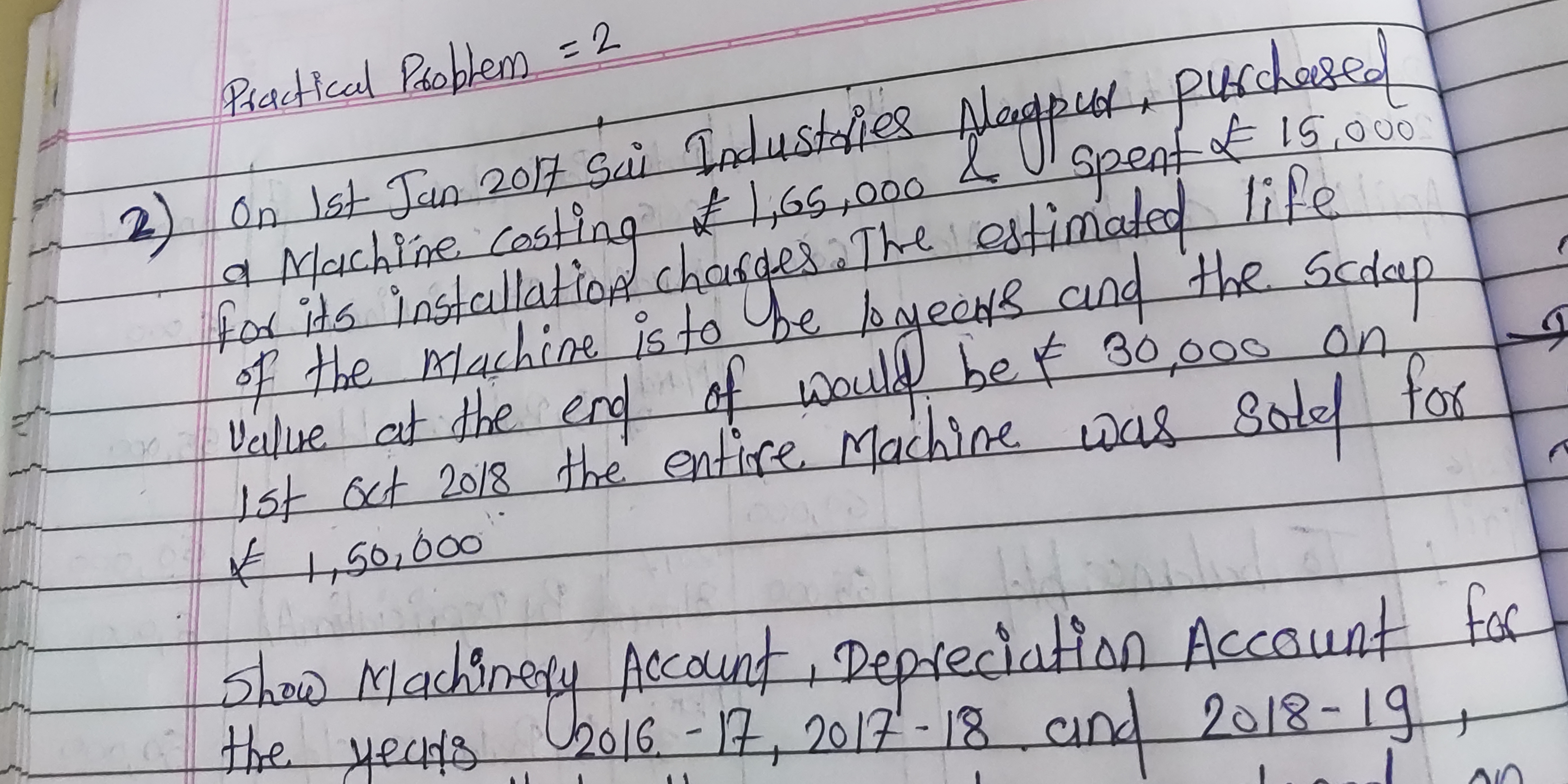

On 1st Jan 2017 Sai Industries Nagpur purchased a Machine costing £1,65,000 and spent £15,000 for its installation charges. The estimated life of the Machine is to be 10 years and... On 1st Jan 2017 Sai Industries Nagpur purchased a Machine costing £1,65,000 and spent £15,000 for its installation charges. The estimated life of the Machine is to be 10 years and the scrap value at the end of would be £30,000. On 1st Oct 2018 the entire Machine was sold for £1,50,000. Show Machinery Account, Depreciation Account for the years 2016-17, 2017-18 and 2018-19.

Understand the Problem

The question is a practical problem related to accounting. It involves calculating depreciation on a machine purchased by Sai Industries Nagpur, preparing the Machinery Account and Depreciation Account for the years 2016-17, 2017-18, and 2018-19. The machine was purchased on January 1, 2017, with a cost of £1,65,000 and installation charges of £15,000. The estimated life of the machine is 10 years with a scrap value of £30,000. The entire machine was sold on October 1, 2018, for £1,50,000. We need to calculate depreciation for each year, considering the sale in 2018, and then prepare the requested accounts.

Answer

Accounting entries for Machinery Account and Depreciation Account are required for the specified years.

Accounting entries for Machinery Account, Depreciation Account for the years 2016-17, 2017-18 and 2018-19 are required.

Answer for screen readers

Accounting entries for Machinery Account, Depreciation Account for the years 2016-17, 2017-18 and 2018-19 are required.

More Information

The straight-line method is used to calculate depreciation. It is calculated by dividing the difference between the asset's cost and its expected salvage value by the number of years you expect to use the asset.

Tips

Ensure the correct year end date is used for each accounting year, e.g. March 31st or December 31st.

Sources

AI-generated content may contain errors. Please verify critical information