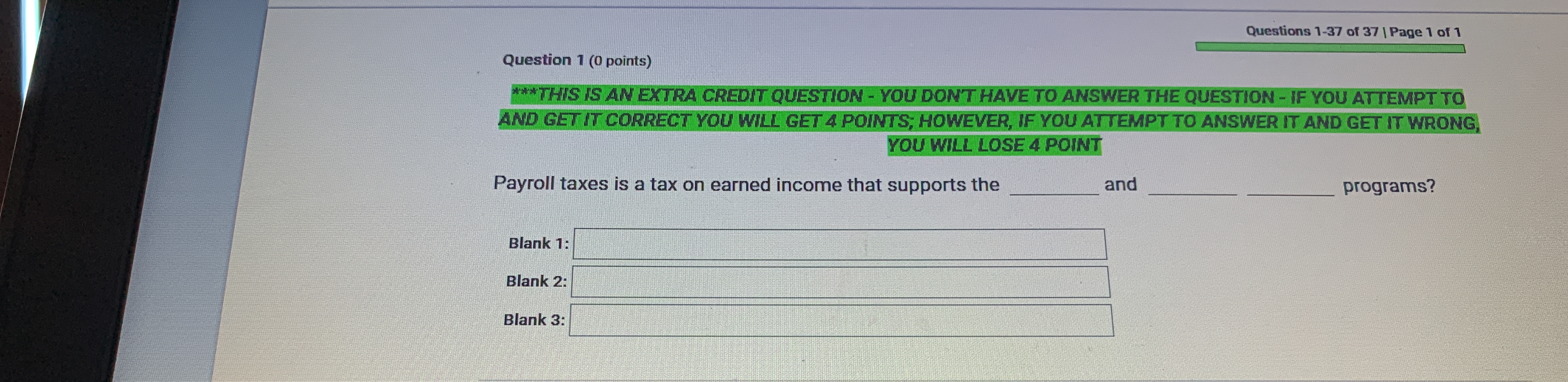

Payroll taxes is a tax on earned income that supports the ____ and _____ programs?

Understand the Problem

The question is asking to identify what payroll taxes support on earned income. This is a fill in the blank question, there are 3 blanks that must be filled in with the correct answers.

Answer

Payroll taxes support Social Security and Medicare.

Payroll taxes support the Social Security and Medicare programs.

Answer for screen readers

Payroll taxes support the Social Security and Medicare programs.

More Information

Payroll taxes are the second-largest source of revenue for the federal government.

Tips

It's easy to confuse payroll taxes with income taxes. Payroll taxes are specifically for funding social insurance programs.

Sources

- Payroll Taxes: What Are They and What Do They Fund? - pgpf.org

- Policy Basics: Federal Payroll Taxes - cbpp.org

- Payroll Tax Definition | TaxEDU Glossary - Tax Foundation - taxfoundation.org

AI-generated content may contain errors. Please verify critical information