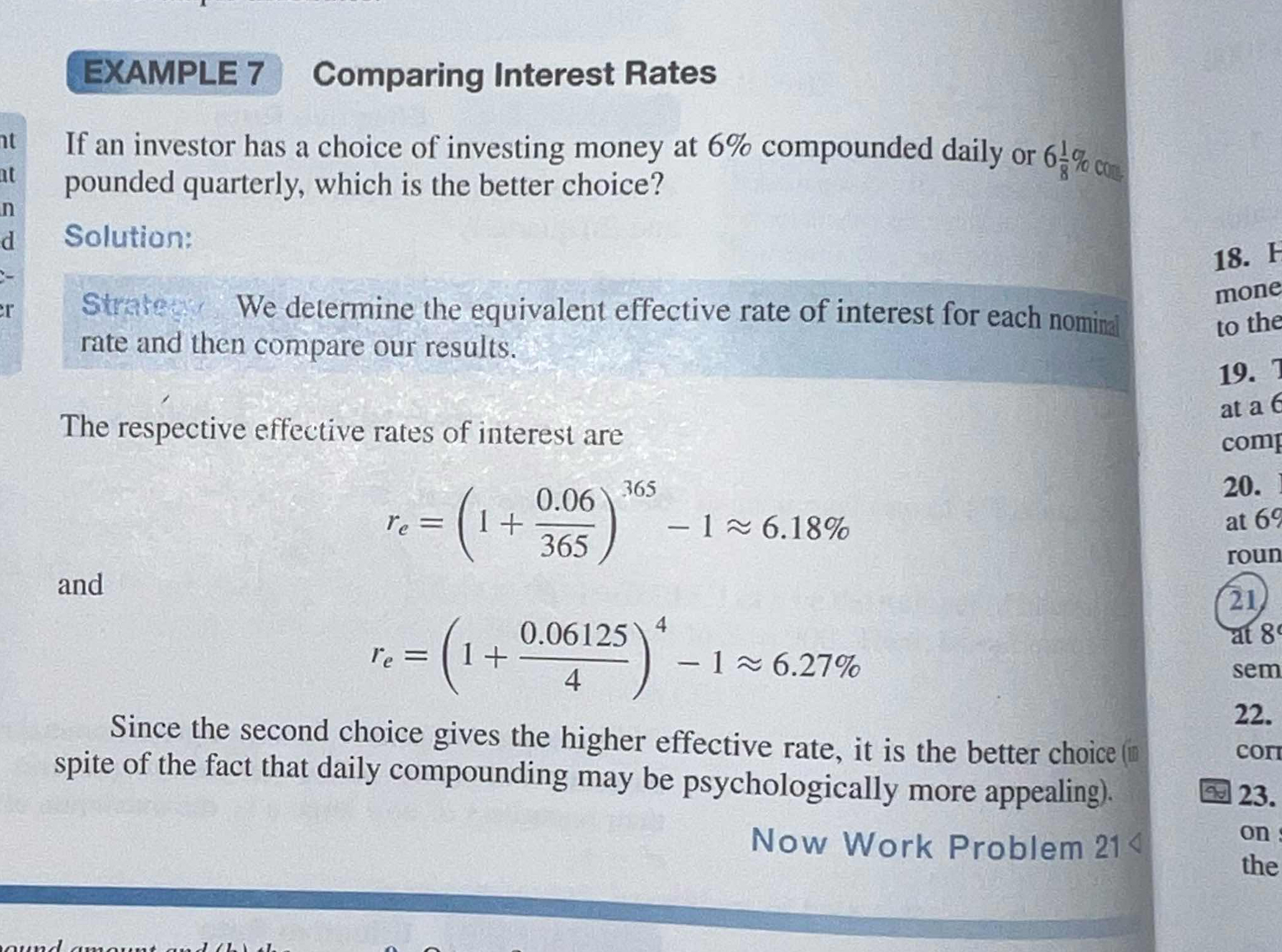

If an investor has a choice of investing money at 6% compounded daily or 6 1/8% compounded quarterly, which is the better choice?

Understand the Problem

This question asks us to compare two different investment options with different interest rates and compounding frequencies to determine which one is the better choice for an investor. We need to understand how compounding frequency affects the effective interest rate and then compare the effective rates to make a sound investment decision.

Answer

The $6\frac{1}{8}\%$ compounded quarterly option is better because it has a higher effective interest rate of $6.27\%$ compared to the 6% compounded daily option which has an effective interest rate of $6.18\%$.

Answer for screen readers

The investment option with $6\frac{1}{8}%$ compounded quarterly is the better choice because its effective interest rate ($6.27%$) is higher than the effective interest rate of the 6% compounded daily option ($6.18%$).

Steps to Solve

-

Calculate the effective interest rate for the 6% compounded daily option. Use the formula for effective interest rate: $ r_e = (1 + \frac{r}{n})^n - 1 $, where $r$ is the nominal interest rate and $n$ is the number of compounding periods per year. In this case, $ r = 0.06 $ and $ n = 365 $. Plug the values into the equation: $ r_e = (1 + \frac{0.06}{365})^{365} - 1 $

-

Approximate the effective interest rate for the first option. $ r_e \approx 0.0618 = 6.18% $

-

**Calculate the effective interest rate for the $6\frac{1}{8}%$ compounded quarterly option. ** First convert $6\frac{1}{8}%$ to a decimal. $6\frac{1}{8}% = 6.125% = 0.06125$. Here $r = 0.06125$ and $n = 4$ (quarterly). Plug the values into the equation: $ r_e = (1 + \frac{0.06125}{4})^{4} - 1 $

-

Approximate the effective interest rate for the second option. $ r_e \approx 0.0627 = 6.27% $

-

Compare the effective interest rates. Compare the effective interest rates of the two options: $6.18%$ vs $6.27%$.

-

Determine the better option. Since $6.27% > 6.18%$, the second option is the better choice.

The investment option with $6\frac{1}{8}%$ compounded quarterly is the better choice because its effective interest rate ($6.27%$) is higher than the effective interest rate of the 6% compounded daily option ($6.18%$).

More Information

The effective interest rate represents the real return on an investment when the effects of compounding are taken into account. Comparing effective interest rates allows investors to accurately compare different investment options with varying nominal rates and compounding frequencies, leading to better financial decisions.

Tips

A common mistake is to simply compare the nominal interest rates without considering the effect of compounding frequency. For instance, one might incorrectly assume that 6% is always less than $6\frac{1}{8}%$, without calculating the effective rates. Another mistake is using the wrong value for $n$ (number of compounding periods per year).

AI-generated content may contain errors. Please verify critical information