Solve the actuarial science questions in the image.

Understand the Problem

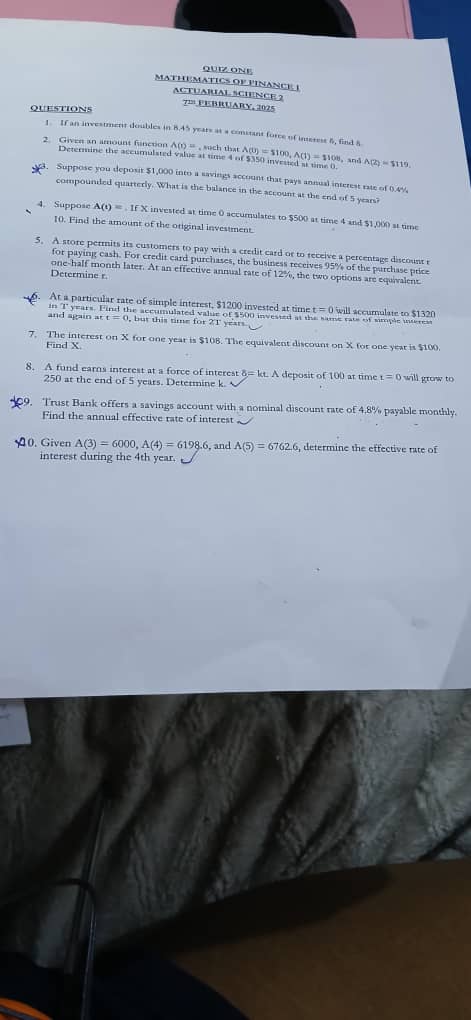

The image contains a quiz on Mathematics of Finance / Actuarial Science. The questions cover topics such as force of interest, accumulated value, simple and compound interest, discount rates, and effective interest rates. The task is to solve these problems from Actuarial Science 2 course, 7th of February 2025.

Answer

1. $\delta \approx 0.08203$ 2. $531.79 3. $1020.18 4. $315 5. $5.45\%$ 6. $600 7. $1350 8. $k \approx 0.0733$ 9. $4.91\%$ 10. $3.31\%$

Answer for screen readers

- $\delta \approx 0.08203$

- The accumulated value at time 4 is approximately $531.79

- The balance in the account at the end of 5 years is approximately $1020.18.

- The amount of the original investment is approximately $315.

- The discount rate $r \approx 5.45%$.

- The accumulated value of $500$ invested for $2T$ years is $600.

- $X = 1350$

- $k \approx 0.0733$

- The annual effective rate of interest is approximately $4.91%$.

- The effective interest rate during the 4th year is $3.31%$.

Steps to Solve

- Solve Question 1: Find $\delta$ when an investment doubles in 8.45 years

Since the investment doubles, we have $2 = e^{\delta t}$, where $t = 8.45$. Then $\ln(2) = \delta t$, so $\delta = \frac{\ln(2)}{t}$

- Calculation for Question 1

Substituting $t=8.45$, we get $\delta = \frac{\ln(2)}{8.45} \approx 0.08203$.

- Solve Question 2: Determine accumulated value at time 4 of $350 invested at time 0

We are given $A(0) = 100$, $A(1) = 108$, $A(2) = 119$. We want to find $350 \cdot \frac{A(4)}{A(0)}$. We need to estimate $A(4)$.

Let's analyze the growth: From $t=0$ to $t=1$, the growth is $108/100 = 1.08$. From $t=1$ to $t=2$, the growth is $119/108 \approx 1.1019$.

We can approximate the growth from $t=2$ to $t=3$ as $1.12$ and from $t=3$ to $t=4$ as $1.14$. Then $A(3) \approx 119 \cdot 1.12 = 133.28$ and $A(4) \approx 133.28 \cdot 1.14 = 151.94$. So $A(4) \approx 152$.

Therefore, the accumulated value at time 4 of $350 invested at time 0 is approximately $350 \cdot \frac{152}{100} = 350 \cdot 1.52 = 532$.

Since we do not have enough amount function information, we will assume simple interest for each year (i.e. calculate $i_1$ and $i_2$ and then derive $i_3$ and $i_4$) for the single year, not compounded. Then $100(1+i_1) = 108 \implies i_1 = 0.08$ so $i_1 = 8%$ Also $108(1+i_2) = 119 \implies i_2 = 11/108 \approx 0.10185$ so $i_2 \approx 10.19%$ We can estimate $i_3 \approx 12%$ and $i_4 \approx 14%$.

Then $A(3) = 119(1+0.12) = 119(1.12) = 133.28$ and $A(4) = 133.28(1+0.14) = 133.28(1.14) = 151.9392 \approx 151.94$

The accumulated value at time 4 of $350 invested at time 0 is $350 \cdot A(4)/A(0) = 350 \cdot 151.94/100 = 350 \cdot 1.5194 = 531.79$

- Solve Question 3: Balance after 5 years with 0.4% interest compounded quarterly

The nominal annual interest rate is 0.4%, so the quarterly interest rate is $\frac{0.4%}{4} = 0.1% = 0.001$. The number of quarters in 5 years is $5 \cdot 4 = 20$. The balance is $1000(1 + 0.001)^{20} = 1000(1.001)^{20} \approx 1000(1.02018) \approx 1020.18$.

