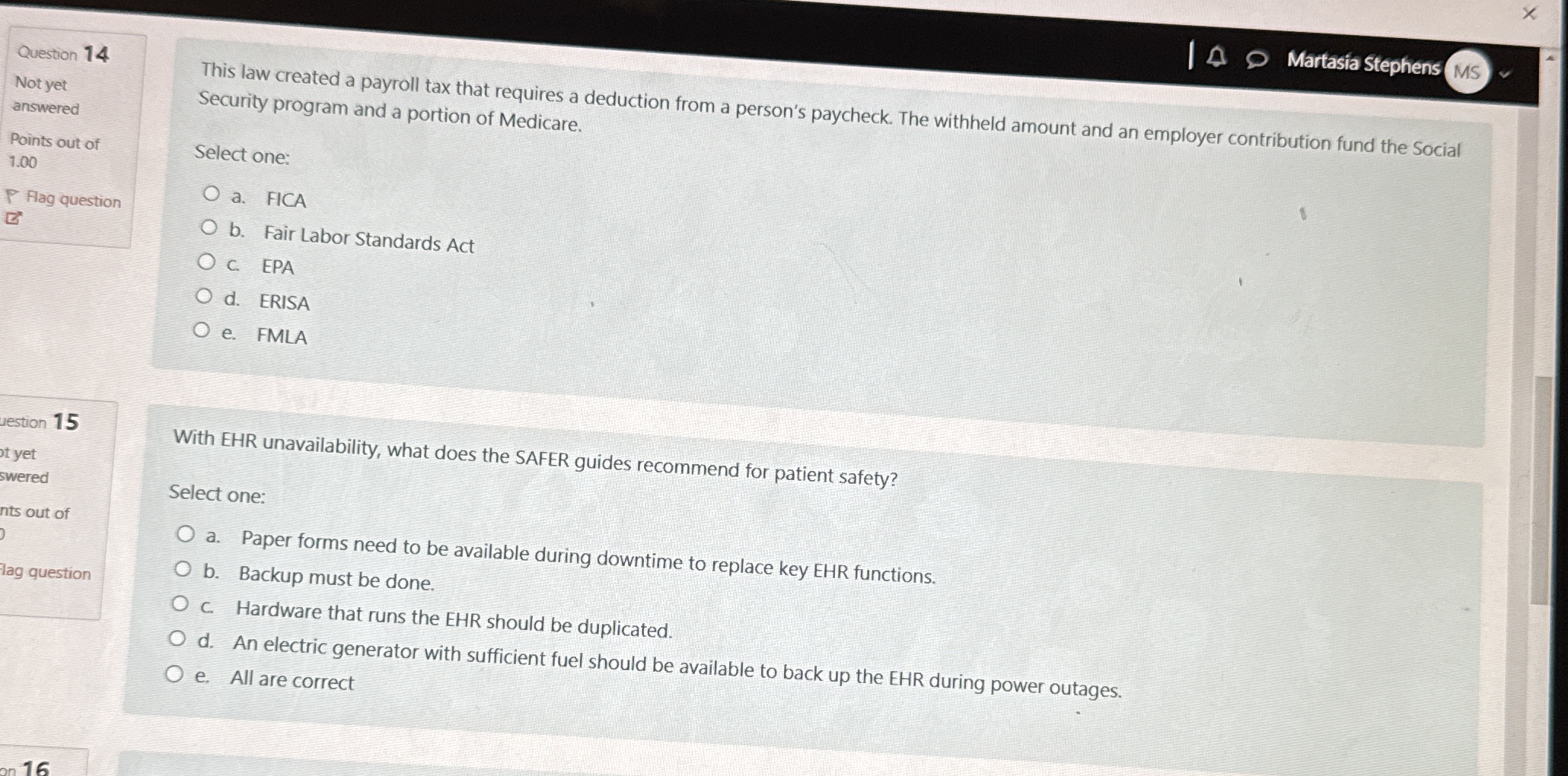

This law created a payroll tax that requires a deduction from a person’s paycheck. The withheld amount and an employer contribution fund the Social Security program and a portion o... This law created a payroll tax that requires a deduction from a person’s paycheck. The withheld amount and an employer contribution fund the Social Security program and a portion of Medicare. Select one: a. FICA b. Fair Labor Standards Act c. EPA d. ERISA e. FMLA

Understand the Problem

The question is asking about a law that established a payroll tax for funding Social Security and Medicare, and seeks to identify the correct law among a list of options.

Answer

FICA

The final answer is FICA.

Answer for screen readers

The final answer is FICA.

More Information

FICA stands for the Federal Insurance Contributions Act, which mandates payroll taxes to fund Social Security and Medicare.

Tips

A common mistake is choosing options related to employment law or environmental protection, which do not involve payroll taxes.

Sources

- Federal Insurance Contributions Act (FICA): What It Is, Who Pays - investopedia.com

AI-generated content may contain errors. Please verify critical information