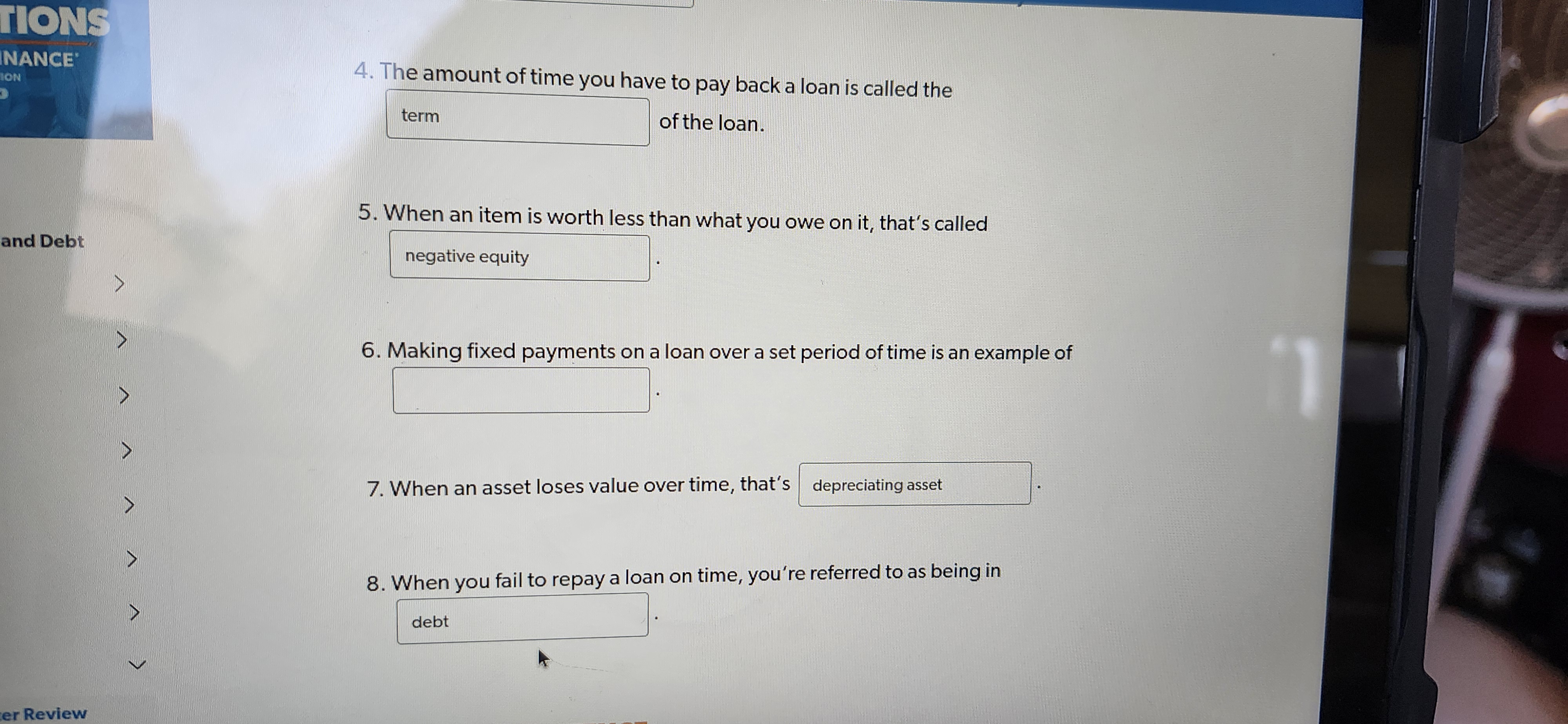

The amount of time you have to pay back a loan is called the _____ of the loan. When an item is worth less than what you owe on it, that’s called _____ . Making fixed payments on a... The amount of time you have to pay back a loan is called the _____ of the loan. When an item is worth less than what you owe on it, that’s called _____ . Making fixed payments on a loan over a set period of time is an example of _____. When an asset loses value over time, that’s called _____. When you fail to repay a loan on time, you’re referred to as being in _____.

Understand the Problem

The question comprises several statements seeking specific financial terms related to loans, equity, and asset depreciation. Each blank requires a knowledgeable response about the definitions or concepts in finance.

Answer

4. term, 5. negative equity, 6. amortization, 7. depreciation, 8. default

The final answers are: 4. term, 5. negative equity, 6. amortization, 7. depreciation, 8. default.

Answer for screen readers

The final answers are: 4. term, 5. negative equity, 6. amortization, 7. depreciation, 8. default.

More Information

Understanding these terms is crucial for financial literacy and can help you manage loans and assets effectively.

Tips

Common mistakes include confusing 'amortization' with 'payment' or 'installment,' and 'default' with 'debt.'

Sources

- End of chapter 4 review .docx - Course Hero - coursehero.com

AI-generated content may contain errors. Please verify critical information