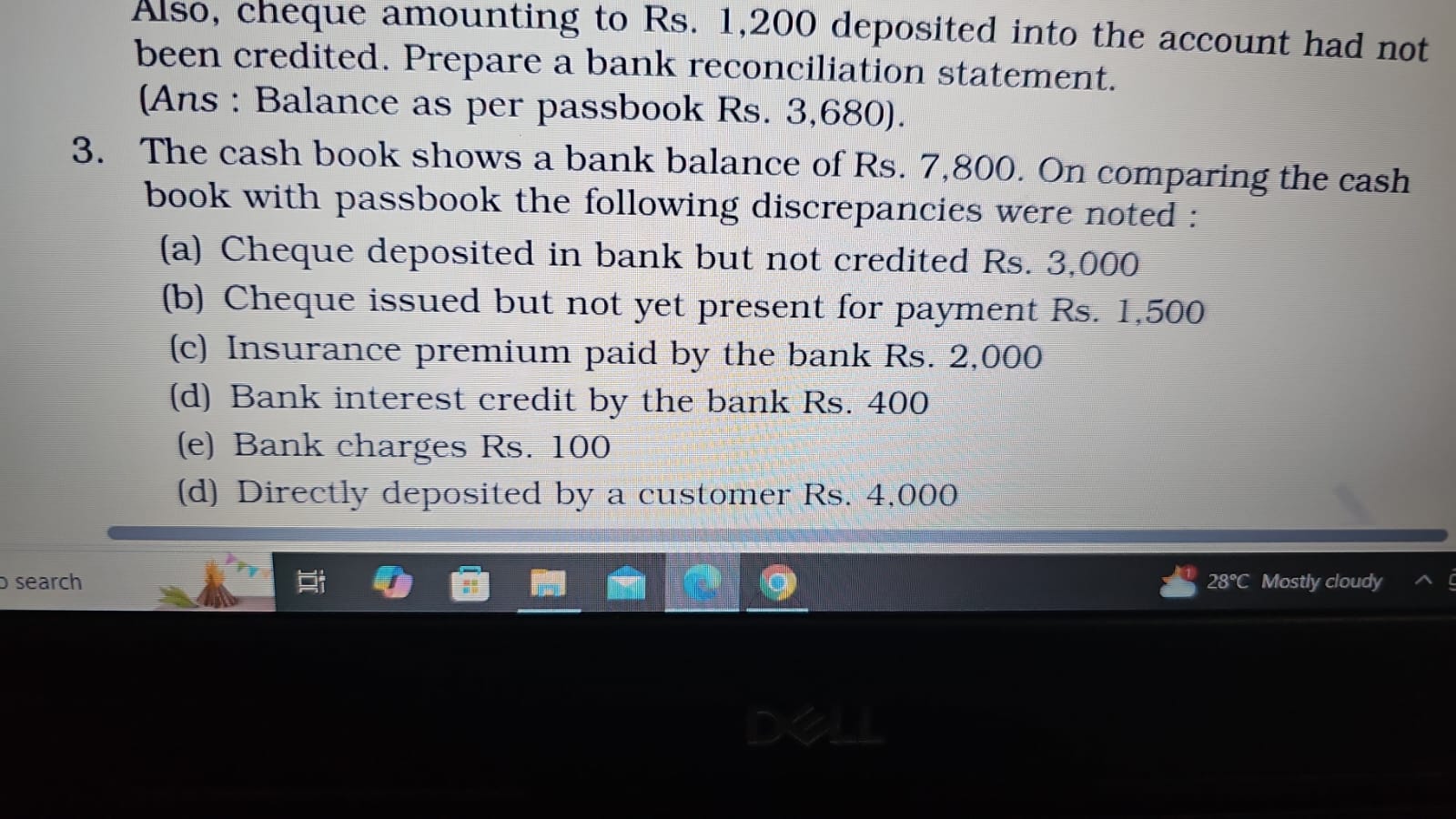

The cash book shows a bank balance of Rs. 7,800. On comparing the cash book with the passbook, the following discrepancies were noted: (a) Cheque deposited in bank but not credited... The cash book shows a bank balance of Rs. 7,800. On comparing the cash book with the passbook, the following discrepancies were noted: (a) Cheque deposited in bank but not credited Rs. 3,000 (b) Cheque issued but not yet present for payment Rs. 1,500 (c) Insurance premium paid by the bank Rs. 2,000 (d) Bank interest credit by the bank Rs. 400 (e) Bank charges Rs. 100 (f) Directly deposited by a customer Rs. 4,000. Prepare a bank reconciliation statement.

Understand the Problem

The question is asking to prepare a bank reconciliation statement based on discrepancies between the cash book and passbook balances. It lists various discrepancies that affect the bank balance, which need to be addressed to align the statements.

Answer

The adjusted cash book balance is $12,600$.

Answer for screen readers

The adjusted cash book balance is $12,600$.

Steps to Solve

-

Identify the opening balances The cash book shows a balance of Rs. 7,800. The passbook balance is given as Rs. 3,680.

-

List the discrepancies The discrepancies between the cash book and passbook are as follows:

- Cheque deposited but not credited: Rs. 3,000

- Cheque issued but not yet presented for payment: Rs. 1,500

- Insurance premium paid by bank: Rs. 2,000

- Bank interest credited by bank: Rs. 400

- Bank charges: Rs. 100

- Direct deposit by a customer: Rs. 4,000

-

Adjust for each discrepancy in the cash balance

- Start with the cash book balance: Rs. 7,800.

- Subtract cheques issued but not presented: $7,800 - 1,500 = 7,300$.

- Subtract the insurance premium paid by bank: $7,300 - 2,000 = 5,300$.

- Subtract bank charges: $5,300 - 100 = 5,200$.

- Add bank interest credited: $5,200 + 400 = 5,600$.

- Add directly deposited by a customer: $5,600 + 4,000 = 9,600$.

- Finally, add the cheque deposited but not credited: $9,600 + 3,000 = 12,600$.

-

Calculate the final bank reconciliation statement

- The cash book adjusted balance is Rs. 12,600.

- The passbook shows Rs. 3,680; thus, the adjusted cash book balance exceeds the passbook balance.

-

Prepare the reconciliation statement

- Present the final figures:

- Cash Book balance (adjusted): Rs. 12,600.

- Less: Passbook balance: Rs. 3,680.

- Adjusted balances balanced: This indicates discrepancies need to be resolved.

The adjusted cash book balance is $12,600$.

More Information

The bank reconciliation statement highlights discrepancies between the cash book and the passbook. Such statements are crucial for maintaining accurate financial records and ensuring that all transactions are properly accounted for. In this case, the adjusted cash book balance reflects all discrepancies reconciled against the bank’s records.

Tips

- Neglecting direct deposits: Sometimes, people forget to include deposits made directly by customers when calculating the balanced figures.

- Incorrect adjustments for outstanding cheques: Deducting cheques that are issued but not yet presented can lead to incorrect balances.

- Failure to include bank charges and interest: Users may overlook bank service charges or interest earned, leading to an inaccurate reconciliation.

AI-generated content may contain errors. Please verify critical information