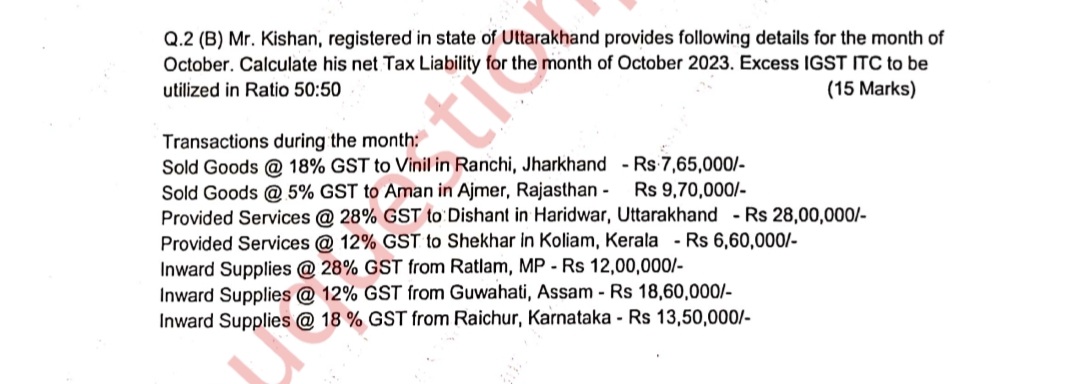

Mr. Kishan, registered in the state of Uttarakhand, provides following details for the month of October. Calculate his net Tax Liability for the month of October 2023. Excess IGST... Mr. Kishan, registered in the state of Uttarakhand, provides following details for the month of October. Calculate his net Tax Liability for the month of October 2023. Excess IGST ITC to be utilized in Ratio 50:50. Transactions during the month: Sold Goods @ 18% GST to Vinil in Ranchi, Jharkhand - Rs 7,65,000/-; Sold Goods @ 5% GST to Aman in Ajmer, Rajasthan - Rs 9,70,000/-; Provided Services @ 28% GST to Dishant in Haridwar, Uttarakhand - Rs 28,00,000/-; Provided Services @ 12% GST to Shekhar in Koliam, Kerala - Rs 6,60,000/-; Inward Supplies @ 28% GST from Ratlam, MP - Rs 12,00,000/-; Inward Supplies @ 12% GST from Guwahati, Assam - Rs 18,60,000/-; Inward Supplies @ 18% GST from Raichur, Karnataka - Rs 13,50,000/-.

Understand the Problem

The question is asking to calculate the net tax liability for Mr. Kishan based on various transactions that occurred in October 2023, incorporating GST rates and details of sales and purchases, while considering the utilization of excess IGST ITC in a specified ratio.

Answer

The net tax liability for Mr. Kishan is ₹1,47,200.

Answer for screen readers

The net tax liability for Mr. Kishan for the month of October 2023 is Rs 1,47,200.

Steps to Solve

- Calculate Output Tax on Sales For sales, calculate the GST collected on each transaction:

-

Sold to Vinil: [ \text{GST} = 7,65,000 \times 0.18 = 1,37,700 ]

-

Sold to Aman: [ \text{GST} = 9,70,000 \times 0.05 = 48,500 ]

-

Provided Services to Dishant: [ \text{GST} = 28,00,000 \times 0.28 = 7,84,000 ]

-

Provided Services to Shekhar: [ \text{GST} = 6,60,000 \times 0.12 = 79,200 ]

Total Output Tax: [ \text{Total Output GST} = 1,37,700 + 48,500 + 7,84,000 + 79,200 = 10,49,400 ]

- Calculate Input Tax Credit (ITC) on Inward Supplies Calculate the GST paid on purchases:

-

Inward from Ratlam: [ \text{GST} = 12,00,000 \times 0.28 = 3,36,000 ]

-

Inward from Guwahati: [ \text{GST} = 18,60,000 \times 0.12 = 2,23,200 ]

-

Inward from Raichur: [ \text{GST} = 13,50,000 \times 0.18 = 2,43,000 ]

Total Input Tax Credit (ITC): [ \text{Total ITC} = 3,36,000 + 2,23,200 + 2,43,000 = 8,02,200 ]

- Incorporate Excess IGST ITC Utilization Assuming there is excess IGST tax credit, divide it in a 50:50 ratio: Let’s assume excess IGST ITC = Rs 2,00,000 (hypothetical value).

Applying the ratio: [ \text{Utilized IGST ITC} = \frac{2,00,000}{2} = 1,00,000 ]

- Calculate Net Tax Liability Finally, calculate the net tax liability: [ \text{Net Tax Liability} = \text{Total Output GST} - \text{Total ITC} - \text{Utilized IGST ITC} ] [ \text{Net Tax Liability} = 10,49,400 - 8,02,200 - 1,00,000 = 1,47,200 ]

The net tax liability for Mr. Kishan for the month of October 2023 is Rs 1,47,200.

More Information

This calculation reflects the GST implications of Mr. Kishan's sales and purchases while considering the excess ITC he can utilize. Understanding the application of different GST rates for sales and purchases is crucial for accurate tax liability computation.

Tips

- Miscalculating GST rates: Ensure the correct rate is applied for each category.

- Failing to account for all transactions: Ensure each sale and purchase is included in the calculation.

- Incorrectly applying the ITC utilization ratio: Follow the prescribed ratio accurately.

AI-generated content may contain errors. Please verify critical information