State the provisions of section 80 GGA.

Understand the Problem

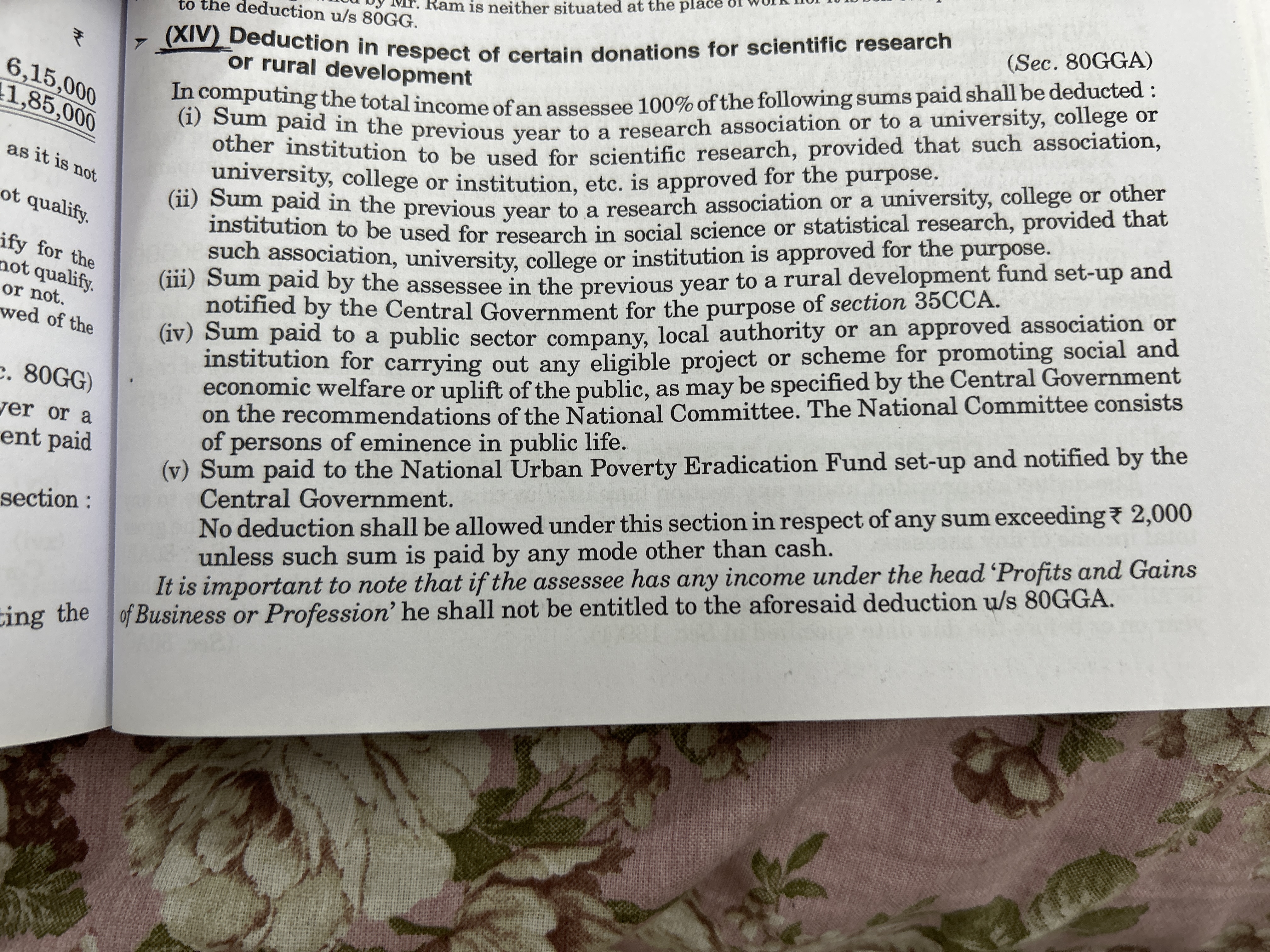

The question is asking for the specific provisions or details outlined in Section 80 GGA of the Income Tax Act, which pertains to deductions concerning contributions made for scientific research and rural development. This involves understanding the eligibility criteria, the nature of expenditures deductible, and the related formalities.

Answer

100% deduction for donations to scientific research and rural development; certain conditions apply.

Section 80GGA of the Income Tax Act provides a 100% deduction for donations made towards scientific research and rural development. The donations must be made to approved institutions or associations, and if the amount exceeds ₹2,000, it must not be paid in cash. Deductions are not allowed if the assessee has income under the head 'Profits and Gains of Business or Profession.'

Answer for screen readers

Section 80GGA of the Income Tax Act provides a 100% deduction for donations made towards scientific research and rural development. The donations must be made to approved institutions or associations, and if the amount exceeds ₹2,000, it must not be paid in cash. Deductions are not allowed if the assessee has income under the head 'Profits and Gains of Business or Profession.'

More Information

This provision encourages taxpayers to contribute towards national projects in scientific research and rural development, intending to boost these sectors.

Tips

Ensure that donations are paid through a method other than cash if exceeding ₹2,000 to qualify for deduction.

Sources

- Section 80GGA of Income Tax Act - Bank Bazaar - bankbazaar.com

- Donations Eligible Under Section 80G and 80GGA - ClearTax - cleartax.in

- Section 80GGA: Tax Deductions for Donations of Scientific Research - indiafilings.com

AI-generated content may contain errors. Please verify critical information