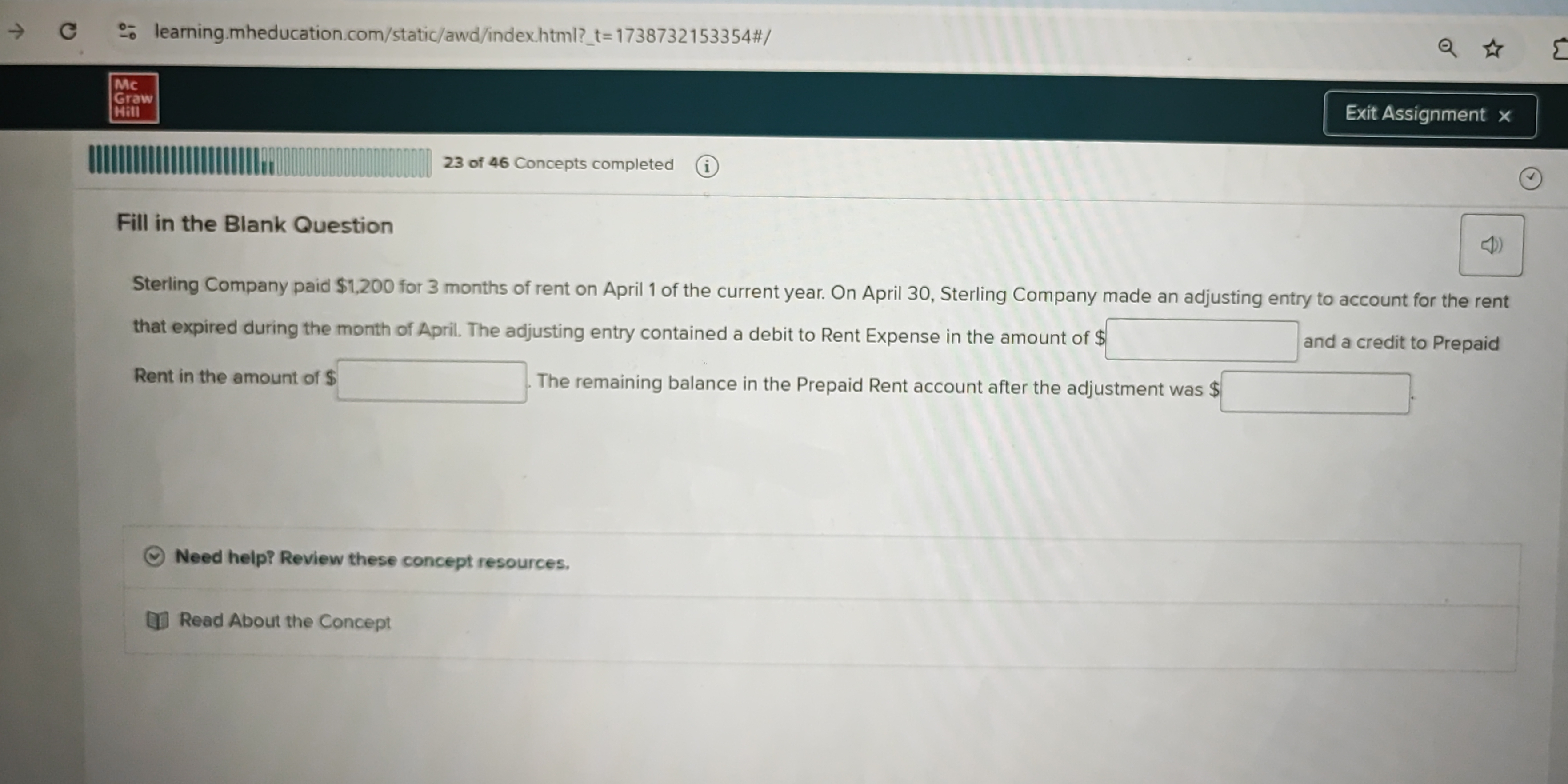

Sterling Company paid $1,200 for 3 months of rent on April 1 of the current year. On April 30, Sterling Company made an adjusting entry to account for the rent that expired during... Sterling Company paid $1,200 for 3 months of rent on April 1 of the current year. On April 30, Sterling Company made an adjusting entry to account for the rent that expired during the month of April. The adjusting entry contained a debit to Rent Expense in the amount of $ and a credit to Prepaid Rent in the amount of $. The remaining balance in the Prepaid Rent account after the adjustment was $.

Understand the Problem

The question is asking to fill in the blanks regarding an adjusting journal entry for prepaid rent for the Sterling Company. It requires determining the amounts to be debited and credited for the rent expense and the remaining balance in the prepaid rent account after the adjustment.

Answer

$400; $400; $800

The adjusting entry contained a debit to Rent Expense in the amount of $400 and a credit to Prepaid Rent in the amount of $400. The remaining balance in the Prepaid Rent account after the adjustment was $800.

Answer for screen readers

The adjusting entry contained a debit to Rent Expense in the amount of $400 and a credit to Prepaid Rent in the amount of $400. The remaining balance in the Prepaid Rent account after the adjustment was $800.

More Information

This type of adjustment ensures that rent expenses are recognized in the period they relate to, and the balance sheet reflects the correct asset value.

Tips

A common mistake is to miscalculate the monthly rent expense by dividing by the wrong number of periods.

AI-generated content may contain errors. Please verify critical information