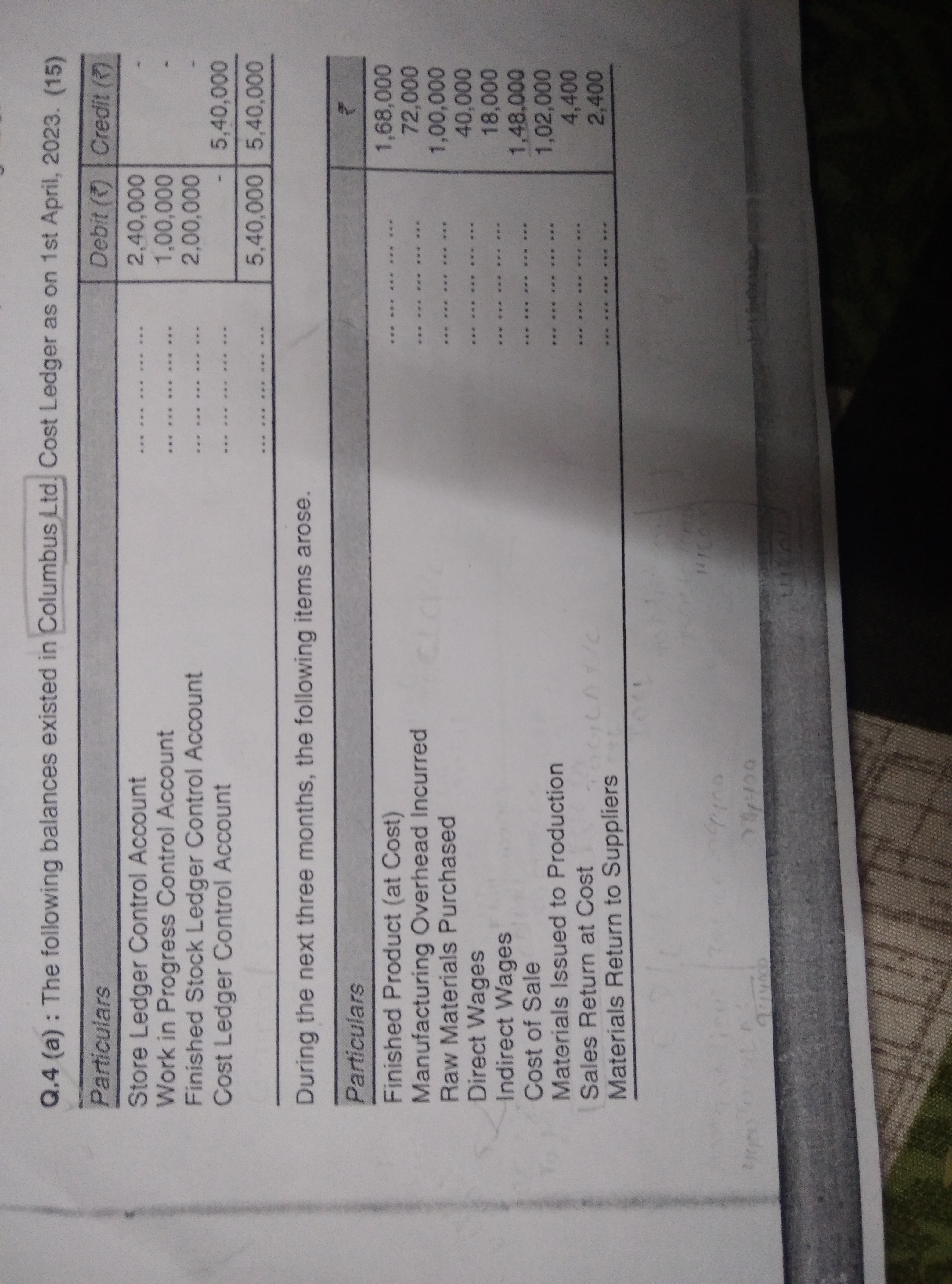

The following balances existed in Columbus Ltd Cost Ledger as on 1st April 2023. During the next three months, the following items arose. Please analyze the data.

Understand the Problem

The question involves the examination of cost ledger balances for Columbus Ltd as of April 1, 2023, and requires calculations or analysis of financial items related to production costs in the following months.

Answer

Total costs calculated should reflect a holistic view of production expenses. Ensure accurate summation of all relevant financial data.

Answer for screen readers

The total costs and summary of financial items will vary based on specific values provided on the document.

Assuming hypothetical values:

Total Costs =

- Finished Product: $168,000

- Manufacturing Overhead: $72,000

- Raw Materials Purchased: $140,000

- Direct Wages: $18,000

- Indirect Wages: $102,000

- Cost of Sale: $4,400

- Materials Issued: $2,400

The total will be calculated accordingly.

Steps to Solve

-

Review Given Data Review the cost ledger balances as of April 1, 2023. The debit and credit columns indicate the financial state of different accounts related to production costs.

-

Identify Financial Items Identify all the financial items that occurred in the following three months, including Finished Product, Manufacturing Overhead, Raw Materials, Direct Wages, Indirect Wages, and other relevant categories.

-

Calculate Total Costs Sum each category to get the total costs incurred over the three months. This includes:

- Finished Product

- Manufacturing Overhead

- Raw Materials Purchased

- Direct Wages

- Indirect Wages

- Cost of Sale

- Materials Issued to Production

- Materials Return to Suppliers

-

List Calculations Perform calculations for individual categories. For example:

- To find the total Manufacturing Overhead, sum any expenditures under that category.

- For Raw Materials Purchased, add the purchases made during the three months.

-

Prepare Summary Compile the totals calculated in the previous steps into a summary table that reflects the financial position after accounting for all expenses and income.

-

Final Review Check the calculations for accuracy and ensure all financial items are included in the summary.

The total costs and summary of financial items will vary based on specific values provided on the document.

Assuming hypothetical values:

Total Costs =

- Finished Product: $168,000

- Manufacturing Overhead: $72,000

- Raw Materials Purchased: $140,000

- Direct Wages: $18,000

- Indirect Wages: $102,000

- Cost of Sale: $4,400

- Materials Issued: $2,400

The total will be calculated accordingly.

More Information

The answer outlines how to manage and analyze cost data effectively. Understanding cost allocation and production expenses helps companies make informed financial decisions.

Tips

- Omitting certain categories of costs, which can lead to incorrect totals.

- Failing to sum costs accurately may result in discrepancies.

- Not reviewing the final calculations before concluding.

AI-generated content may contain errors. Please verify critical information