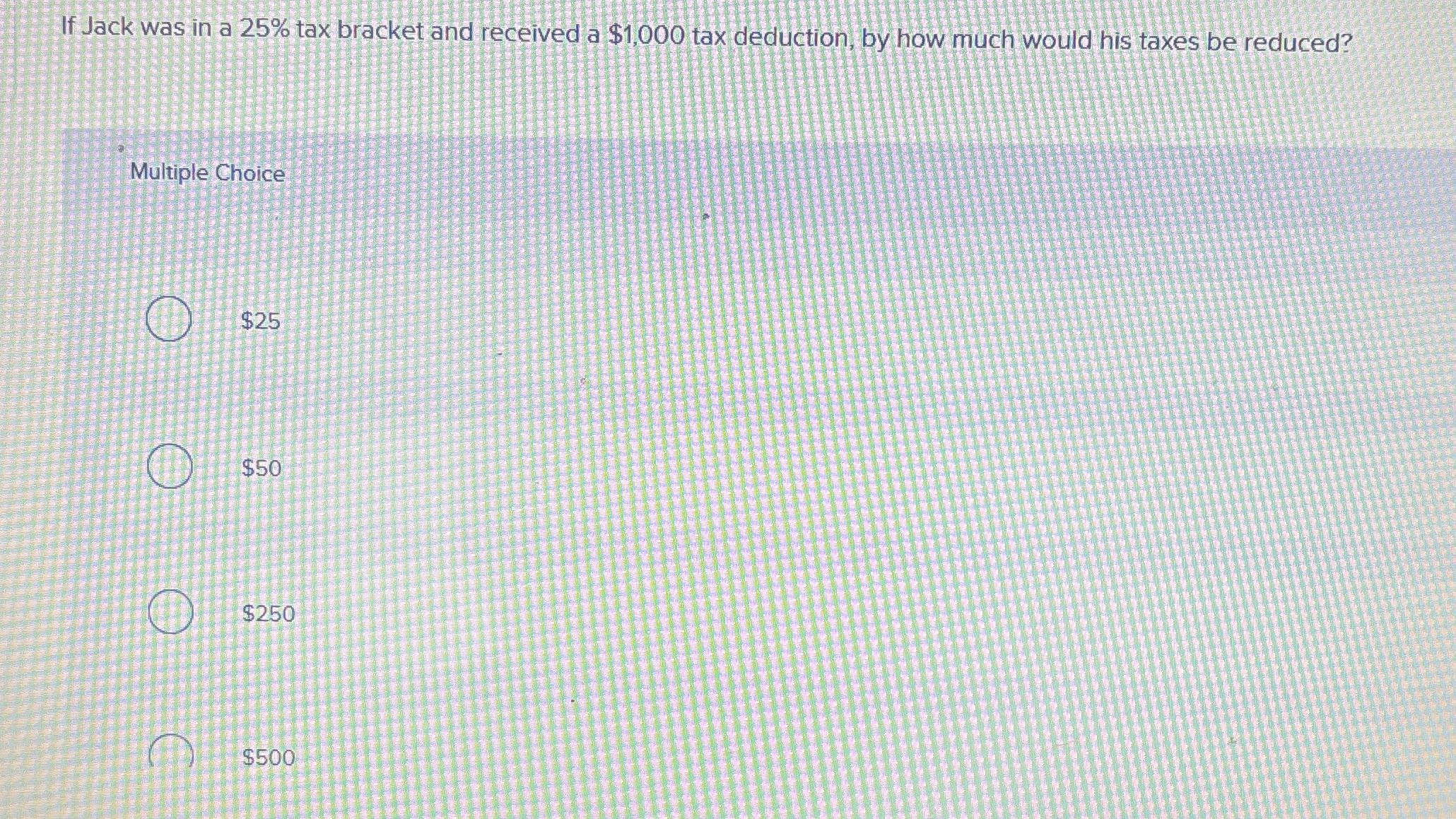

If Jack was in a 25% tax bracket and received a $1000 tax deduction, by how much would his taxes be reduced?

Understand the Problem

The question is asking how much Jack's taxes would be reduced given a 25% tax bracket and a $1000 tax deduction. To find the reduction, we need to calculate 25% of the deduction amount.

Answer

Jack's taxes would be reduced by $250.

Answer for screen readers

Jack's taxes would be reduced by $250.

Steps to Solve

-

Identify the tax deduction and tax bracket Jack has a tax deduction of $1000 and is in a 25% tax bracket.

-

Calculate the tax reduction To find how much Jack's taxes would be reduced, multiply the tax deduction by the tax bracket percentage: $$ \text{Tax Reduction} = \text{Tax Deduction} \times \text{Tax Rate} $$ Substituting the values: $$ \text{Tax Reduction} = 1000 \times 0.25 $$

-

Perform the calculation Calculating the above expression gives: $$ \text{Tax Reduction} = 250 $$

Jack's taxes would be reduced by $250.

More Information

A tax deduction reduces taxable income; therefore, the amount you save in taxes is determined by your tax rate applied to the deduction amount. In Jack's case, a 25% rate on a $1000 deduction results in a savings of $250.

Tips

- Misunderstanding of tax brackets: Some may confuse the deduction itself with the actual tax saved. The tax saved is a percentage of the deduction.

- Incorrect multiplication: Forgetting to convert the percentage into decimal form (25% should be 0.25 for calculations).

AI-generated content may contain errors. Please verify critical information