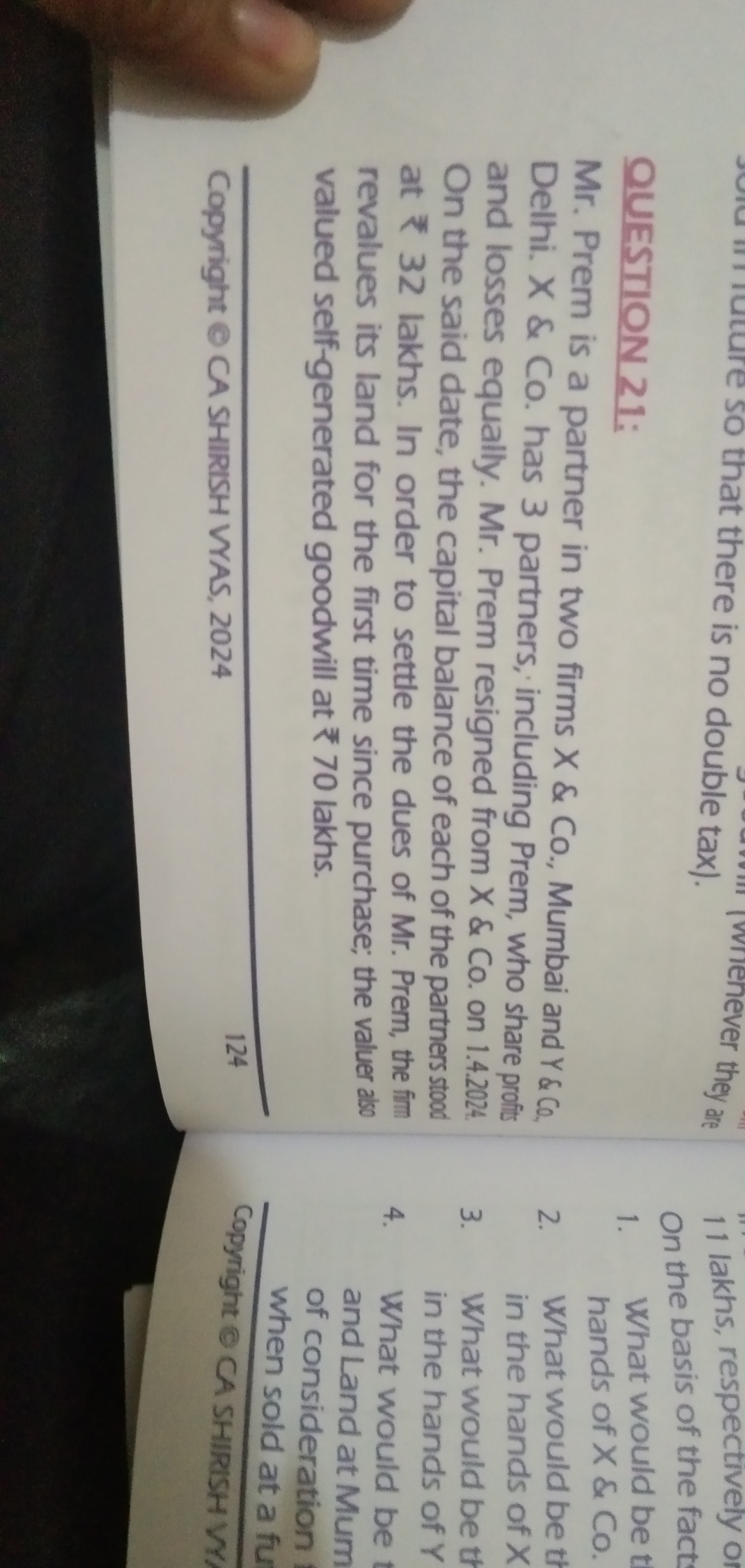

Mr. Prem is a partner in two firms X & Co. and Y & Co., which share profits and losses equally. Mr. Prem resigned from X & Co. on 1.4.2024. What would be the financial consequences... Mr. Prem is a partner in two firms X & Co. and Y & Co., which share profits and losses equally. Mr. Prem resigned from X & Co. on 1.4.2024. What would be the financial consequences in the hands of X & Co. regarding the valuation of land and good will when Mr. Prem leaves the partnership?

Understand the Problem

The question involves a scenario where Mr. Prem, a partner in a firm, is resigning and there are financial implications related to his capital balance, partnership structure, and asset valuations. It requires analyzing the accounting details and calculating financial outcomes based on the given data.

Answer

Each remaining partner in X & Co. will increase their capital balances by ₹34 lakhs due to the valuation adjustments upon Mr. Prem's resignation.

Answer for screen readers

The financial consequences for X & Co. regarding the valuation of land and goodwill when Mr. Prem leaves the partnership result in each remaining partner increasing their capital balances by ₹34 lakhs.

Steps to Solve

- Understanding the Capital Balance

Determine the capital balance of Mr. Prem at the time of his resignation from X & Co. The capital balance is given as ₹1,000,000 (according to the question context).

- Valuation of Assets

Mr. Prem's departure necessitates the valuation of land and goodwill. The land is valued at ₹32 lakhs and the self-generated goodwill is valued at ₹70 lakhs as per the details provided.

- Impact on Financial Statements

When Mr. Prem exits, X & Co. needs to adjust their financial statements to reflect the valuation of assets. The new valuations would impact the capital accounts of remaining partners since they share profits and losses equally.

- Calculating the Goodwill and Land Impact

Determine the total value of the firm's assets attributable to their shared profits:

- Total value of land + Goodwill: $$ 32 \text{ lakhs} + 70 \text{ lakhs} = 102 \text{ lakhs} $$

- Final Implication for Remaining Partners

The remaining partners will adjust their capital accounts based on their respective shares of the new valuations: $$ \text{Each Partner's Impact} = \frac{102 \text{ lakhs}}{3} = 34 \text{ lakhs} $$

This means that the remaining partners will each record an increase in their capital balances by ₹34 lakhs due to the valuation adjustments stemming from Mr. Prem's resignation.

The financial consequences for X & Co. regarding the valuation of land and goodwill when Mr. Prem leaves the partnership result in each remaining partner increasing their capital balances by ₹34 lakhs.

More Information

When a partner resigns, it often triggers a revaluation of the partnership's assets. This can significantly impact the capital balances, requiring adjustments for remaining partners to reflect their shares of the newly valued assets.

Tips

- Not Considering All Assets: Some might neglect to include both the land and goodwill in their calculations.

- Misunderstanding Shared Profits: Miscalculating how shared profits and losses affect partner capital balances can lead to incorrect conclusions.

- Forgetting to Adjust Capital Accounts: Failing to update the capital accounts of remaining partners after revaluation is a common oversight.

AI-generated content may contain errors. Please verify critical information