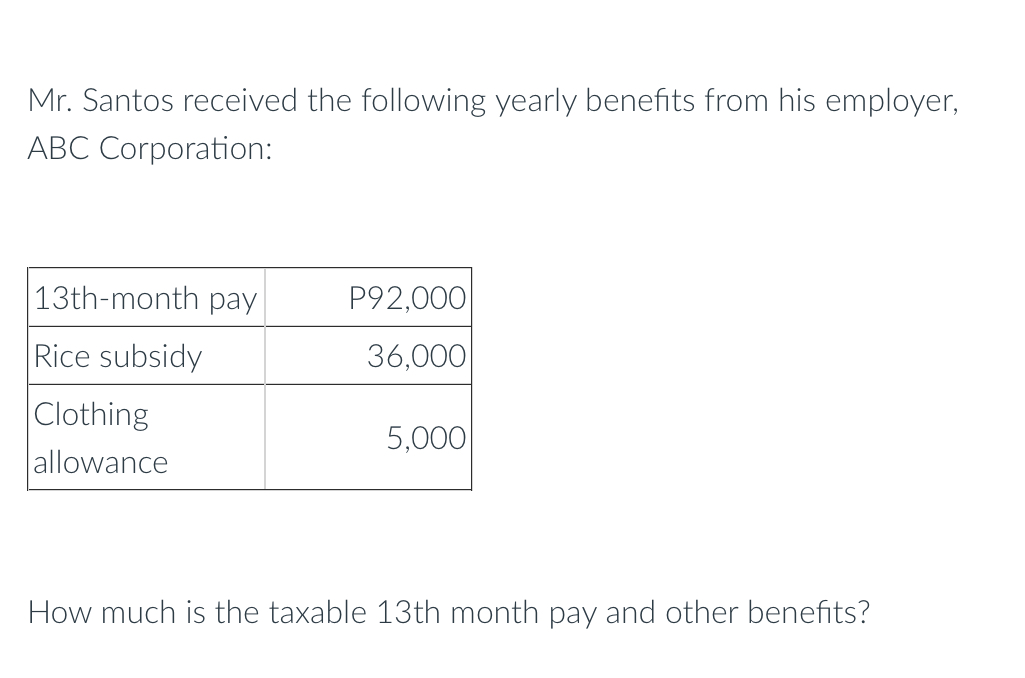

Mr. Santos received the following yearly benefits from his employer, ABC Corporation: 13th-month pay: P92,000 Rice subsidy: 36,000 Clothing allowance: 5,000 How much is the taxable... Mr. Santos received the following yearly benefits from his employer, ABC Corporation: 13th-month pay: P92,000 Rice subsidy: 36,000 Clothing allowance: 5,000 How much is the taxable 13th-month pay and other benefits?

Understand the Problem

The question requires determining the total amount of taxable benefits Mr. Santos received, given his 13th-month pay, rice subsidy, and clothing allowance. In the Philippines, there is a threshold for tax-exempt benefits; any amount exceeding this threshold is subject to tax. Need to determine the taxable component of the total benefits.

Answer

P43,000

Answer for screen readers

The taxable amount of Mr. Santos' 13th-month pay and other benefits is P43,000.

Steps to Solve

- Calculate the total amount of benefits received. Add up all the benefits Mr. Santos received: 13th-month pay, rice subsidy, and clothing allowance

$$ \text{Total Benefits} = \text{13th Month Pay} + \text{Rice Subsidy} + \text{Clothing Allowance} $$ $$ \text{Total Benefits} = 92,000 + 36,000 + 5,000 = 133,000 $$

-

Determine the tax-exempt threshold for benefits. In the Philippines, the tax-exempt threshold for 13th-month pay and other benefits is P90,000.

-

Calculate the taxable amount. Subtract the tax-exempt threshold from the total benefits to find the taxable amount.

$$ \text{Taxable Amount} = \text{Total Benefits} - \text{Tax-Exempt Threshold} $$ $$ \text{Taxable Amount} = 133,000 - 90,000 = 43,000 $$

The taxable amount of Mr. Santos' 13th-month pay and other benefits is P43,000.

More Information

The tax-exempt threshold is defined in the National Internal Revenue Code (NIRC) of the Philippines, as amended. This threshold is subject to change through legislation or regulatory updates.

Tips

A common mistake is failing to consider the tax-exempt threshold. Many people simply add up all the benefits and assume the entire amount is taxable, without subtracting the allowable tax-exempt amount. Another mistake could be using an outdated tax-exempt threshold.

AI-generated content may contain errors. Please verify critical information