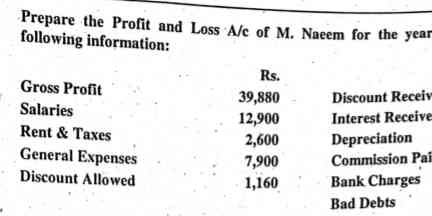

Prepare the Profit and Loss A/c of M. Naeem for the year using the following information: Gross Profit: 39,880, Salaries: 12,900, Rent & Taxes: 2,600, General Expenses: 7,900, Disc... Prepare the Profit and Loss A/c of M. Naeem for the year using the following information: Gross Profit: 39,880, Salaries: 12,900, Rent & Taxes: 2,600, General Expenses: 7,900, Discount Allowed: 1,160, Discount Received, Interest Received, Depreciation, Commission Paid, Bank Charges, Bad Debts.

Understand the Problem

The question presents a set of financial information and asks to prepare a Profit and Loss account. The question is asking to properly categorize the expenses and calculate a net profit or loss.

Answer

I can create a Profit and Loss (P&L) statement, but some values are missing to complete it.

I can create a Profit and Loss (P&L) statement for M. Naeem. However, some values are missing. I need the values for 'Discount Received,' 'Interest Received,' 'Depreciation,' 'Commission Paid,' 'Bank Charges,' and 'Bad Debts' to complete the P&L A/c.

Answer for screen readers

I can create a Profit and Loss (P&L) statement for M. Naeem. However, some values are missing. I need the values for 'Discount Received,' 'Interest Received,' 'Depreciation,' 'Commission Paid,' 'Bank Charges,' and 'Bad Debts' to complete the P&L A/c.

More Information

A Profit and Loss statement, also known as an income statement, summarizes the revenues, costs, and expenses of a company during a specific period of time. It provides insights into a company's ability to generate profit by managing revenue, production costs, and expenses.

Tips

Ensure that you have all the necessary information before preparing a financial statement.

AI-generated content may contain errors. Please verify critical information