Provide information about the Cost Accounting course for B. Com Third Semester, including course code, marks distribution, credits, topics covered, and suggested readings.

Understand the Problem

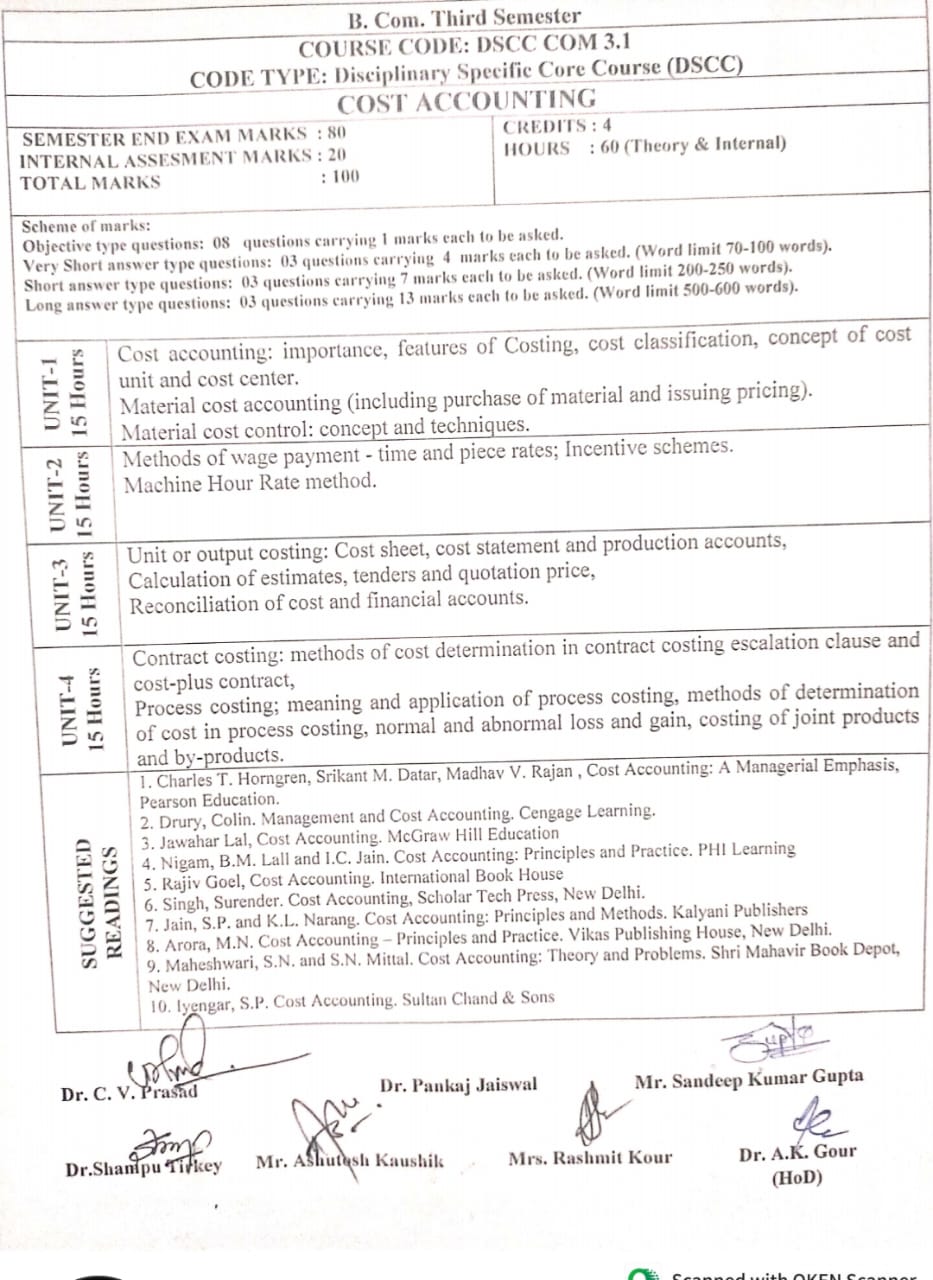

The image contains course information for a B. Com. Third Semester course titled "Cost Accounting". It includes details such as course code, marks distribution, credits, and topics covered in each unit, along with suggested readings. This is information about a course, it is not a question.

Answer

The Cost Accounting course for B. Com Third Semester includes course code DSCC COM 3.1, 100 total marks, 4 credits, 60 hours, and covers topics from cost accounting basics to contract and process costing. A list of 10 suggested readings is provided.

Here is the information for the B. Com Third Semester Cost Accounting course:

- Course Code: DSCC COM 3.1

- Code Type: Disciplinary Specific Core Course (DSCC)

- Marks: Semester End Exam: 80, Internal Assessment: 20, Total: 100

- Credits: 4

- Hours: 60 (Theory & Internal)

- Topics Covered:

- Unit 1: Cost accounting basics, material cost accounting and control.

- Unit 2: Wage payment methods, incentive schemes, machine hour rate.

- Unit 3: Unit costing, cost sheet, reconciliation of cost and financial accounts.

- Unit 4: Contract costing, process costing.

- Suggested Readings: A list of 10 books with authors and publishers is provided in the original document.

Answer for screen readers

Here is the information for the B. Com Third Semester Cost Accounting course:

- Course Code: DSCC COM 3.1

- Code Type: Disciplinary Specific Core Course (DSCC)

- Marks: Semester End Exam: 80, Internal Assessment: 20, Total: 100

- Credits: 4

- Hours: 60 (Theory & Internal)

- Topics Covered:

- Unit 1: Cost accounting basics, material cost accounting and control.

- Unit 2: Wage payment methods, incentive schemes, machine hour rate.

- Unit 3: Unit costing, cost sheet, reconciliation of cost and financial accounts.

- Unit 4: Contract costing, process costing.

- Suggested Readings: A list of 10 books with authors and publishers is provided in the original document.

More Information

Cost accounting helps businesses make informed decisions about pricing, production, and profitability by providing detailed information about costs.

Tips

Make sure to understand the difference between cost accounting and financial accounting. Cost accounting is for internal use, while financial accounting is for external reporting.

AI-generated content may contain errors. Please verify critical information