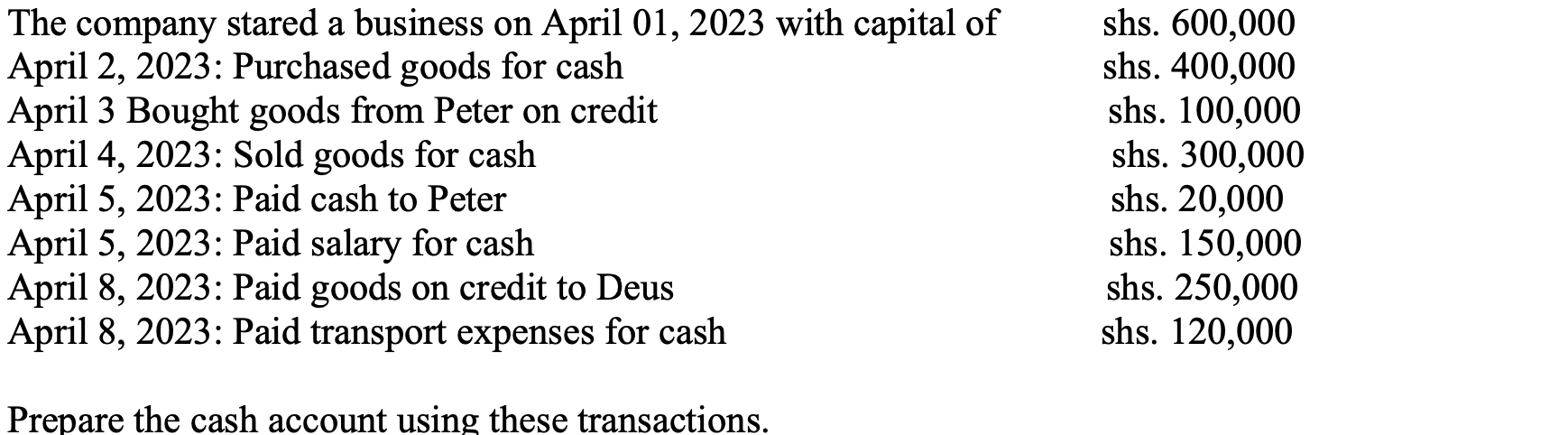

Prepare the cash account using these transactions: The company started a business on April 01, 2023 with capital of shs. 600,000 April 2, 2023: Purchased goods for cash shs. 400,00... Prepare the cash account using these transactions: The company started a business on April 01, 2023 with capital of shs. 600,000 April 2, 2023: Purchased goods for cash shs. 400,000 April 3 Bought goods from Peter on credit shs. 100,000 April 4, 2023: Sold goods for cash shs. 300,000 April 5, 2023: Paid cash to Peter shs. 20,000 April 5, 2023: Paid salary for cash shs. 150,000 April 8, 2023: Paid goods on credit to Deus shs. 250,000 April 8, 2023: Paid transport expenses for cash shs. 120,000

Understand the Problem

The question requires preparing a cash account using the provided transactions. This involves recording all cash inflows (receipts) and cash outflows (payments) to determine the overall cash balance for the period.

Answer

A cash account tracks all cash inflows (debits) and outflows (credits) to determine the cash balance. Based on the transactions, the final cash balance is shs. 210,000.

To prepare the cash account, list all cash inflows (debits) and outflows (credits). Calculate the balance.

Cash Account

Date Description Debit (shs) Credit (shs) Balance (shs)

Apr 1 Capital 600,000 600,000

Apr 2 Purchases 400,000 200,000

Apr 4 Sales 300,000 500,000

Apr 5 Payment to Peter 20,000 480,000

Apr 5 Salary 150,000 330,000

Apr 8 Transport 120,000 210,000

Note: The transaction on April 3rd and April 8th (paid goods on credit to Deus) is not a cash transaction, therefore it is not included in the cash account.

Answer for screen readers

To prepare the cash account, list all cash inflows (debits) and outflows (credits). Calculate the balance.

Cash Account

Date Description Debit (shs) Credit (shs) Balance (shs)

Apr 1 Capital 600,000 600,000

Apr 2 Purchases 400,000 200,000

Apr 4 Sales 300,000 500,000

Apr 5 Payment to Peter 20,000 480,000

Apr 5 Salary 150,000 330,000

Apr 8 Transport 120,000 210,000

Note: The transaction on April 3rd and April 8th (paid goods on credit to Deus) is not a cash transaction, therefore it is not included in the cash account.

More Information

A cash account is a fundamental part of accounting and is used to track the movement of cash within a business.

Tips

The most common mistake is including credit transactions. Remember that cash accounts only track actual cash inflows and outflows.

AI-generated content may contain errors. Please verify critical information