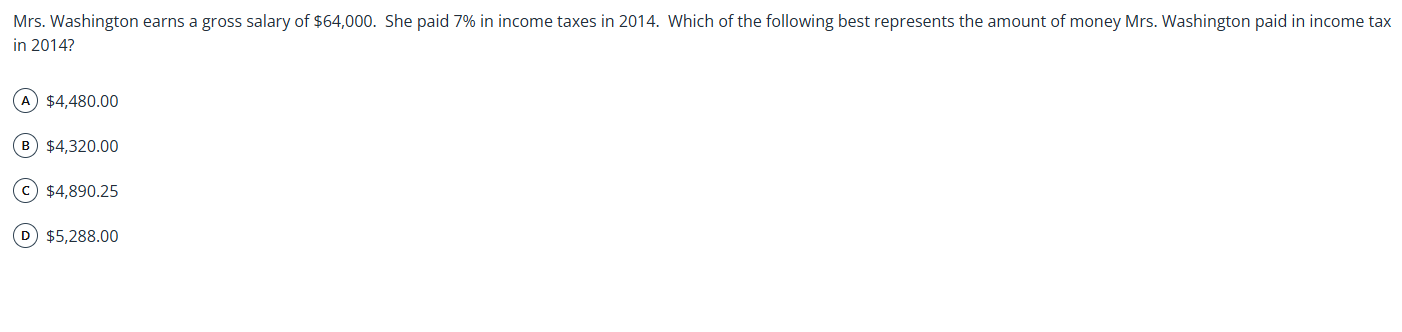

Mrs. Washington earns a gross salary of $64,000. She paid 7% in income taxes in 2014. Which of the following best represents the amount of money Mrs. Washington paid in income tax... Mrs. Washington earns a gross salary of $64,000. She paid 7% in income taxes in 2014. Which of the following best represents the amount of money Mrs. Washington paid in income tax in 2014?

Understand the Problem

The question asks to calculate the amount of income tax Mrs. Washington paid in 2014, given that she earned a gross salary of $64,000 and paid 7% of it in income taxes. We need to find 7% of $64,000.

Answer

$4,480.00

Answer for screen readers

$4,480.00

Steps to Solve

- Convert the percentage to a decimal

Convert 7% to a decimal by dividing by 100: $7% = \frac{7}{100} = 0.07$

- Calculate the income tax amount

Multiply the gross salary by the decimal equivalent of the tax percentage: $Income\ tax = 0.07 \times $64,000$

- Perform the multiplication

$Income\ tax = $4,480$

$4,480.00

More Information

The question asks simply for the amount paid in income tax, which is 7% of the gross salary. Calculating this gives us $4,480.00.

Tips

A common mistake might be misinterpreting the percentage or making a calculation error during multiplication. Double-checking the calculation can prevent this. Additionally, some people may try to subtract the tax amount from the salary, but the question asks only for the tax amount itself.

AI-generated content may contain errors. Please verify critical information