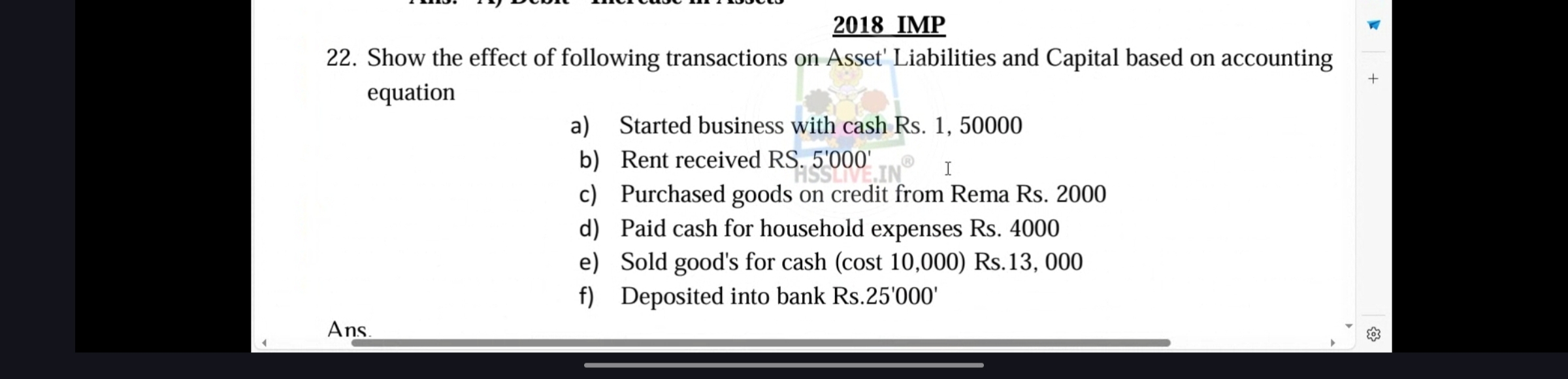

Show the effect of the following transactions on Assets, Liabilities, and Capital based on the accounting equation: a) Started business with cash Rs. 1,50,000 b) Rent received Rs.... Show the effect of the following transactions on Assets, Liabilities, and Capital based on the accounting equation: a) Started business with cash Rs. 1,50,000 b) Rent received Rs. 5,000 c) Purchased goods on credit from Rema Rs. 2,000 d) Paid cash for household expenses Rs. 4,000 e) Sold goods for cash (cost 10,000) Rs. 13,000 f) Deposited into bank Rs. 25,000

Understand the Problem

The question requires demonstrating the impact of several transactions on the assets, liabilities, and capital using the accounting equation (Assets = Liabilities + Capital). Each transaction needs to be analyzed for its effects on these components of the equation. This is a typical accounting problem involving journal entries and their effect on the balance sheet.

Answer

a) Assets: +Rs. 150,000, Liabilities: 0, Capital: +Rs. 150,000 b) Assets: +Rs. 5,000, Liabilities: 0, Capital: +Rs. 5,000 c) Assets: +Rs. 2,000, Liabilities: +Rs. 2,000, Capital: 0 d) Assets: -Rs. 4,000, Liabilities: 0, Capital: -Rs. 4,000 e) Assets: +Rs. 3,000, Liabilities: 0, Capital: +Rs. 3,000 f) Assets: 0, Liabilities: 0, Capital: 0

Answer for screen readers

a) Assets: +Rs. 150,000, Liabilities: 0, Capital: +Rs. 150,000 b) Assets: +Rs. 5,000, Liabilities: 0, Capital: +Rs. 5,000 c) Assets: +Rs. 2,000, Liabilities: +Rs. 2,000, Capital: 0 d) Assets: -Rs. 4,000, Liabilities: 0, Capital: -Rs. 4,000 e) Assets: +Rs. 13,000 and -Rs. 10,000, Liabilities: 0, Capital: +Rs. 3,000 f) Assets: +Rs. 25,000 and -Rs. 25,000, Liabilities: 0, Capital: 0

Steps to Solve

-

Analyze transaction a: Started business with cash Rs. 150,000

When the business starts with cash, the cash (an asset) increases, and the capital also increases.

Assets increase by Rs. 150,000 Capital increases by Rs. 150,000 Equation: Assets = Liabilities + Capital becomes $150,000 = 0 + 150,000$

-

Analyze transaction b: Rent received Rs. 5,000

When rent is received, cash (an asset) increases, and capital also increases because rent received is revenue.

Assets increase by Rs. 5,000 Capital increases by Rs. 5,000 Equation: Assets = Liabilities + Capital becomes $150,000 + 5,000 = 0 + 150,000 + 5,000$ which simplifies to $155,000 = 0 + 155,000$

-

Analyze transaction c: Purchased goods on credit from Rema Rs. 2,000

When goods are purchased on credit, inventory (an asset) increases, and accounts payable (a liability) also increases.

Assets increase by Rs. 2,000 Liabilities increase by Rs. 2,000 Equation: Assets = Liabilities + Capital becomes $155,000 + 2,000 = 2,000 + 155,000$ which simplifies to $157,000 = 2,000 + 155,000$

-

Analyze transaction d: Paid cash for household expenses Rs. 4,000

Since this is for household expenses, these are drawings. Cash (an asset) decreases, and capital decreases.

Assets decrease by Rs. 4,000 Capital decreases by Rs. 4,000 Equation: Assets = Liabilities + Capital becomes $157,000 - 4,000 = 2,000 + 155,000 - 4,000$ which simplifies to $153,000 = 2,000 + 151,000$

-

Analyze transaction e: Sold goods for cash (cost Rs. 10,000) Rs. 13,000

When goods are sold for cash, cash (an asset) increases by the selling price, inventory (another asset) decreases by the cost, and capital increases by the profit (selling price - cost).

Assets (cash) increase by Rs. 13,000 Assets (inventory) decrease by Rs. 10,000 Capital increases by Rs. 3,000 (13,000 - 10,000) Equation: Assets = Liabilities + Capital becomes $153,000 + 13,000 - 10,000 = 2,000 + 151,000 + 3,000$ which simplifies to $156,000 = 2,000 + 154,000$

-

Analyze transaction f: Deposited into bank Rs. 25,000

When cash is deposited into the bank, the bank balance (an asset) increases, and cash (another asset) decreases.

Assets (bank) increase by Rs. 25,000 Assets (cash) decrease by Rs. 25,000 Equation: Assets = Liabilities + Capital becomes $156,000 + 25,000 - 25,000 = 2,000 + 154,000$ which simplifies to $156,000 = 2,000 + 154,000$

a) Assets: +Rs. 150,000, Liabilities: 0, Capital: +Rs. 150,000 b) Assets: +Rs. 5,000, Liabilities: 0, Capital: +Rs. 5,000 c) Assets: +Rs. 2,000, Liabilities: +Rs. 2,000, Capital: 0 d) Assets: -Rs. 4,000, Liabilities: 0, Capital: -Rs. 4,000 e) Assets: +Rs. 13,000 and -Rs. 10,000, Liabilities: 0, Capital: +Rs. 3,000 f) Assets: +Rs. 25,000 and -Rs. 25,000, Liabilities: 0, Capital: 0

More Information

The accounting equation (Assets = Liabilities + Capital) always remains balanced after each transaction. This is because every transaction affects at least two accounts.

Tips

A common mistake is misunderstanding the effect of personal/household expenses. These are drawings and reduce capital, not business expenses. Another common mistake is with transaction (e), not recognizing that the profit increases owner's equity.

AI-generated content may contain errors. Please verify critical information