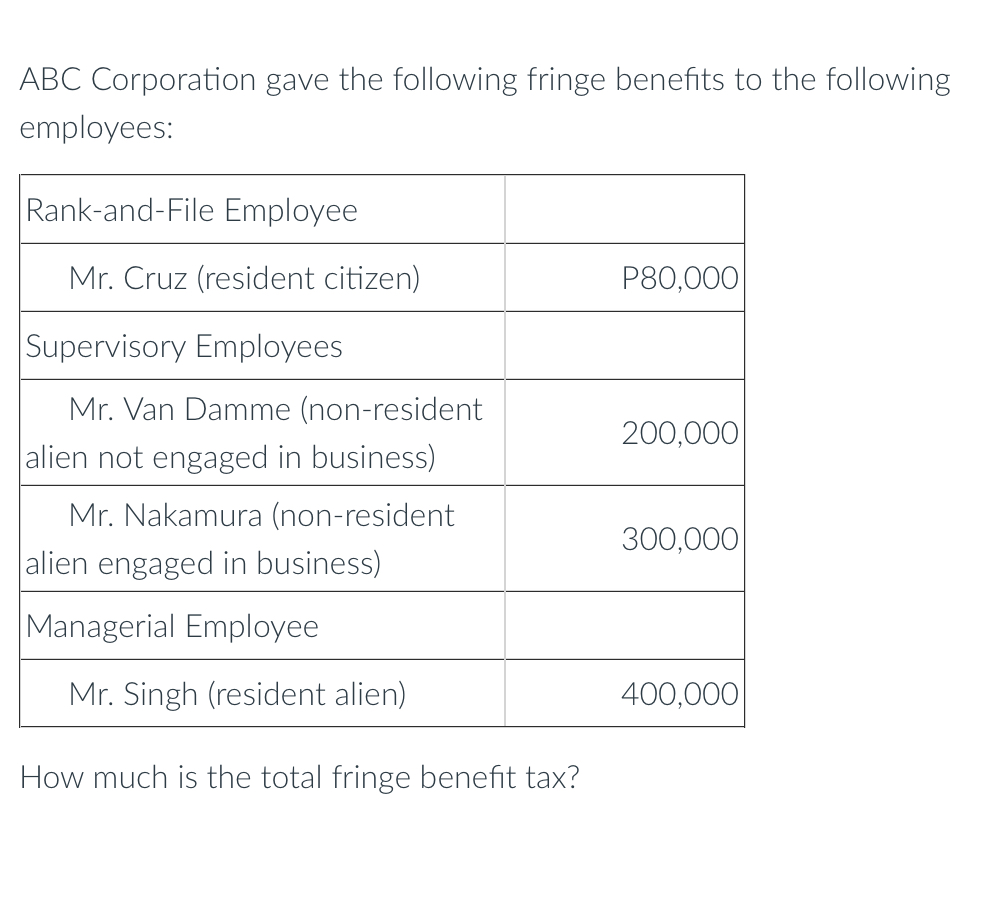

How much is the total fringe benefit tax?

Understand the Problem

The question provides information about the fringe benefits given by ABC Corporation to its employees. The task is to calculate the total fringe benefit tax based on the provided details.

Answer

P265,158.37

Answer for screen readers

P265,158.37

Steps to Solve

-

Identify Taxable Fringe Benefits Fringe benefits given to rank-and-file employees are not subject to fringe benefit tax (FBT). FBT applies only to fringe benefits given to managerial or supervisory employees. Therefore, we only consider benefits given to Mr. Van Damme, Mr. Nakamura, and Mr. Singh.

-

Determine if Fringe Benefits are Taxable for Each Employee

- Mr. Van Damme (non-resident alien not engaged in business): Fringe benefits are subject to a final tax of 25% on the grossed-up monetary value.

- Mr. Nakamura (non-resident alien engaged in business): Fringe benefits are not subject to FBT; instead, these are considered as compensation income subject to regular income tax.

- Mr. Singh (resident alien): Fringe benefits are subject to FBT.

-

Calculate the Fringe Benefit Tax for Mr. Van Damme

The formula for calculating the grossed-up monetary value (GUMV) when the employee is a non-resident alien not engaged in trade or business is:

$$ \text{Fringe Benefit Tax} = \frac{\text{Value of Fringe Benefit}}{65%} \times 25% $$

$$ \text{Fringe Benefit Tax (Van Damme)} = \frac{200,000}{0.65} \times 0.25 $$

$$ \text{Fringe Benefit Tax (Van Damme)} = 307,692.31 \times 0.25 $$

$$ \text{Fringe Benefit Tax (Van Damme)} = 76,923.08 $$

- Calculate the Fringe Benefit Tax for Mr. Singh

The formula for calculating the grossed-up monetary value (GUMV) when the employee is a resident alien is:

$$ \text{Fringe Benefit Tax} = \frac{\text{Value of Fringe Benefit}}{68%} \times 32% $$

$$ \text{Fringe Benefit Tax (Singh)} = \frac{400,000}{0.68} \times 0.32 $$

$$ \text{Fringe Benefit Tax (Singh)} = 588,235.29 \times 0.32 $$

$$ \text{Fringe Benefit Tax (Singh)} = 188,235.29 $$

- Compute Total Fringe Benefit Tax Add the fringe benefit tax for Mr. Van Damme and Mr. Singh. Mr. Nakamura's fringe benefits are not subject to FBT.

$$ \text{Total Fringe Benefit Tax} = 76,923.08 + 188,235.29 $$

$$ \text{Total Fringe Benefit Tax} = 265,158.37 $$

P265,158.37

More Information

The fringe benefit tax is a tax imposed on the employer for providing certain benefits to managerial or supervisory employees. The tax rates and treatment of fringe benefits can vary based on the employee's residency and employment status (i.e., resident vs. non-resident alien, and whether the non-resident alien is engaged in business in the Philippines).

Tips

- Including rank-and-file employees' fringe benefits in FBT calculation.

- Confusing the tax treatment of fringe benefits for different types of employees (resident vs. non-resident, engaged in business or not).

- Forgetting to gross up the monetary value of the fringe benefit.

AI-generated content may contain errors. Please verify critical information