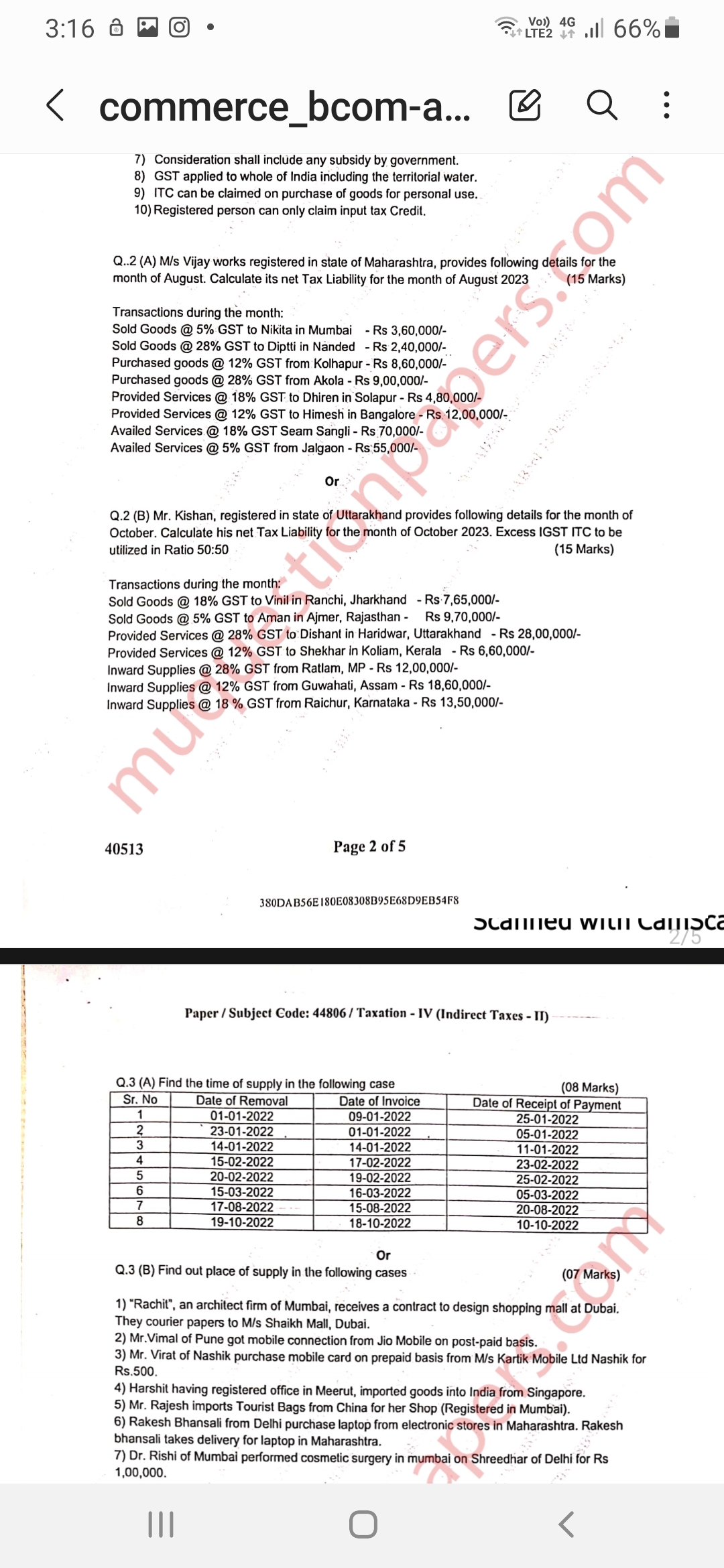

M/s Vijay works registered in the state of Maharashtra, provides following details for the month of August. Calculate its net Tax Liability for the month of August 2023.

Understand the Problem

The question is asking to calculate the net tax liability for a business based on provided transactions during a specific month, applying GST rates to sales, purchases, and services.

Answer

The net tax liability is ₹(-54,950).

Answer for screen readers

The net tax liability for M/s Vijay for the month of August 2023 is ₹(85,200 + 2,30,400 - 3,55,200 - 15,350) = ₹(85,200 + 2,30,400 - 3,70,550) = ₹(3,15,600 - 3,70,550) = ₹(-54,950).

Steps to Solve

-

Calculate Total Sales Tax

For the sales made, calculate the GST for each transaction.

-

Sold Goods @ 5% GST: [ 3,60,000 \times 0.05 = 18,000 ]

-

Sold Goods @ 28% GST: [ 2,40,000 \times 0.28 = 67,200 ]

-

Total Sales Tax = ( 18,000 + 67,200 = 85,200 )

-

-

Calculate Total Purchase Tax

For the purchases made, calculate the GST for each transaction.

-

Purchased goods @ 12% GST: [ 8,60,000 \times 0.12 = 1,03,200 ]

-

Purchased goods @ 28% GST: [ 9,00,000 \times 0.28 = 2,52,000 ]

-

Total Purchase Tax = ( 1,03,200 + 2,52,000 = 3,55,200 )

-

-

Calculate Total Service Tax from Provided Services

Calculate the GST for the services provided.

-

Provided Services @ 18% GST: [ 4,80,000 \times 0.18 = 86,400 ]

-

Provided Services @ 12% GST: [ 12,00,000 \times 0.12 = 1,44,000 ]

-

Total Service Tax = ( 86,400 + 1,44,000 = 2,30,400 )

-

-

Calculate Total Tax Credits on Services Availed

Calculate the GST for the services availed.

-

Availed Services @ 18% GST: [ 70,000 \times 0.18 = 12,600 ]

-

Availed Services @ 5% GST: [ 55,000 \times 0.05 = 2,750 ]

-

Total Tax Credits = ( 12,600 + 2,750 = 15,350 )

-

-

Calculate Net Tax Liability

The net tax liability can be calculated as follows:

[ \text{Net Tax Liability} = \text{Total Sales Tax} + \text{Total Service Tax} - \text{Total Purchase Tax} - \text{Total Tax Credits} ]

Substituting the calculated values:

[ \text{Net Tax Liability} = 85,200 + 2,30,400 - 3,55,200 - 15,350 ]

The net tax liability for M/s Vijay for the month of August 2023 is ₹(85,200 + 2,30,400 - 3,55,200 - 15,350) = ₹(85,200 + 2,30,400 - 3,70,550) = ₹(3,15,600 - 3,70,550) = ₹(-54,950).

More Information

The negative net tax liability indicates that M/s Vijay had a tax credit surplus for the month. This typically means that the business can carry forward this excess credit to offset future tax liabilities.

Tips

- Failing to include all transactions in calculations.

- Misapplying the GST rates on different categories of transactions.

- Not simplifying the calculations properly.

AI-generated content may contain errors. Please verify critical information