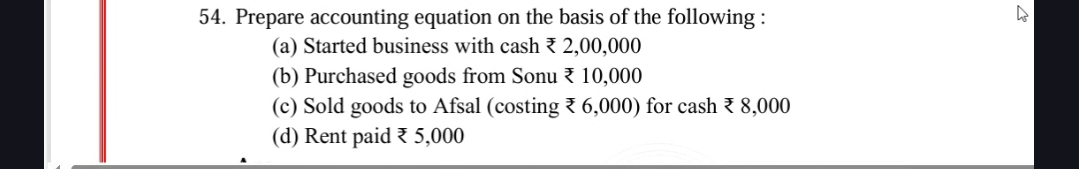

Prepare an accounting equation on the basis of the following: (a) Started business with cash ₹2,00,000 (b) Purchased goods from Sonu ₹10,000 (c) Sold goods to Afsal (costing ₹6,000... Prepare an accounting equation on the basis of the following: (a) Started business with cash ₹2,00,000 (b) Purchased goods from Sonu ₹10,000 (c) Sold goods to Afsal (costing ₹6,000) for cash ₹8,000 (d) Rent paid ₹5,000

Understand the Problem

The question is asking to prepare an accounting equation based on the given transactions. This involves understanding how each transaction affects the assets, liabilities, and equity of the business, and then presenting these effects in the form of an accounting equation (Assets = Liabilities + Equity).

Answer

The accounting equation reflects the balance between assets, liabilities, and equity after each transaction: 1. Initial investment: Assets ₹2,00,000 = Equity ₹2,00,000 2. Goods purchased on credit: Assets ₹2,10,000 = Liabilities ₹10,000 + Equity ₹2,00,000 3. Goods sold for cash: Assets ₹2,12,000 = Liabilities ₹10,000 + Equity ₹2,02,000 4. Rent paid: Assets ₹2,07,000 = Liabilities ₹10,000 + Equity ₹1,97,000

The accounting equation is as follows:

- Started business with cash: * Assets = Cash: ₹2,00,000 * Equity = Capital: ₹2,00,000 * Equation: ₹2,00,000 (Cash) = ₹2,00,000 (Capital)

- Purchased goods from Sonu (on credit): * Assets = Inventory: +₹10,000 * Liabilities = Accounts Payable: +₹10,000 * Equation: ₹2,00,000 (Cash) + ₹10,000 (Inventory) = ₹10,000 (Accounts Payable) + ₹2,00,000 (Capital)

- Sold goods to Afsal (costing ₹6,000) for cash ₹8,000: * Assets = Cash: +₹8,000, Inventory: -₹6,000 * Equity = Profit: ₹2,000 (₹8,000 - ₹6,000) * Equation: ₹2,08,000 (Cash) + ₹4,000 (Inventory) = ₹10,000 (Accounts Payable) + ₹2,02,000 (Capital)

- Rent paid: * Assets = Cash: -₹5,000 * Equity = Reduced by ₹5,000 * Equation: ₹2,03,000 (Cash) + ₹4,000 (Inventory) = ₹10,000 (Accounts Payable) + ₹1,97,000 (Capital)

Answer for screen readers

The accounting equation is as follows:

- Started business with cash: * Assets = Cash: ₹2,00,000 * Equity = Capital: ₹2,00,000 * Equation: ₹2,00,000 (Cash) = ₹2,00,000 (Capital)

- Purchased goods from Sonu (on credit): * Assets = Inventory: +₹10,000 * Liabilities = Accounts Payable: +₹10,000 * Equation: ₹2,00,000 (Cash) + ₹10,000 (Inventory) = ₹10,000 (Accounts Payable) + ₹2,00,000 (Capital)

- Sold goods to Afsal (costing ₹6,000) for cash ₹8,000: * Assets = Cash: +₹8,000, Inventory: -₹6,000 * Equity = Profit: ₹2,000 (₹8,000 - ₹6,000) * Equation: ₹2,08,000 (Cash) + ₹4,000 (Inventory) = ₹10,000 (Accounts Payable) + ₹2,02,000 (Capital)

- Rent paid: * Assets = Cash: -₹5,000 * Equity = Reduced by ₹5,000 * Equation: ₹2,03,000 (Cash) + ₹4,000 (Inventory) = ₹10,000 (Accounts Payable) + ₹1,97,000 (Capital)

More Information

The accounting equation (Assets = Liabilities + Equity) is the foundation of double-entry accounting. It ensures that the balance sheet always remains balanced. Each transaction affects at least two accounts to keep the equation in balance.

Tips

A common mistake is not adjusting both sides of the equation for each transaction. Always make sure that the accounting equation remains balanced (Assets = Liabilities + Equity) after each transaction.

Sources

AI-generated content may contain errors. Please verify critical information