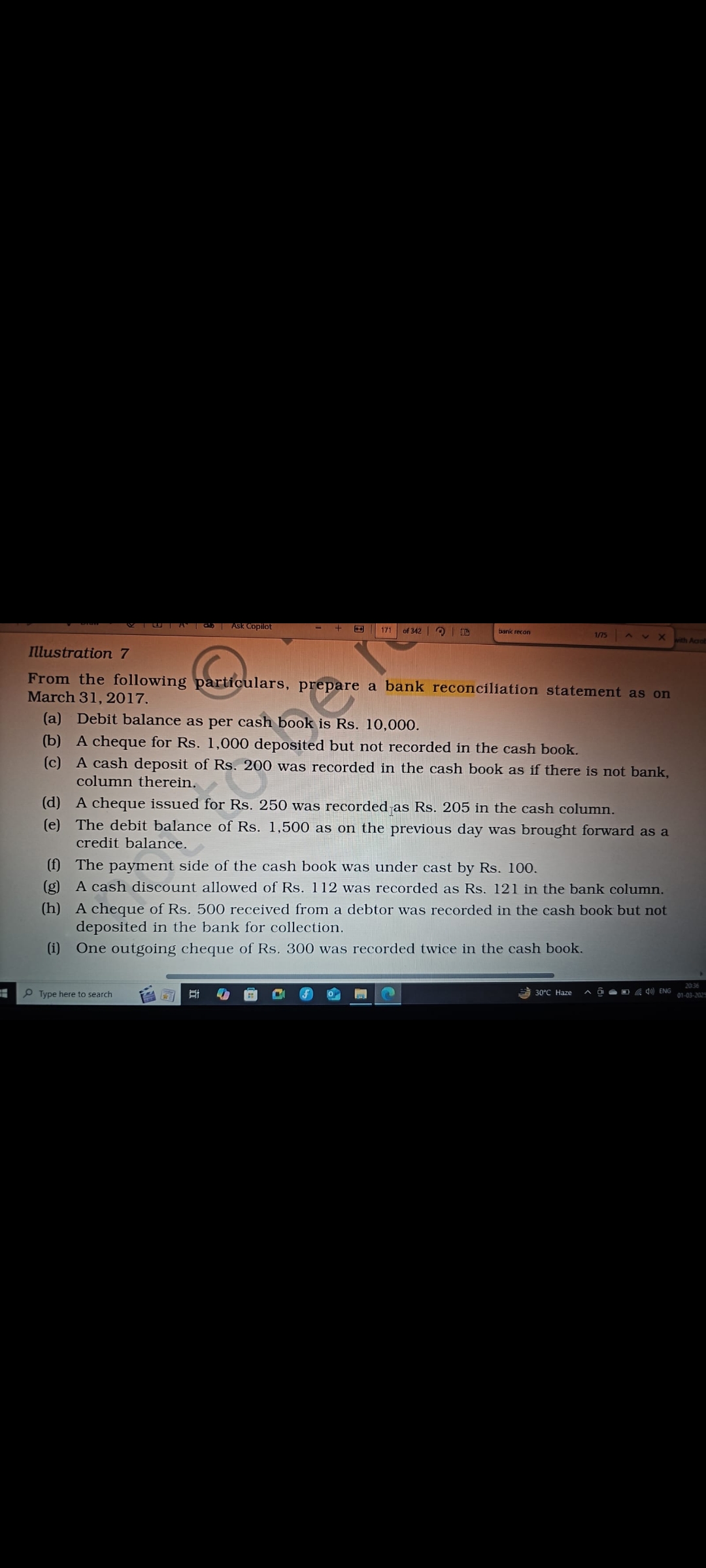

Prepare a bank reconciliation statement as of March 31, 2017, using the following information: (a) Debit balance as per cash book is Rs. 10,000. (b) A cheque for Rs. 1,000 deposite... Prepare a bank reconciliation statement as of March 31, 2017, using the following information: (a) Debit balance as per cash book is Rs. 10,000. (b) A cheque for Rs. 1,000 deposited but not recorded in the cash book. (c) A cash deposit of Rs. 200 was recorded in the cash book as if there is not bank column therein. (d) A cheque issued for Rs. 250 was recorded as Rs. 205 in the cash column. (e) The debit balance of Rs. 1,500 as on the previous day was brought forward as a credit balance. (f) The payment side of the cash book was under cast by Rs. 100. (g) A cash discount allowed of Rs. 112 was recorded as Rs. 121 in the bank column. (h) A cheque of Rs. 500 received from a debtor was recorded in the cash book but not deposited in the bank for collection. (i) One outgoing cheque of Rs. 300 was recorded twice in the cash book.

Understand the Problem

The question provides a list of transactions and discrepancies between a company's cash book and its bank statement. The task is to prepare a bank reconciliation statement as of March 31, 2017, by adjusting for these differences to arrive at the true or correct cash balance.

Answer

The adjusted cash book balance is Rs. 10,091.

The adjusted cash book balance is Rs. 10,091. Adjustments include items like unrecorded deposits, errors in recording cheques, and correcting balances brought forward. This balance would then be used to reconcile with the bank statement.

Answer for screen readers

The adjusted cash book balance is Rs. 10,091. Adjustments include items like unrecorded deposits, errors in recording cheques, and correcting balances brought forward. This balance would then be used to reconcile with the bank statement.

More Information

A Bank Reconciliation Statement is prepared to reconcile the bank balance as per the cash book with the bank balance as per the passbook.

Tips

A common mistake is not understanding the impact of each transaction on the cash book and passbook balances. Carefully consider whether each item increases or decreases the balance as per the cash book.

Sources

AI-generated content may contain errors. Please verify critical information