,000 - €3,645 = €32,355 $$

- Calculate Tommy's USC

The first €12,012 is taxed at 0.5%, the next €9,281 is taxed at 2%, and the balance is taxed at 4.5%.

USC on first €12,012: $$ 0.005 \times €12,012 = €60.06 $$ USC on next €9,281: $$ 0.02 \times €9,281 = €185.62 $$

Balance of income for USC calculation: To calculate the balance we need to subtract the previous thresholds from the gross income $$ €110,000 - €12,012 - €9,281 = €88,707 $$ USC on the balance: $$ 0.045 \times €88,707 = €3,991.82 $$ Total USC: $$ €60.06 + €185.62 + €3,991.82 = €4,237.50 $$

- Calculate Tommy's PRSI

Tommy pays PRSI at 4% of his total gross income of €110,000. $$ \text{PRSI} = 0.04 \times €110,000 = €4,400 $$

- Calculate Tommy's annual take-home pay

Subtract the net PAYE, total USC, and PRSI from his total gross income. $$ \text{Take-Home Pay} = €110,000 - €32,355 - €4,237.50 - €4,400 = €69,007.50 $$

(i) The PAYE which Tommy has to pay is €32,355. (ii) The total amount of USC is €4,237.50. (iii) The total amount of PRSI is €4,400. (iv) Tommy's annual take-home pay is €69,007.50.

More Information

These calculations are based on the provided tax information for the year 2023. Tax laws and rates are subject to change, which would impact the final figures.

Tips

- Forgetting to include the company car value in gross income when calculating taxes.

- Not applying the tax credits to reduce the gross PAYE.

- Incorrectly calculating the balance of income for the 40% PAYE and 4.5% USC bands.

- Not correctly applying the different USC rates to the correct income bands.

AI-generated content may contain errors. Please verify critical information