- Solve Question 4: Find original investment if it accumulates to $500 at time 4 and $1000 at time 10

Let the original investment be $X$. Then $X \cdot a(4) = 500$ and $X \cdot a(10) = 1000$. Thus, $\frac{a(10)}{a(4)} = \frac{1000}{500} = 2$.

We have $a(10) = a(4) \cdot 2$. Since $a(10)$ is the accumulated value at time 10 and $a(4)$ is the accumulated value at time 4, it took 6 years to double. Assume exponential growth. Then $a(t) = e^{\delta t}$. So $e^{10\delta} = 2 e^{4\delta}$. $e^{6\delta} = 2$, so $6\delta = \ln 2$ and $\delta = \frac{\ln 2}{6}$. Then $a(4) = e^{4 \cdot \frac{\ln 2}{6}} = e^{\frac{2}{3} \ln 2} = e^{\ln 2^{2/3}} = 2^{2/3} \approx 1.5874$. Since $X \cdot a(4) = 500$, we have $X = \frac{500}{a(4)} = \frac{500}{2^{2/3}} = \frac{500}{1.5874} \approx 314.98 \approx 315$.

- Solve Question 5: Find discount rate r for cash payment

The store receives 95% of the purchase price one-half month later for credit card purchases. The effective annual rate is 12%, so the monthly effective rate is $i$ where $(1+i)^{12} = 1.12$, or $i = (1.12)^{1/12} - 1 \approx 0.0094888$. The half-month effective rate $j$ is such that $(1+j)^2 = 1+i = 1.0094888$, so $j = \sqrt{1.0094888} - 1 \approx 0.004733$. Let the purchase price be 1. Paying with credit card yields $0.95$ after one-half month. The present value of this is $0.95/(1+j) = 0.95/1.004733 \approx 0.94552$. The cash payment yields $1-r$ immediately. So $1-r = 0.94552$. Then $r = 1 - 0.94552 = 0.05448$, so $r \approx 5.45%$.

- Solve Question 6: Find the accumulated value of $500 invested for 2T years

The accumulated value of $1200$ invested at time 0 for $T$ years is $1320$. Using simple interest, $1200(1+rT) = 1320$, so $1+rT = \frac{1320}{1200} = 1.1$. Then $rT = 0.1$. Since $r = \frac{0.1}{T}$. We want the accumulated value of $500$ invested for $2T$ years. This is $500(1 + r(2T)) = 500(1 + 2rT) = 500(1 + 2 \cdot 0.1) = 500(1.2) = 600$.

- Solve Question 7: Find X given interest of $108 and discount of $100

Interest on $X$ for one year is $108$, so $X \cdot i = 108$, where $i$ is the interest rate. The equivalent discount on $X$ is $100$, so $X \cdot d = 100$, where $d$ is the discount rate. These are equivalent, so $i = \frac{d}{1-d}$, so $i = \frac{100/X}{1 - 100/X} = \frac{100}{X-100}$. Since $X \cdot i = 108$, we have $X \cdot \frac{100}{X-100} = 108$, so $100X = 108(X-100) = 108X - 10800$, which gives $8X = 10800$, so $X = \frac{10800}{8} = 1350$.

- Solve Question 8: Find k given $\delta = kt$ and $A(5) = 250$ for an initial deposit of 100

The accumulated value is $A(t) = A(0) e^{\int_0^t \delta(s) ds}$. Here, $A(0) = 100$ and $A(5) = 250$. So $A(5) = 100 e^{\int_0^5 ks ds} = 100 e^{k s^2/2 \vert_0^5} = 100 e^{25k/2} = 250$. Then $e^{25k/2} = \frac{250}{100} = 2.5$. Taking the natural logarithm, $\frac{25k}{2} = \ln(2.5)$, so $k = \frac{2 \ln(2.5)}{25} \approx \frac{2 \cdot 0.91629}{25} \approx 0.0733$.

- Solve Question 9: Find annual effective rate of interest

Nominal discount rate of 4.8% payable monthly means $d^{(12)} = 0.048$. Thus $d = d^{(12)}/12 = 0.048/12 = 0.004$ is the monthly discount rate. $1-d = 1/ (1+i)$, thus $1-0.004 = 1/(1+i)$, and $i = 0.004016$. The monthly interest rate is 0.004016 The effective annual rate of interest is $(1+i)^{12} - 1 = (1.004016)^{12} - 1 \approx 0.04907$. Thus the effective interest rate is 4.91%.

- Solve Question 10: Find effective interest rate during the 4th year

$A(3) = 6000$, $A(4) = 6198.6$, and $A(5) = 6762.6$. We want to find the effective interest rate during the 4th year, which is $i_4 = \frac{A(4) - A(3)}{A(3)} = \frac{6198.6 - 6000}{6000} = \frac{198.6}{6000} = 0.0331$. The effective interest rate during the 4th year is 3.31%.

- $\delta \approx 0.08203$

- The accumulated value at time 4 is approximately $531.79

- The balance in the account at the end of 5 years is approximately $1020.18.

- The amount of the original investment is approximately $315.

- The discount rate $r \approx 5.45%$.

- The accumulated value of $500$ invested for $2T$ years is $600.

- $X = 1350$

- $k \approx 0.0733$

- The annual effective rate of interest is approximately $4.91%$.

- The effective interest rate during the 4th year is $3.31%$.

More Information

These questions cover fundamental concepts in the Mathematics of Finance and Actuarial Science. They test your understanding of interest rates, discount rates, accumulation functions, and forces of interest.

Tips

Null

AI-generated content may contain errors. Please verify critical information